Major US stock indices closed with losses on Tuesday [21/22], after the Federal Open Market Committee (FOMC) revealed all policy makers agreed that monetary policy should remain restrictive for some time and some disappointing corporate earnings results weighed on the overall market. In addition, semiconductor stocks were weaker as they declined after Monday’s sharp gains.

The US30 closed down -0.18% with Intel Corp down -2.47%. The US100 lost -0.58% as Sirius XM Holdings shrank -5.64%. The US500 fell -0.20%, while Jacobs Solutions plummeted -8.69% after its 2024 adjusted EBITDA forecast was below consensus. 7 out of 11 S&P sectors ended lower, led by declines by the technology, real estate and consumer sectors.

The minutes of the 31 October-1 November FOMC meeting were neutral to slightly hawkish – all participants agreed that the committee is in a position to proceed cautiously, and that policy decisions at each meeting will continue to be based on the totality of incoming information and interest rates will remain restrictive for some time.

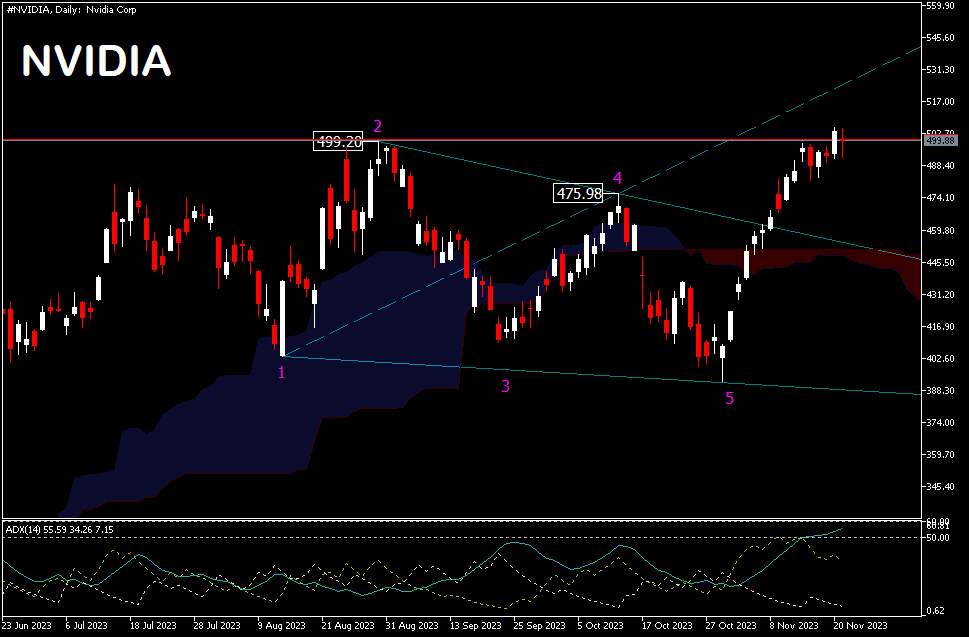

After the latest earnings report from Nvidia, its share price fell more than 1% in extended trading after beating expectations, but warned against export restrictions in China. The market response to the chipmaker’s strong earnings could be an indication that the stock is overvalued.

Nvidia Corp. said that its revenue for the third quarter of fiscal 2024 skyrocketed 206% to $18.12 billion on an annualised basis, beating market estimates. With operating expenses of $2.9 billion, net income for the three months to 29 October jumped 1,259% to $9.2 billion, or $3.71 per diluted share. Nvidia’s Data Centre revenue jumped 279% to $14.51 billion from a year ago, followed by increases in Gaming, Professional Visualisation and Automotive of 15%, 10% and 3% respectively. Regarding guidance, Nvidia expects revenue of $20 billion in Q4, representing revenue growth of nearly 231%.

The price of #NVIDIA closed at $499.88 in yesterday’s trading, still within the range of bullish points.

Shares of #Microsoft were flat in after-hours trading. The stock fell -1.2% to $372.91 on Tuesday, within the $366.78 cup-base support range. A longer pause would help the moving averages catch up. The OpenAI drama is still not over, but it seems that Microsoft will strengthen its capabilities eventually. Shares of #AMD declined slightly in extended trading, slipping -1.9% to $119.15 on Tuesday. Rival Nvidia now has important support at $111.80. Google #Alphabet-A shares were flat late in the session, edging up 0.5% on Tuesday to $136.97. Shares of #Meta lost a small portion overnight. Shares edged down -0.9% to $337.01 and have been in a consolidation buy zone since late July.

Technical Review

The #USA100 still maintains its positive bias above the 52-week EMA and sits above the 15946.40 resistance. The weekly candlestick shape’s appearance is still strongly to the upside, but it may lose weight as the size is getting smaller, which is understandable as investors tend to be cautious as the price approaches the 16767.80 ATH peak.

The golden-cross of 26/52-day EMA still validates the price action, but the price clearly looks overbought. A move above the recent high would confirm the continuation of the bullish trend from the bullish flags’ 14054.80 rebound for the FE61.8% projection [from 11683.10-15946.40 drawdown and 14054.80 at 16689.52]. However, a move below 15747.10 intraday support can’t be ruled out either due to sentiment factors. And if that happens, then the USA100 could enter a consolidation phase later this month.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.