In the midst of the recent market intricacies, the USD index showcased an intriguing ride during the past few sessions. It’s evident that the dollar’s trajectory is drawing attention from investors globally. The recent unveiling of the US real GDP and Q2 ADP employment data painted a picture of mixed fortunes, contributing to a nuanced perspective on the Federal Reserve’s potential actions and a revaluation of future rate hikes.

In the midst of the recent market intricacies, the USD index showcased an intriguing ride during the past few sessions. It’s evident that the dollar’s trajectory is drawing attention from investors globally. The recent unveiling of the US real GDP and Q2 ADP employment data painted a picture of mixed fortunes, contributing to a nuanced perspective on the Federal Reserve’s potential actions and a revaluation of future rate hikes.

A cascade of events, including significant drops in JOLTS job openings for July, the Conference Board Consumer Confidence Index for August, and the subsequent unveiling of weaker ADP employment data, have set the stage for meticulous observation. Notably, the Q2 GDP’s departure from expectations prompts us to think whether the larger cycle’s downward trajectory for the US index is already etched in stone. This transition could potentially catalyse a reconfiguration of investor attention towards non-US entities.

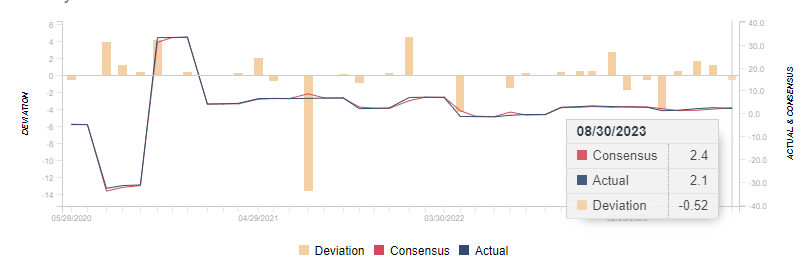

Peering into the data, the US ADP employment figures for August unveiled a modest tally of 177,000 – a notch below the anticipated 195,000 and strikingly distant from the revised value of 371,000 from the preceding period. Such a divergence raises a red flag, evoking apprehensions concerning the impending Non-Farm Payroll release. Equally significant, the revised Q2 GDP, charting at 2.1%, fell short of the envisaged 2.4%, adding another layer of complexity to the unfolding narrative.

A shift to the technical analysis reveals an intricate pattern within the daily timeframe. The USD index has ventured below the ascending trend line since July, penetrating the pivotal 103.40 Level. This could signify a notable reversal. Presently, the index is in the throes of testing support around the psychological 103 mark – a breach here could pave the way for deeper downward strides. Meanwhile, the MACD indicator paints a vivid picture of a death cross at elevated levels, ushering a discernible bearish signal. A noteworthy shift in the moving averages (MAs) from ascension to adhesion further underscores this evolving narrative. Should this scenario be augmented by a pronounced bearish trend, the dollar index could be destined for more formidable pressures.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.