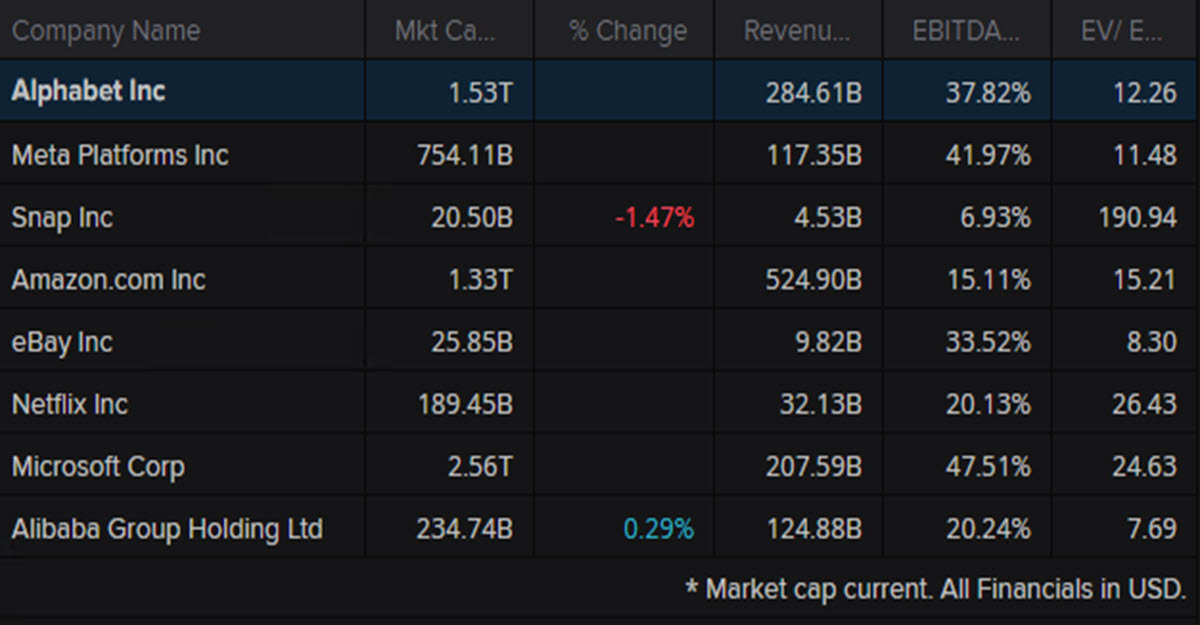

Despite mounting competition in artificial intelligence and internet search, Google stock has advanced 40% this year. That’s in line with the nearly 39% rise in the Nasdaq composite, but it certainly does not make it one of the best performing tech companies.

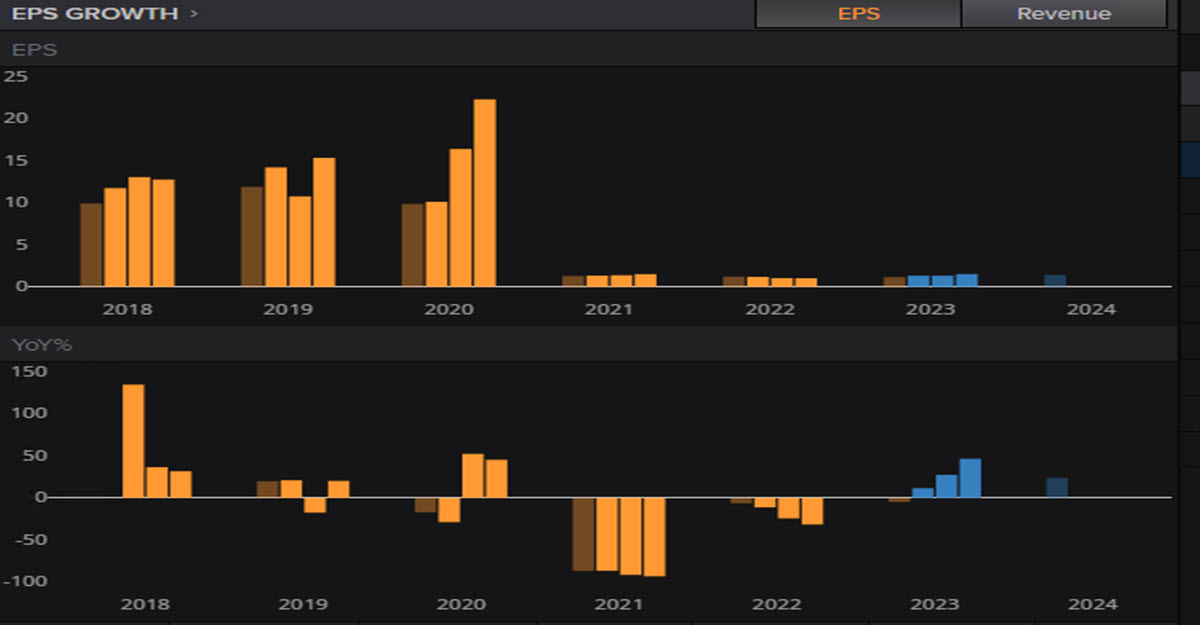

The Mountain View California-based company is expected to report a 4.5% increase in revenue to $72.799 billion from $69.69 billion a year ago, according to the mean estimate from 32 analysts, based on Refinitiv data. The same analysts are looking for a $1.34 EPS. The current average rating on the shares is “buy” and the breakdown of recommendations is 41 “strong buy” or “buy,” 9 “hold” and no “sell” or “strong sell.”

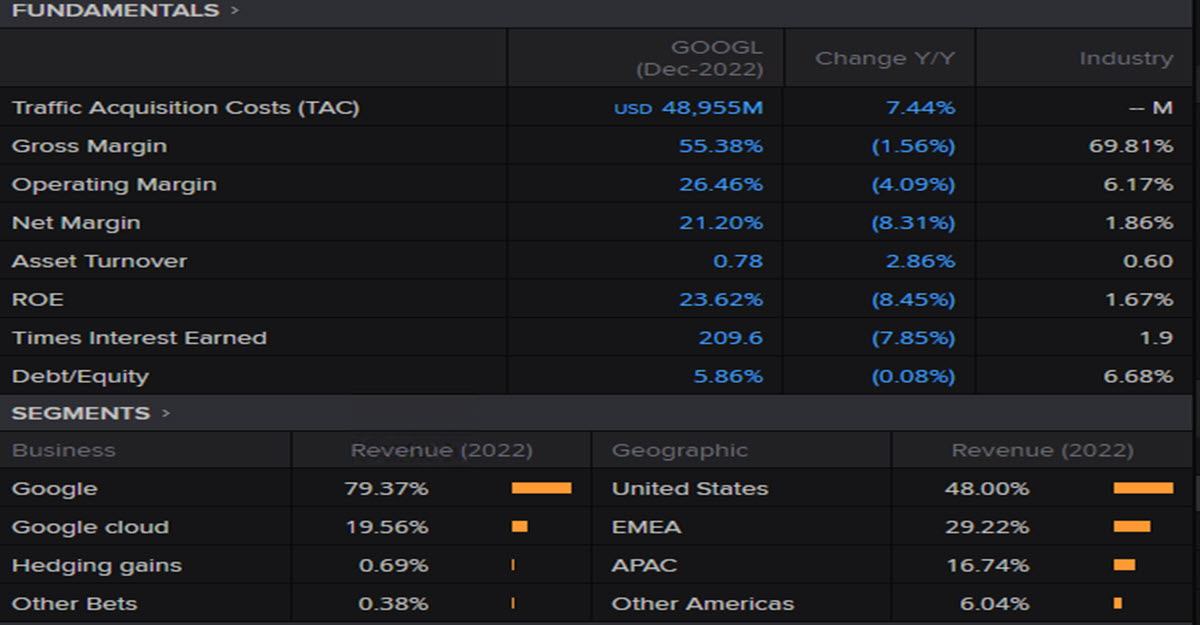

GOOGL Q2 2023 results are likely to reflect gains from its strengthening cloud service offerings that include Google Cloud Platform and Google Workspace, which have been continuously gaining momentum. The segment’s Revenues were $7.45 in Q123 and accounted for 10.7% of total revenues, exhibiting a y/y growth of 28%: GOOGL’s efforts in integrating data lakes, data warehouses, data governance and advanced machine learning into a single platform are expected to have bolstered its prospects in the cloud market.

The company’s deepening focus on generative AI will be another major focus of attention: there are two projects going on right now, BARD and SGE (Search Generative Experience) and the monetization plans for these tools, the way they will be integrated in the Search business – that through advertising is the BIGGEST driver of GOOGL revenues – and how demand for AI will help pushing the growth of the cloud business will be closely analysed by investors.

The dependency on continuing online advertising growth is one of the RISKS for the company and Microsoft’s current large investments with Bing and the acquisition of OpenAI could in the future erode Alphabet’s currently undisputed dominance in the search market (in any case fostered by Android’s dominance in the mobile sector). Alphabet is also allocating a lot of capital toward high-risk bets (helped by the steady cash flow coming from ads) and will probably see an erosion of margins also due to aggressive hiring during 2022 (followed by 16,000 redundancies at the beginning of this year). The continuous scrutiny of regulators because of its market dominance and the billions in fines the company has been forced to pay recently are another risk to take into account.

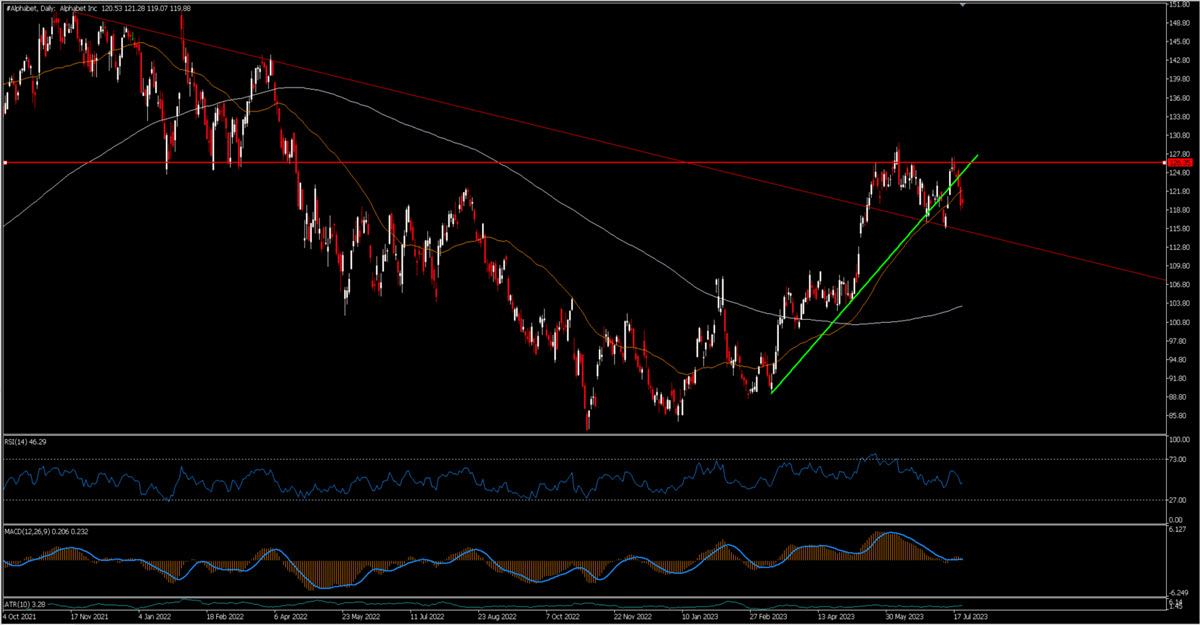

Technical Analysis

GOOGL is far from its all-time highs but has recently broken the long-term bearish trendline under which it was trading in May 2023: having found a serious obstacle in the $125 area, it is still trading above that trendline and $118/$120 is a level to monitor. As for the ascending structure within which the stock has been moving this year, at first glance the growth is slowing down (broken dark green dotted trendline), but it is also true that – allowing for a bit of ”rumor/noise” – it seems that the price is still framed within an ascending channel. Analysts interviewed by Infinitiv/Reuters seem to be indicating that the consensus is for an upward move above the $126/$130 area and a potential medium-term target around $139.

The biggest risk is probably a general market correction which would also take GOOGL down with it, although it certainly hasn’t been among the best performing mega-caps this year.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.