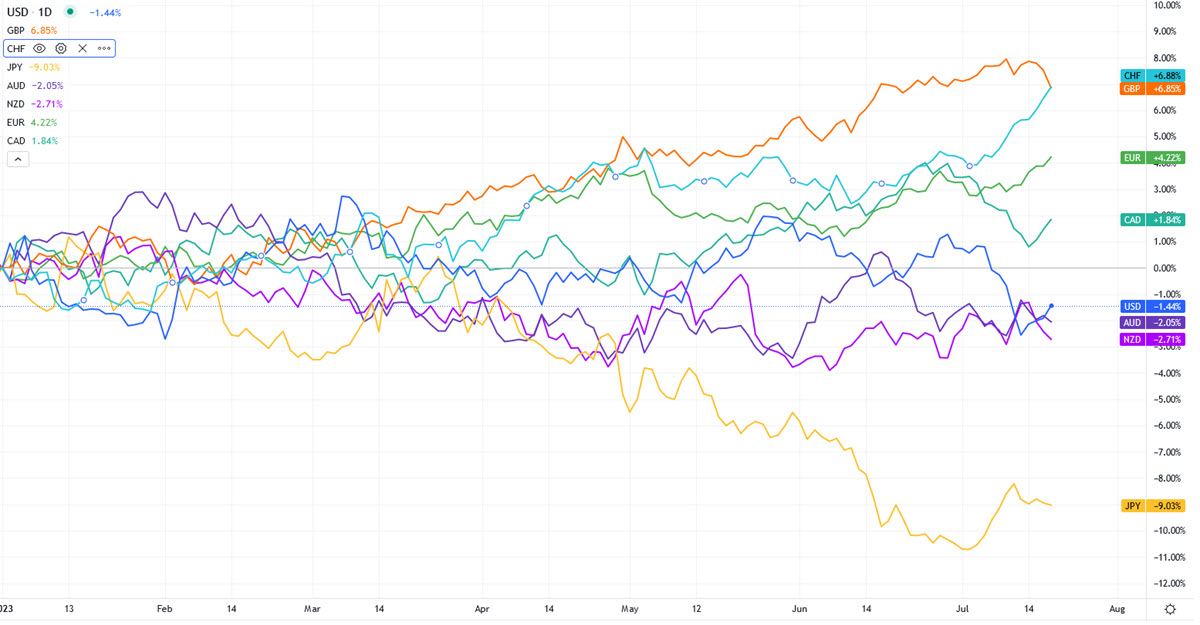

Do you know which has been the strongest major in 2023? Well yes, the Pound Sterling, +6.98% is the YTD result of its weighted index (ok, the CHF didn’t do so bad neither). Well, UK inflation has been the highest among the DMs and the ‘Old Lady’ – the BOE – has been repeatedly accused – especially internally – of having been too slow to react, to take action, of being clearly ‘behind the curve’. So, at a certain point the conviction spread that the prospects for their strongly restrictive action, much more than any other central bank, would have been the most likely option. A few weeks ago, the terminal rate was expected by the markets to be 6.5% by MAR 2024 (with some possibility of 6.75%); the current rate is 5%, just for your guide.

Currency Indices, 2023

This morning the headline CPI finally dropped below 7% Y/Y (6.9%) – and remember it was at 10.1% in March. Producer price inputs slumped into deep deflationary territory at -2.7% y/y. And so did expectations on the terminal rate on swap markets: below 6% today. Sterling is sinking: -0.95% against the USD, -0.81% against the EUR. But since we often talk about the Cable and moreover the USD has been particularly weak lately (-13% since September 2022) today we will look at the EURGBP chart.

TECHNICAL ANALYSIS

Although it is not so clearly visible in this chart, EURGBP has been trading between 0.83 and 0.93 since 2016, slowly moving from one side of the wide range to the other: the 0.93 area was almost touched in September 2022 while the subsequent bearish phase failed to go down to 0.83, stopping its fall first in the 0.8575 area and a few weeks ago in the 0.85 area. In the last four sessions the EUR has been regaining strength (well the Pound is weakening, as is the case today) and the pair has come to trade at 0.8690. Well, there is a bearish trendline passing just here and moreover 0.8715 is a rather important intermediate resistance/support area. The RSI is clearly positive and the MACD is also tilted upwards. The price broke above the 50 days MM just today but is below the 200 days MM.

EURGBP, Daily, 2019 – Today

So, between 0.8690 and 0.8715 we are really at a pivotal point, and we got there thanks to today’s ”shocking” (ahem) data. We will monitor this area carefully, a break upwards could prolong the rally, also because the MM200 also passes very close to 0.8725.

But we’ll be honest: for now, despite the indicators, we prefer the hypothesis that the one of the last few days is only a temporary rebound and that monetary policy and price trends still favour the Pound in the medium term. Despite this, let us not forget that at least once, in May 2019, the rally to 0.93 started from 0.85 and – although it is not so likely to happen now in our opinion – let us keep this in mind.

EURGBP, 4 Hours

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.