USDCAD has rebounded from recent losses, tracking a broader price action in the US Dollar. Above forecast data out of the US, including the latest readings on jobless claims and Philly Fed index, propped up Treasury yields. At the same time Oil prices pulled back from fresh trend highs.

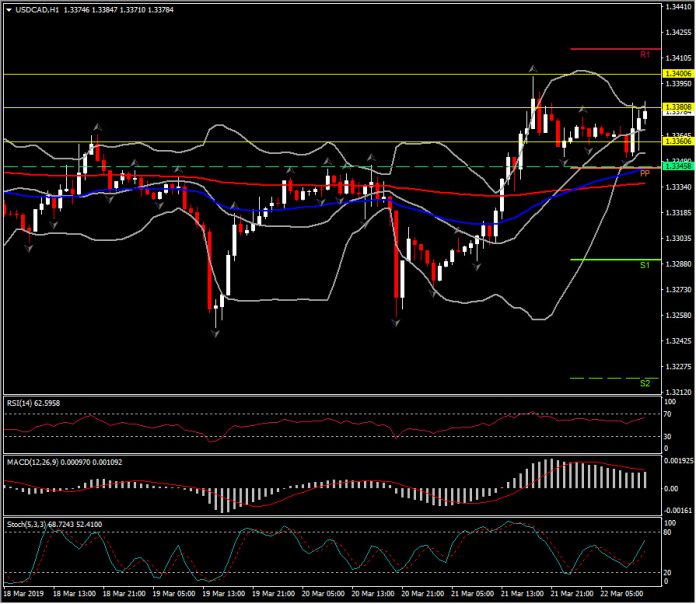

USDCAD saw a rebound high at 1.3383 earlier and has currently settled few pips lower. From the economic data perspective, Loonie might be affected by the Canadian February CPI data and Retail Sales which will be released today.

The CPI is expected to climb 0.5% in February (m/m, nsa) after the 0.1% rise in January, boosted by stronger gasoline prices and seasonal strength in February’s CPI. Total CPI is projected to expand at a 1.4% y/y pace (nsa) in February, matching the 1.4% clip in January. The core CPI measures are expected to hold just under a 2.0% y/y clip in February, consistent with a subdued backdrop for underlying inflation.

The month of February displays some of the strongest month comparable seasonal gains of they year. Gasoline prices were firmer in February, rising 4.0% compared to January. Mortgage costs are likely to have firmed further and the usual bounce in travel service prices should be seen. The airfare component is the usual wildcard.

For Retail sales, growth of 0.3% in January is anticipated, after the 0.1% dip in December.Gasoline prices fell 3.1% in January after dropping 6.5% in December according to the CPI, which should weigh on total and ex-autos sales values in January.

Data in line with expectations shouldn’t have much impact on the Canadian Dollar. Intraday Resistance for USDCAD holds at 1.3390, while a break of it could lead to the retest of 1.3400-1.3420 area. Support holds at 1.3345-1.3360 area.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.