The inflation rate – at least the headline rate – which has fallen sharply in the last four reports (from 10.1% in March to 6.8% in July) has certainly contributed to the Old Lady’s expectations of aggressiveness waning, bringing the terminal rate for the English Central Bank down from close to 6.5% to the current 5.585% expected by the markets in December. Core inflation, on the other hand, is still stubbornly high at 6.9%, and so is wage growth: only this morning we heard of an 8.5% quarterly/year-on-year increase in July average earnings Including Bonus.

However, it should be considered that the equation of the instrument we are analysing here also includes the USD, which has been on an eight-week positive streak and only this current week seems to have got off on the wrong foot: very strong growth, labour market and consumer data have continued to drive up the most used currency in international trade. The result of all this is that Cable has been retracing strongly since mid-July from a level of 1.3142 to the current 1.2480 (-3.64%).

Tomorrow’s US CPI data will be very important in this respect and let’s not forget that from Thursday onwards there will be seven days of fire for central banks around the world, including the BOE and FED.

TECHNICAL ANALYSIS

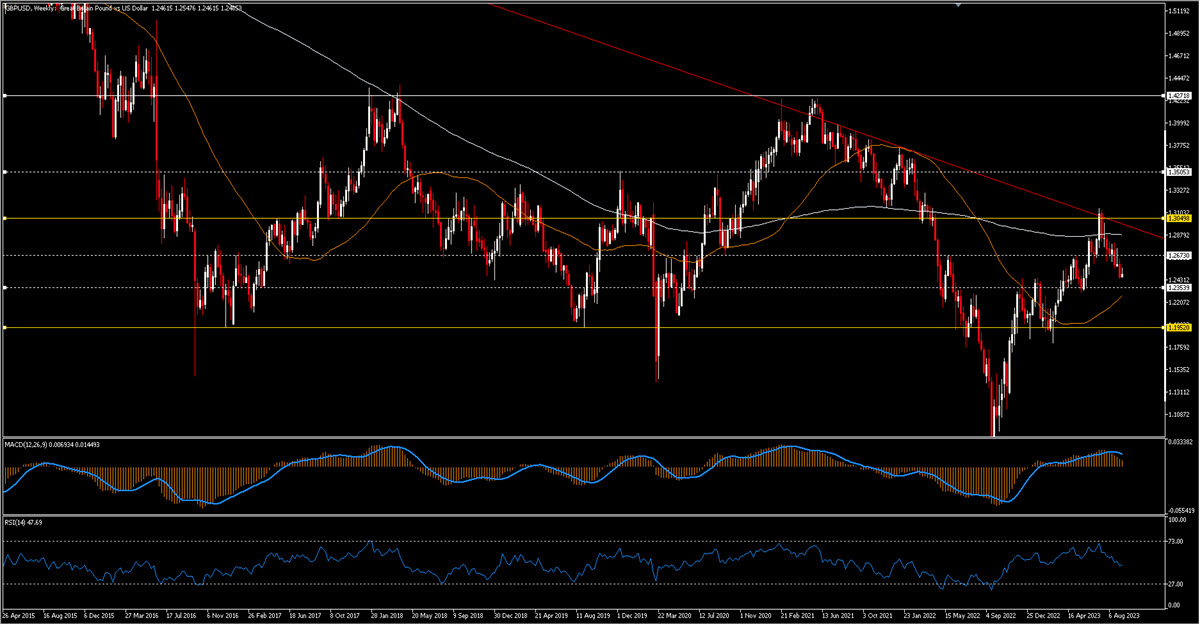

GBPUSD, Weekly

It is not easy to get an idea of the future direction of the GBPUSD for various reasons, not least the almost insignificant interest rate differential, so let’s take a very long-term view with this weekly chart where we see the relevance of some static values such as the 1.305 area from which the price roughly started the pullback. The 1.2675 area is another important static area but it has already been breached, the next one seems to be around 1.2350. The chart also shows that a general downtrend started in 2006 (red line).

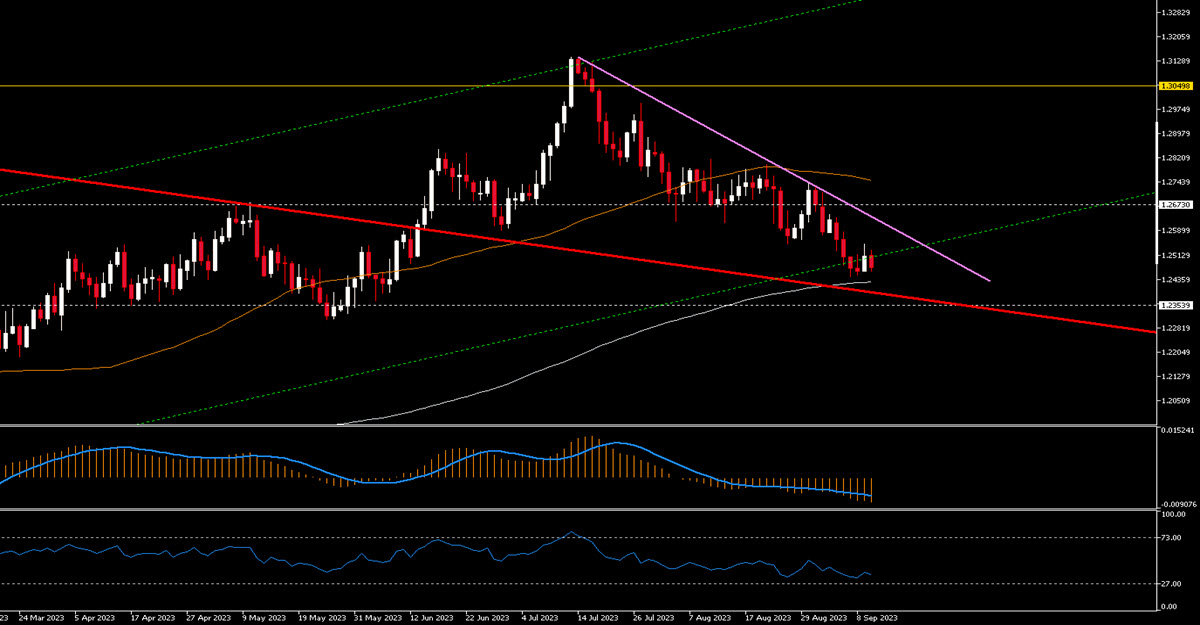

GBPUSD, Daily

The daily chart is interesting: in April, Cable broke the downtrend which started at the beginning of 2021 and in the last few weeks it has come back down to retest it. It is not far now from that level of 1.2350 and the MA200 (1.2425 today) also passes very close to it; this could hint at a bullish channel (dashed green). MACD is certainly negative and RSI below 50. The final outcome can vary but one of these could be that the GBPUSD could fall relatively little further, say another 1% to 1.235. From there, various forces could cause it to bounce, with the purple trendline now passing near 1.26 as initial resistance; a definitive confirmation of a bullish move would come at the break of the MA50, which should occur near 1.27. This will happen -it is clear- if the King USD starts to deflate in the coming weeks.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.