The Producer Price Index (PPI) has once again taken the center stage as a pivotal economic indicator, providing a glimpse into the complex dynamics of inflation. With its finger on the pulse of wholesale price movements, the PPI stands as a harbinger of potential shifts in consumer costs, making it a crucial leading indicator for both investors and policymakers.

The recent PPI report from the US Bureau of Labour Statistics has left economists and analysts intrigued, offering a tableau of data that warrants a closer examination.

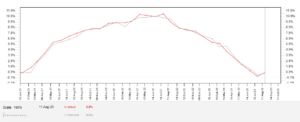

In July, the PPI for final demand in the United States demonstrated a remarkable surge, spiking at an annual rate of 0.8%. This sharp increase marked a significant departure from the modest 0.1% uptick observed in the previous month. The deviation from expectations was equally noteworthy, as the reported 0.8% growth surpassed the projected 0.7% rise.

In July, the PPI for final demand in the United States demonstrated a remarkable surge, spiking at an annual rate of 0.8%. This sharp increase marked a significant departure from the modest 0.1% uptick observed in the previous month. The deviation from expectations was equally noteworthy, as the reported 0.8% growth surpassed the projected 0.7% rise.

Further delving into the data, the monthly fluctuations in producer prices reveal an additional layer of insights. On a month-to-month basis, prices showed a 0.3% increase, suggesting a notable momentum in the wholesale price trends.

Stripping away the impact of volatile factors such as food and energy, the core PPI assumes the spotlight. This metric, which paints a more refined picture of price dynamics, exhibited an annual growth of 2.4% in July. Notably, this mirrors the previous month’s figure, indicating a degree of stability. This performance also exceeded economists’ predictions of a 2.3% rise. On a monthly basis, the core PPI registered a 0.3% increase, reinforcing the underlying trend.

Stripping away the impact of volatile factors such as food and energy, the core PPI assumes the spotlight. This metric, which paints a more refined picture of price dynamics, exhibited an annual growth of 2.4% in July. Notably, this mirrors the previous month’s figure, indicating a degree of stability. This performance also exceeded economists’ predictions of a 2.3% rise. On a monthly basis, the core PPI registered a 0.3% increase, reinforcing the underlying trend.

This unforeseen surge in PPI raises questions about potential repercussions on multiple fronts. Market observers are now contemplating its implications on monetary policy, particularly whether it might trigger a proactive response from the Federal Reserve to address inflationary concerns.

As market players absorb these developments, various sectors brace for potential impact. The US dollar could witness strengthening against major currencies, propelled by the surge in inflation that enhances its purchasing power and safe-haven appeal. Simultaneously, indices such as the Dow Jones Industrial Average (DJIA) and the S&P 500 (SPX) might experience downward pressure due to the ripple effects of higher interest rates, which elevate borrowing costs and affect business profitability. Consumer sentiment and spending could also bear the brunt of elevated inflation, influencing demand patterns for goods and services.

In this unfolding scenario, the PPI report assumes an outsized role in shaping market sentiment and policy considerations. As economic stakeholders await further cues, the report’s nuances and trends will continue to influence decisions and strategies in a dynamic economic landscape.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.