More bad data from Germany. Yesterday, the IFO fell in both the business climate component and future expectations; last Friday, it was the PMI data – especially the manufacturing one – that painted a gloomy picture. In both cases, the BUND future rallied on the increasingly weak economic growth prospects. When an interest rate future goes up, the yield goes down.

Although we are all very focused on the current monetary policy, which is likely to include further steps towards tightening, and although the mantra ”higher for longer” has been repeated for months, investors cannot ignore the broader picture. The high burden of public debt – never so high in at least the last 70 years worldwide -, the poor demographic prospects – especially in a region like Europe – and the modest long-term growth prospects will not allow current interest rate levels to be maintained for many YEARS, far from it. The NATURAL interest rate, R*, is a complicated concept almost purely academic and calculated very differently by different institutions, but it is not far off at 1%-1.5% for Europe.

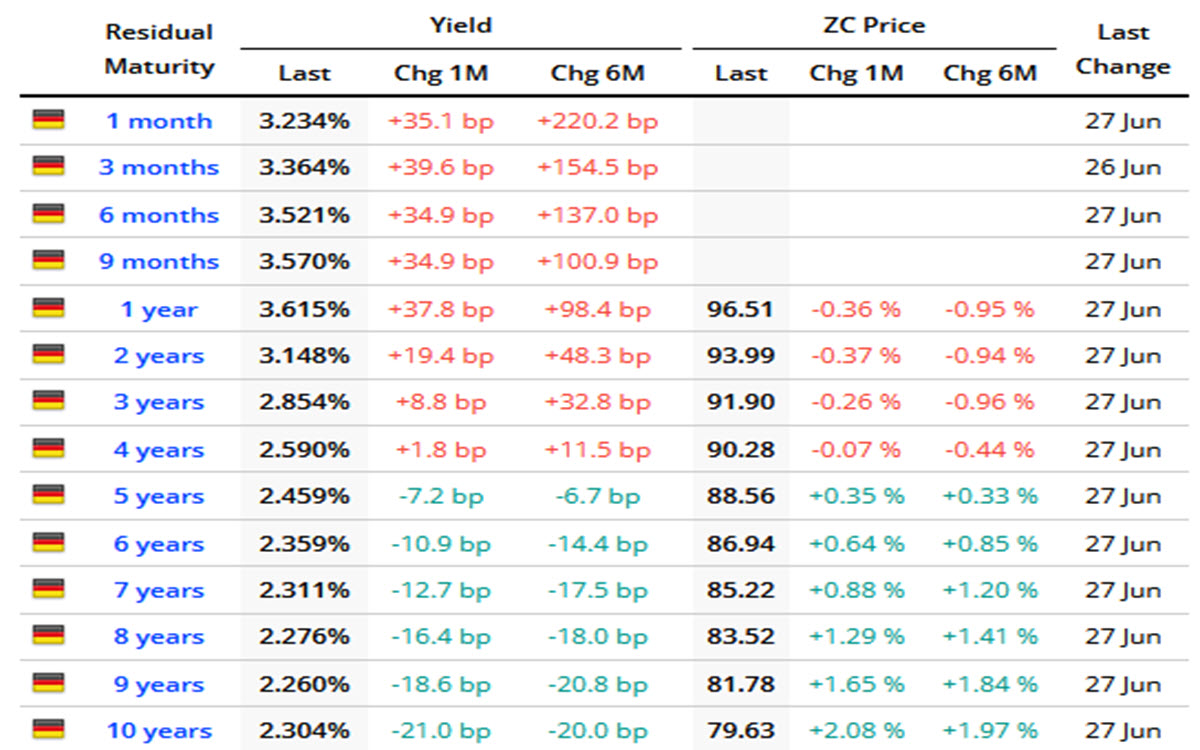

There is nothing strange, therefore, about the short end of the curve yielding more than the long end, as it is more sensitive to what the central bank will do in the next 24 months. And it is clear that the curve is flattening (or inversely steepening) and has been doing so for months: here are the performances for German government bonds, but the same applies for the whole Eurozone and beyond.

German Maturities, Yields – Prices – Change

Despite all the reports of very aggressive central banks, there have been a few days of good performance of government bonds on the European continent: the UK Gilt has been rising for 5 sessions in a row, the Italian 10 year BTP seems to be about to break upwards the resistance represented by 117.15 and the rise in the Bund price in the last 2 days implies a drop in yields of -16 bps since last Friday.

TECHNICAL ANALYSIS

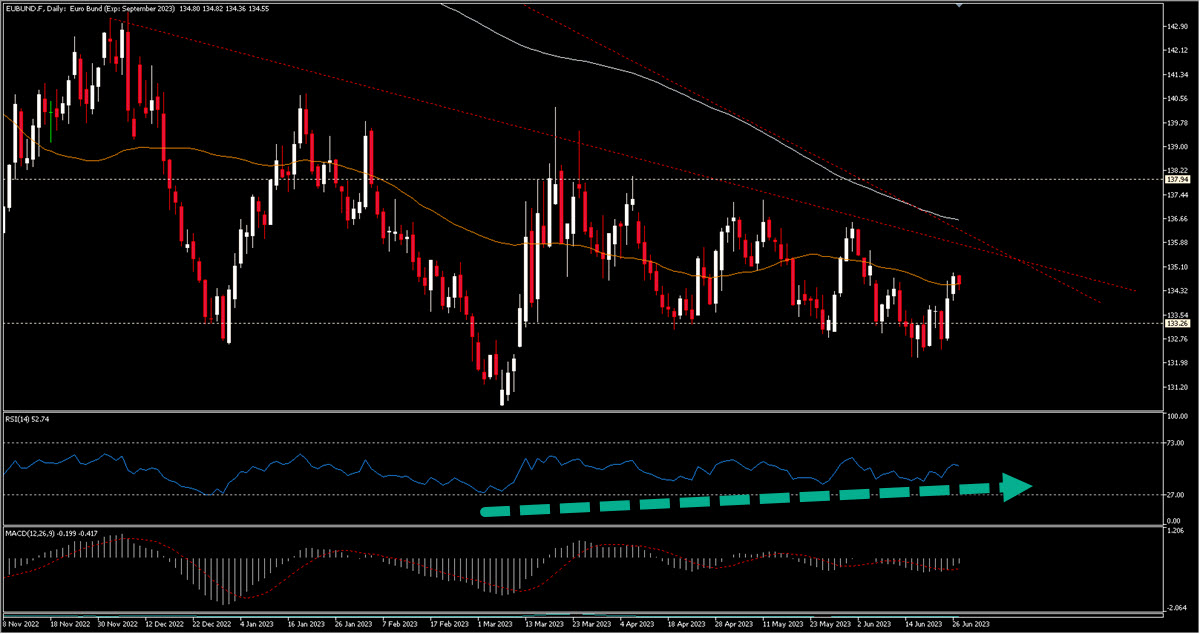

We are only focusing on a mid-term chart that plots the price in 2023: to give context, know that the BUND traded > 175 until autumn 2021 (134.56 now), so it is obviously in a strongly bearish phase (rates up).

EUBUND.F, 2023 – today

The price since the end of November is trading inside a wedge and downwards we see 133.25 as a very important level (although it has been broken several times to the downside, also recently). The price is still below the MA200 and is just today treading waters above the 50 (it has traded above it several times in the last few months and it could have worked as pivot for a mean-reverting strategy). What is also interesting is RSI has been diverging – albeit slight – for months now.

A first long-term change in the trend will not happen without a break of 135.70-136.60: seeing the future at those levels would mean a yield lower by about 20 bps (2.10%).

Downwards the areas to monitor are the 133.25 one first and then 132.70.

In any case, after about 20 months of declining prices, it is not to be excluded that the BUND Future could be near the bottom of its run, unless there are dramatic surprises (which we consider unlikely at the moment) from the ECB.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.