FX News Today

- Wall Street was higher overnight, followed by the better than expected US manufacturing ISM and construction spending reports (they offset disappointing retail sales).

- JGB yields still moved higher, in tandem with most Asian stock markets, but the buoyant mood in equities that dominated yesterday’s session turned a bit more muted, as the focus turned from revived hopes on a US-Sino trade deal and a recovery in the manufacturing sector to Brexit risks.

- RBA left monetary policy on hold amid increased downside risks, but seems to be awaiting the fiscal injection that is expected to be unveiled today.

- UK Parliament rejected all options on Brexit compromise, customs union close miss.

- GBP was under pressure due to revived concerns of a no-deal scenario.

- WTI crude rallied 2% to a fresh 5-mth high near $61.82, on supply side tightness.

- USDJPY lifted to 11-day highs amid risk-on; EURUSD hit 3-week low near 1.12.

- GOLD holds the key 1285 level – at 1287.

Charts of the Day

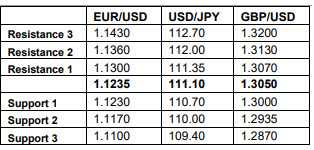

Technician’s Corner

- GBPUSD is under pressure once again, trading southwards below its Pivot for the 10th consecutive hourly session. A breach and break of S1 at 1.3025 could suggest the retest of 26-day Support at 1.2970.

- USDJPY printed an 11-day high at 111.45, as the safe haven premium of the Japanese currency unwinds. USDJPY has support at 111.20.

- NZDUSD holds at 3-week lows. Support holds at 0.6770. The next support on the break of the latter is at 0.6750. If the asset rebounds however, Resistance has been set at 0.6800. Overall outlook remains negative due to the descending triangle formation and the decreasing momentum indicators in the daily chart.

- BTCUSD – biggest mover – Spiked to 5013 from 4216. However, intraday the asset looks overbought, with RSI at 81, and a doji closing the past hour.

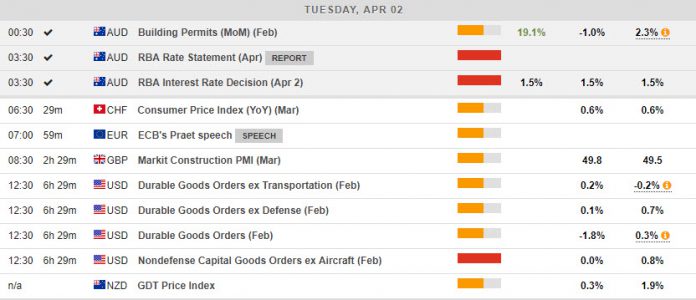

Main Macro Events Today

- UK Markit Construction PMI (GBP, GMT 08:30) – The Construction PMI is expected to improve to a 50.0 reading after dropping sharply in February to 49.5, which was the lowest reading since July 2016 (the month after the vote to leave the EU).

- Durable Goods (USD, GMT 12:30) – February Durable Goods orders are expected to decline to 1.2%, following a 0.3% January gain.

- Nondefense Capital Goods Orders ex Aircraft (USD, GMT 12:30)

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.