Meta, formerly known as Facebook, is all set to release its earning report for the second quarter on July 26, 2023. The company is expecting a significant deceleration in its revenue growth, primarily due to a continued lack of strong growth momentum.

Additionally, Meta may face headwinds from regulatory challenges and platform changes, particularly iOS updates, which are expected to have a greater impact in Q2 compared to the first quarter.

The company foresees its expenditures to be in the range of $95-100 billion, driven by various factors including content costs, consumer hardware, product talent, technical, and infrastructure expenses. Moreover, Meta’s capital expenditure for 2023 is expected to be around $21-23 billion, reflecting its investments in hardware production, network and server infrastructure, and data centers.

Revenue and Earnings Expectations

According to Zacks Consensus Estimate, Meta’s Q2 revenue is projected to be approximately $30.84 billion, indicating a rise of 7.01% from the same quarter in the previous year. The earnings per share (EPS) are expected to stand at $2.85, representing a 15% increase compared to the year-ago quarterly report.

Analyst Predictions

In a report from Bank of America Merrill Lynch, Meta’s Q2 results are expected to beat expectations, driven by gains in digital ad spending stability. As a result, they have raised their stock price expectations from $375 to $400 while maintaining a buy rating. Moreover, they have also increased their revenue and EPS expectations for the company for the years 2023 to 2025, forecasting revenue to reach $31.5 billion and EPS to be at $3.03 for the second quarter of 2023. [2]

Key Factors for Upbeat Performance

Meta’s upbeat performance in Q2 can be attributed to several factors:

- Increased engagement across its family of apps, including Facebook, Instagram, WhatsApp, and Messenger, especially in the Asia Pacific and Rest of World regions.

- Growth in ad impressions delivered across its apps due to higher user activity and product innovations such as Reels.

- Diversification of revenue streams through new offerings like Threads (a microblogging platform), Meta Verified (a subscription service), Oculus Quest (a VR headset), and Horizon (a VR social platform).

- Continued investments in technical and product talent, infrastructure, consumer hardware, and content costs to support its long-term vision of building the metaverse.

Challenges Faced by Meta

Despite the positive outlook, Meta also faces some challenges:

- A decline in revenues compared to prior periods of higher growth.

- Apple’s iOS privacy policy changes, making it harder to track user behavior.

- Rising expenses and decreased margins due to increasing talent and infrastructure costs.

- Regulatory and legal threats, including privacy and taxation concerns.

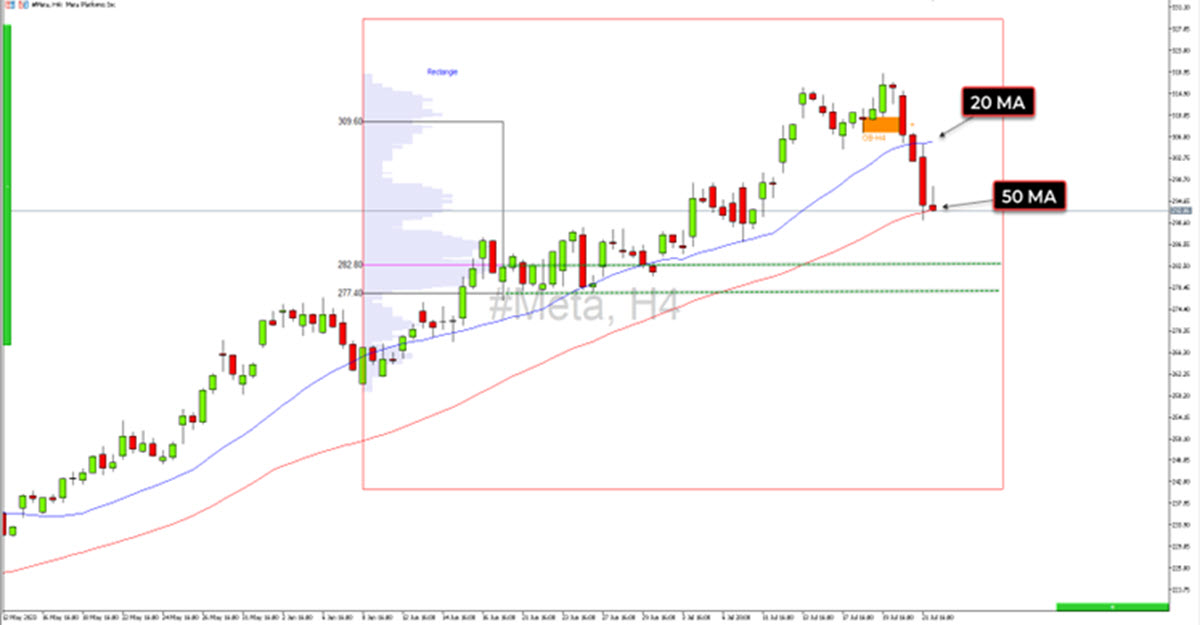

Meta Technical Analysis

From a technical perspective, Meta’s stock price has been maintaining a bullish trend, remaining above the 50-day and 20-day moving averages. However, the Relative Strength Index (RSI) is nearing 70 on the daily chart, suggesting a potential consolidation due to slight overbought conditions.

Looking at the price levels, the $290 region appears to be a solid support area for the asset, coinciding with the old resistance observed in April-May and the lower boundary of the ascending channel. On the other hand, the resistance level lies around $360-370, aligning with the upper boundary of the channel.

As the earning report approaches, investors are eagerly anticipating Meta’s financial performance and closely monitoring both the positive drivers and potential challenges faced by the company. The technical analysis provides additional insights for investors to make

META, Daily

Click here to access our Economic Calendar

Adnan Rehnan

Market Analyst – Educational Office / Pakistan

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.