While the Brexit saga rages on, with most people both in and out of the UK being fed up with it, the question which troubles most traders is how Sterling will behave in the case of a no-deal Brexit. While far from an exact science, what follows is an estimate, based on both technical analysis and a scenario where Sterling behaves as it did back in 2016, on how things could evolve.

Let’s start with the history: on June 23, 2016 the British public voted in favour of leaving the European Union. On that day, Sterling dropped from 0.76 against the Euro to 0.81, further declining to 0.86 on July 06, reaching 0.91 in October 11.

Let’s make a simple assumption: that Sterling, under a no-deal Brexit, will behave similarly to what happened around the Brexit referendum date. This would imply dropping by 6.6% upon announcement, another 6% within 15 days, and an additional 5.8% within four months. Note that this is still a much more conservative estimate to the Reuters poll, which forecasts a 9% immediate negative impact.

At the moment, Sterling is trading around 0.855. Again assuming that the exchange rate does not move by much until the final day of exit we could expect that it could drop to 0.911 on the day and reach 0.966 within two weeks from the exit. From then on, it would depend on the Bank of England’s rate-raising agenda in order to avoid reaching parity, a possibility which cannot be ruled out even against the USD, as other commentators have also noted.

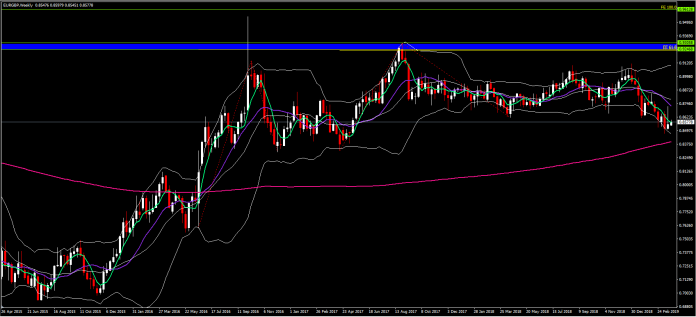

The above assumptions also appear to be roughly supported at a technical level. Using a weekly chart and a Fibonacci expansion indicator, (ignoring the one-off Sterling flash crash in October 2016), the first key Resistance level appears to stand at the area between 0.9247 and 0.9306, slightly higher than the 0.915 level using the simplistic approach above. Then, the next Resistance level also appears to stand at 0.9613, again relatively close to the 0.966 level presented above.

Overall, expectations are gloomy with regards to Sterling’s future, and the recent developments in Parliament have not done anything to assist with that. As the deadline is fast approaching, the probability of a no-deal Brexit, even though still lower than that of reaching an agreement, will increase each day that no decision is made.

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.