The Nasdaq 100, a home to 100 cutting-edge companies, is a snapshot of innovation in action. These aren’t your run-of-the-mill businesses; they’re the vanguards of technology, communication, and more. From the tech titans to the disruptors, this index mirrors the cradle of innovation, representing the forefront of progress.

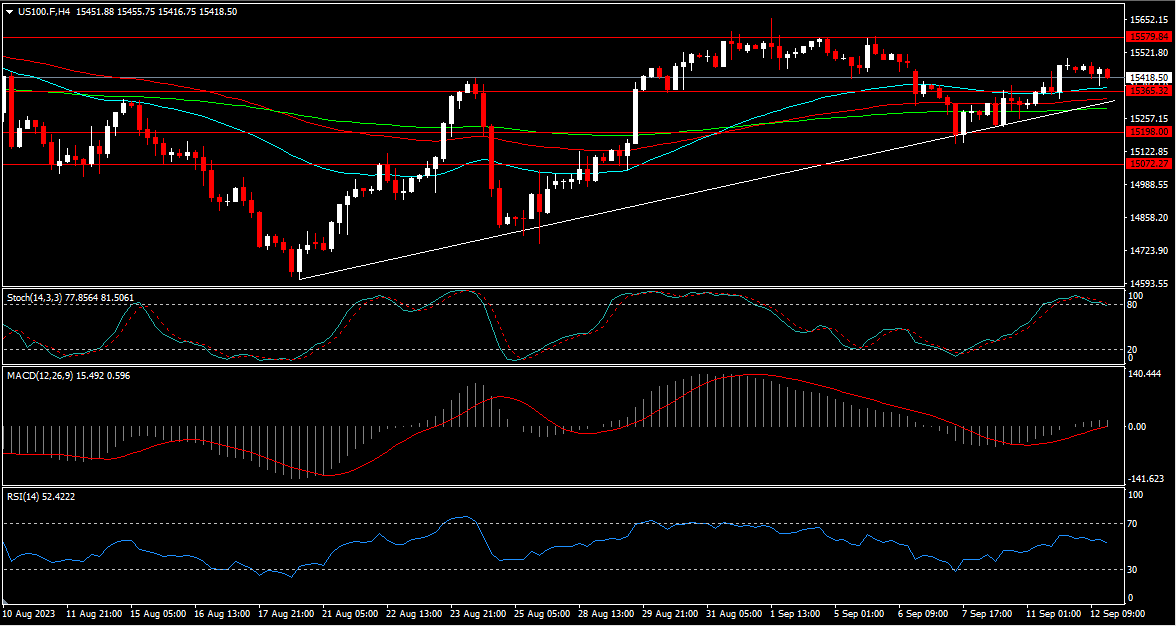

As of September 12, 2023, the Nasdaq 100 stands tall at 15,465. A remarkable journey unfolds from its recent past – an ascent that started in August 2023 from the low at 14,612. A resilient climb of 4.9% has followed, surmounting resistance levels, including the 50, 100, and 200 moving averages on the 4 hour timeframe. It has even breached the formidable psychological barrier at 15,500. Now, it is approaching the July 2023 high point of 16,059. Will it conquer this peak, unveiling further possibilities at 16,300 and 16,600?

The technical indicators tell a bullish story. The MACD signals positive momentum, staying above the zero line and signal line. The RSI also leans bullish, above the 50 level. Yet, a word of caution – the Stochastic indicator lingers in overbought territory, suggesting a possible pause or reversal.

Fundamentals are crucial. The U.S. economy’s performance matters greatly. It showed an annual GDP growth rate of 2.6% in June 2023, surpassing the previous reading, and a slight increase in the unemployment rate coming in at 3.8% August 2023. However, the shadow of inflation, standing at 3.2% in August 2023, looms, albeit partly due to transitory factors like rising energy prices.

Earnings reports and guidance of the Nasdaq 100 components are the heartbeat of this index. In Q2 2023, these companies’ Earnings Per Share increased by an impressive 19.11%. Earnings and revenue growth rates surpassed estimates, showcasing the strength of sectors like technology and healthcare. Positive guidance for the future instils confidence.

So, what’s the verdict? In the short term, optimism prevails, driven by a technical uptrend, strong earnings, and positive risk sentiment. However, there are warning signs – profit-taking, inflation, and uncertain risk sentiment could pose short-term challenges. Therefore, we cautiously rate the index as neutral to bullish in the short term, recognizing the ever-changing market dynamics.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.