European stock markets ARE up from lows, as investors start to move past the fresh set back on the way to an orderly Brexit and hopes of a soft option were thwarted once again yesterday as MPs in London rejected all alternative scenarios. Talks continue, however, and there is still time to come to an agreement, especially as a customs union option, which was very close to getting accepted yesterday would ensure very smooth progress past the April 10 Emergency EU Summit and could still see the UK leaving the EU on May 22.

As of 10:58 GMT the GER30 had extended gains to 0.46%, and other Eurozone markets had managed to recover early losses, while the UK100 managed to benefit from a weaker pound and outperformed with a gain of 0.73%.

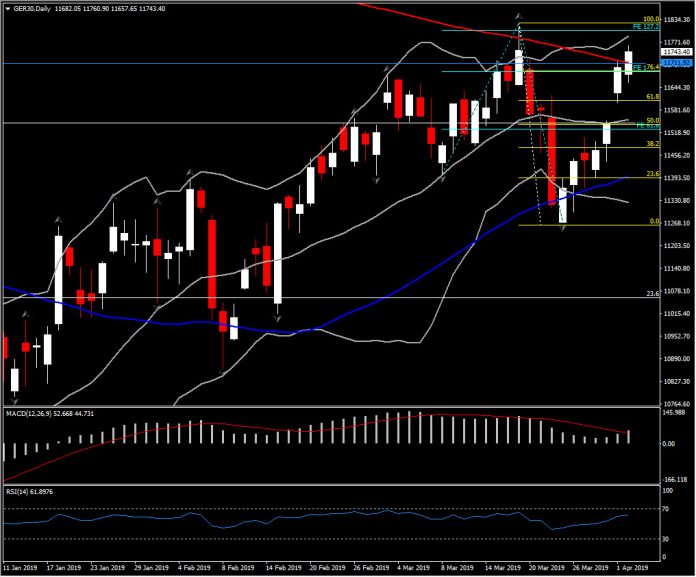

GER30 looks to be in a run to visit A March high, at 11824 Resistance level. However, as the asset looks overbought intraday, with price outside the upper Bollinger bands, which keep extending to the upside, it is likely to face a pullback.

Overall so far today, but also in the medium term, the bullish crossing of MACD lines and the RSI above 60, support the increasing positive bias scenario.

Therefore any pullback could trigger a “buying the dip” response. The overall positive outlook remains however as long as the asset price holds halfway of March’s decline, which also coincides with the 20-day SMA and the gap formed on yesterday’s opening, at around 11,550.

Initial support meanwhile is set at 11,656 and next one at 11,609 (61.8% Fib. level). Meanwhile if the asset sustains its gains today above the 200-day SMA at 11,712, this could add further optimism and could boost GER30 above the March peak to the next long term Resistance at 50-week SMA at 11,869.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.