The USD majors have largely remained steady, within yesterday’s ranges.

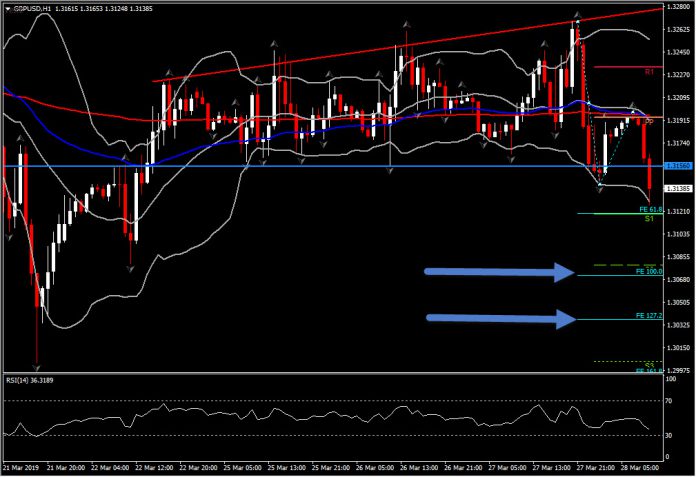

GBP has been unperturbed by the frantic pace of political developments in the UK, and continued impasses in the UK’s parliament over Brexit. Cable settled around the 1.3180-1.3200 mark before reversing back to a moderate dip to 1.3124 earlier, a few pips above day’s S1 at 1.3118. The ascending triangle pattern identified since March 22, broke in the last session, suggesting a rising negative bias. Next Support levels come at 1.3070-1.3080 and 1.3036. Resistance is at Pivot Point.

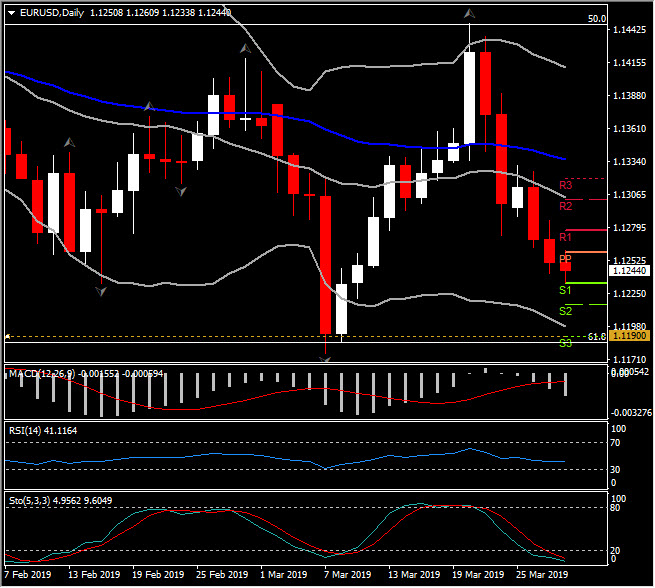

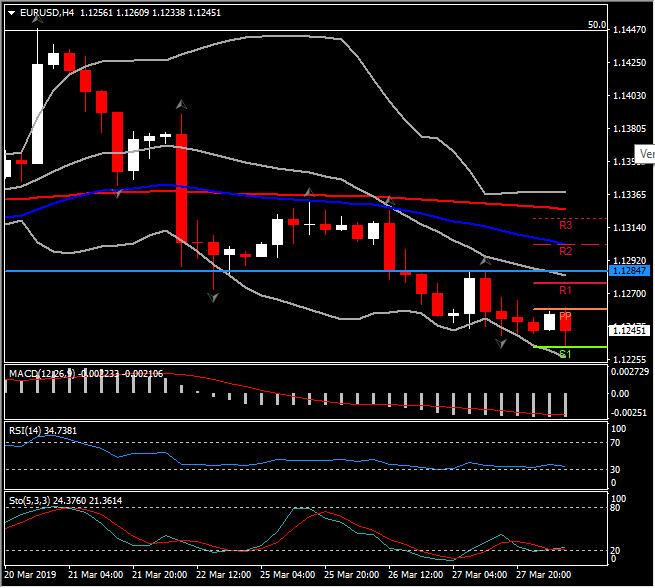

EURUSD posted a new two-week low earlier by breaching the initial Support of the day at 1.1233. Currently it is trading northwards, however no substantial move so far has alerted the potential recovery of the pair. The pair remains down by nearly 2% from the 7-week peak that was seen last Wednesday. The Euro remains in a down channel that has been set since the start of the year, with momentum indicator scontinuing to deteriorate towards bearish configuration intraday and daily. Hence the directional bias could remain to the downside, with incoming US data to show a relative robustness of the economy on that side of the pond. EURUSD has immediate Resistance at 1.1260 (PP) and further up to yesterday’s peak at 1.1285. Meanwhile intraday Support holds at 1.1233, while the break of this level could turn attention to the confluence of S3 of the day and the significant 61.8% Fibonacci level set since the January 2017 rebound, at 1.1185.

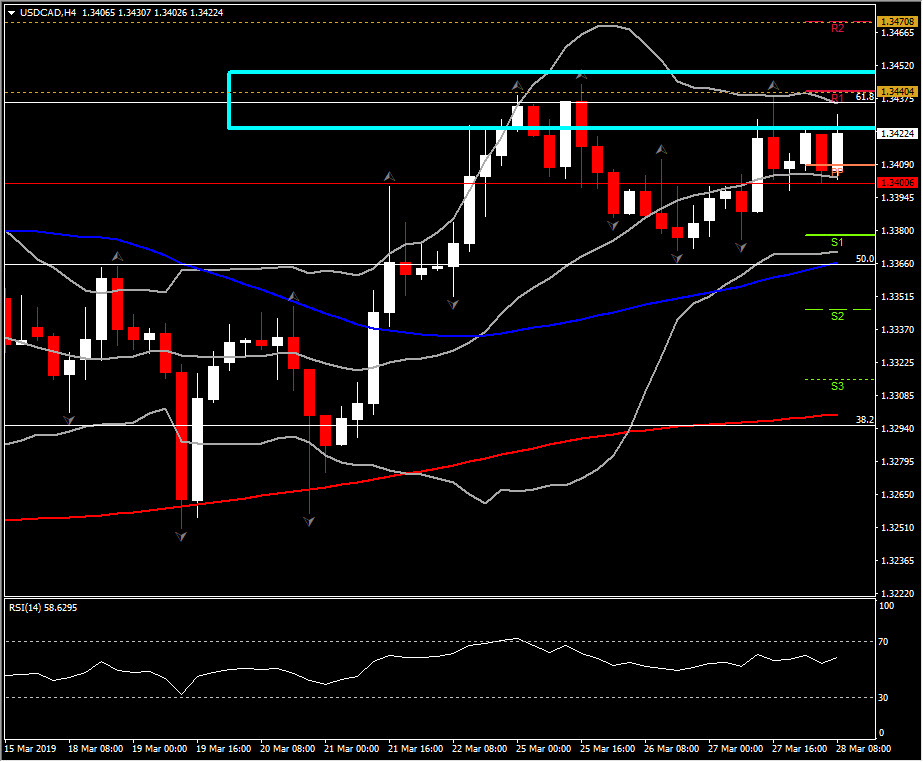

USDCAD has been narrowly orbiting the low 1.3430 area, below the 2-week high that was seen on Monday at 1.3444. Sputtering global stock markets and the associated concerns about global growth have undermined sentiment to the Canadian dollar and its Dollar bloc brethren. Despite that, USDCAD holds above 1.3400 and well off week’s support at 1.3358-60. Momentum indicators are rising gradually suggesting that bulls are keep trying to gain the control of the asset. The break of the 1.3444 level, could re-open December’s highs. Next Resistance stands at March peak at the 1.3465 barrier.

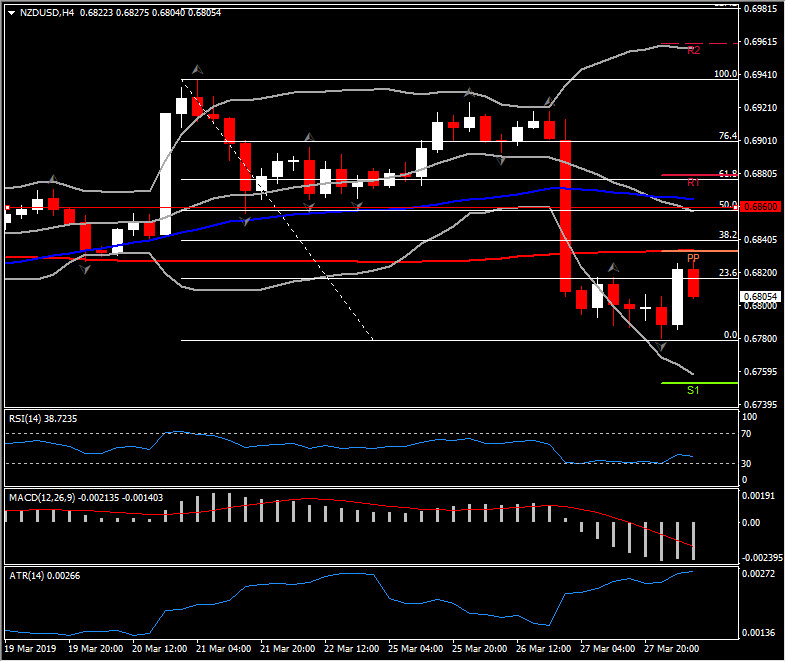

NZDUSD, which dove sharply yesterday after the RBNZ added itself to the growing list of central banks which have made dovish turns, staged a partial recovery, lifting to 0.6828, which still leaves the Kiwi below the 50-day SMA and over 1.2% below the levels prevailing ahead of the central bank’s statement. Only a recovery above 0.6860 (50% regain of March drift) could imply a retest of year’s highs. Intraday the outlook remains bearish as the asset pulls back from day’s high and moves southwards towards day’s lows. A break could open the way towards S1 and 20-day SMA at 0.6737-0.6750 area. ATR indicator points further decline by 27 pips.

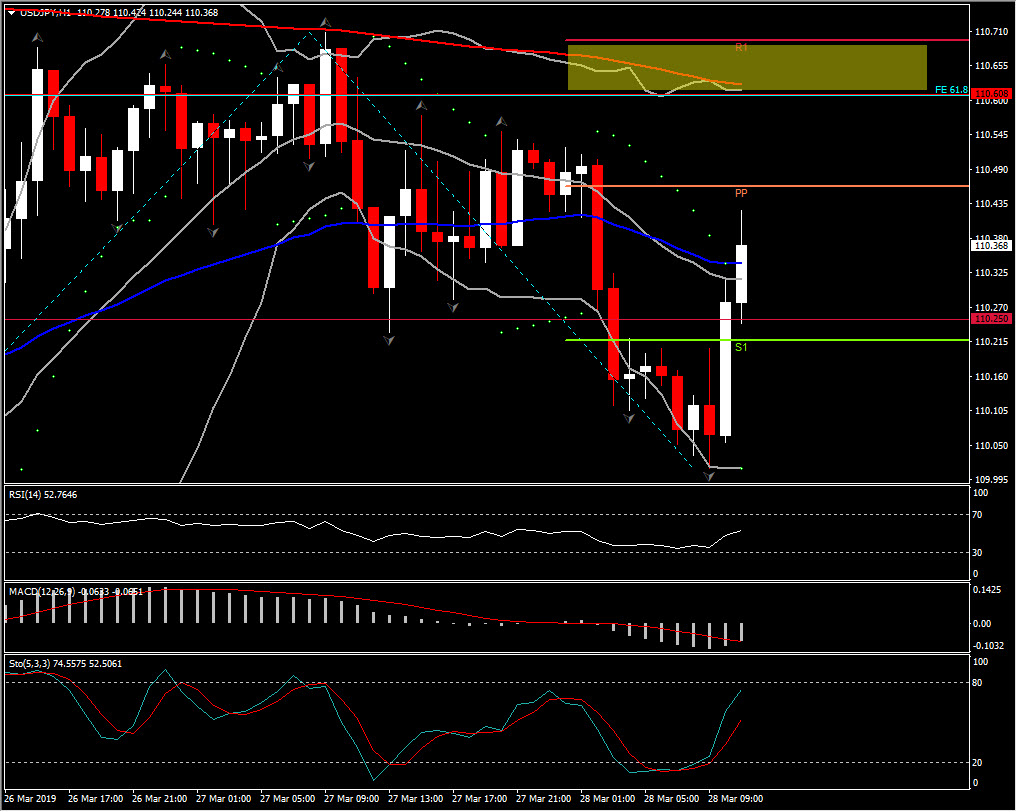

JPY crosses declined overnight as the Japanese currency picked up some safe haven demand as global stock markets continued to sputter as investors fret about recession-signalling yield curve inversions.

However in EU session so far, USDJPY lifted to the 110.39 area after edging out a 3-day low at 110.02. Yen crosses saw a similar down-and-up price action. The movement above 20- and 50-EMA along with the turn of parabolic SAR, reflects the positive configuration of the asset for now. USDJPY holds Support at 111.20 and further lower at 110.10. Immediate Resistance is just few pips higher at 110.46, while a strong hourly candle above it could turn the attention towards 200-hour SMA and yesterday’s high at 110.60-11.70 area.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.