FX News Today

- Slide in global bond yields continues.

- The flattening or outright inversion of yield curves meanwhile is fuelling recession fears and also turning into a self-sustained cycle.

- Bund yields drop below those of JGBs yesterday after ECB tiered depo story potentially pushing the timing of the first rate hike.

- US Equities dragged lower by deeper curve inversion, taken as global risk signal.

- WTI crude down 1% under $59.30 after mixed EIA – crude build, product draws.

- Brexit: May’s pledge to step down may not be enough to secure her deal.

- GBP steady as Brexit process reaches defining phase; no-deal exit now very unlikely.

- DUP still doesn’t back Withdrawal Agreement.

- MPs yesterday rejected a range of alternative options, but with the customs union proposal coming pretty close and losing by just 8 votes, so that seems to be the front runner in alternative scenarios to May’s deal.

Charts of the Day

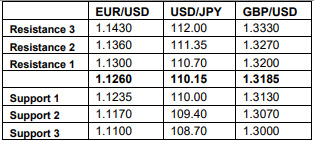

Technician’s Corner

- EURUSD has formed a falling wedge since March 27. Indicators are issuing neutral to positive signals. This pattern is still in the process of forming. Possible bullish price movement towards the resistance 1.1283 within the next 6 hours.

- GBPUSD rebounded from 1.3140 and is trading a breath below PP level at 1.3193. Support is set at 1.3118 as the indicators suggest a slightly downwards tendency.

- USDJPY bottomed at 110.05, with next Support at 109.70 level. Indicators are negatively configured suggesting further negative bias intraday.

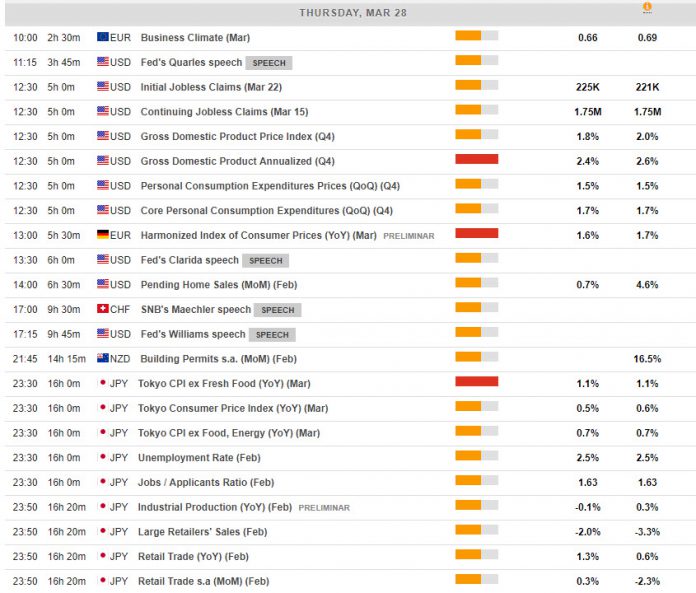

Main Macro Events Today

- German CPI (EUR, N/A) – The German inflation rate is expected to have increased to 0.6%, compared to 0.4% in the previous month.

- US Final GDP (USD, GMT 12:30) – The final release of the 2018Q4 GDP growth rate is expected to see the world largest economy’s economic activity to have grown by 2.4% compared with the preliminary reading of 2.6%.

- Tokyo CPI and Production Data (JPY, GMT 23:30) – The country’s main leading indicator of inflation is expected to have remained at 1.1% y/y in March, at the same level as in February. Industrial Production is expected to have improved, growing by 1.4% m/m in February, compared to -3.4% m/m in January, while Retail Sales are expected to have increased by 0.9% y/y in February, compared to 0.6% in January.

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.