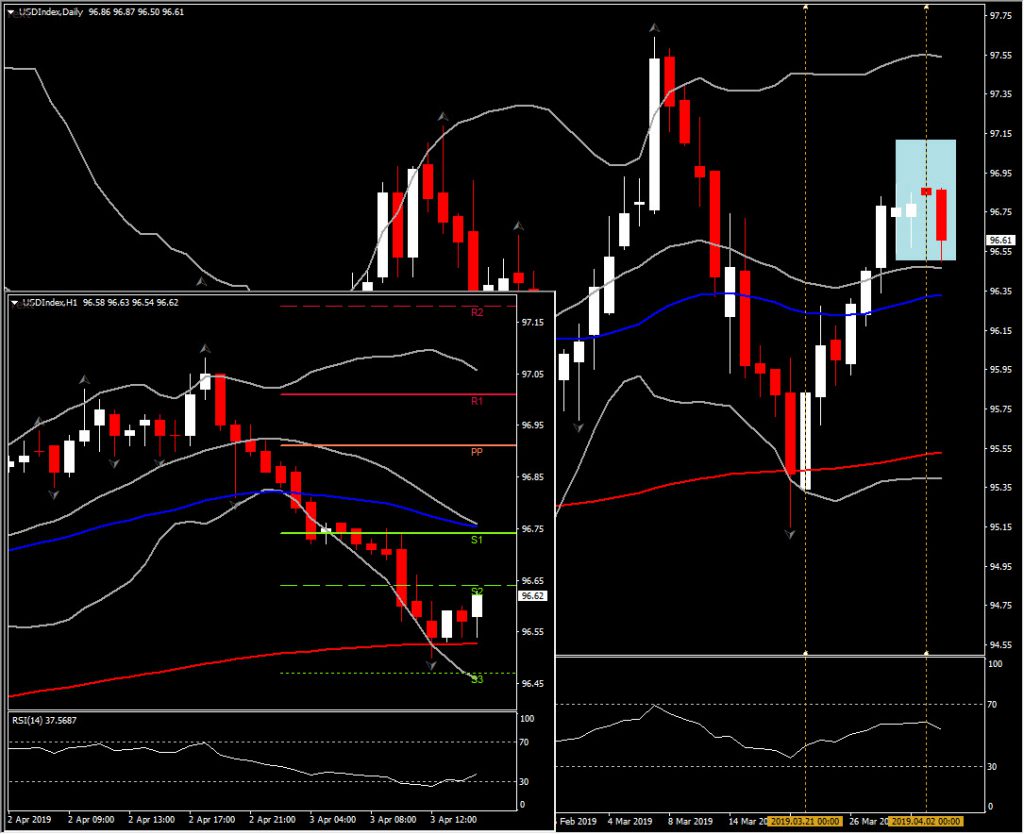

The Dollar dipped after the ADP jobs miss, taking USDJPY to 111.40 from 111.50, and EURUSD to 1.1250 from 1.1240. The Dollar index meanwhile, narrowed around mid of 96 area, after trying the last 4 hours to keep a floor of the 2-day decline at 96.50 (20-day SMA). The USD has lost some ground since yesterday, as risk appetite has continued to course through global markets. Equity futures continue to imply a higher Wall Street open, while yields are under session highs.

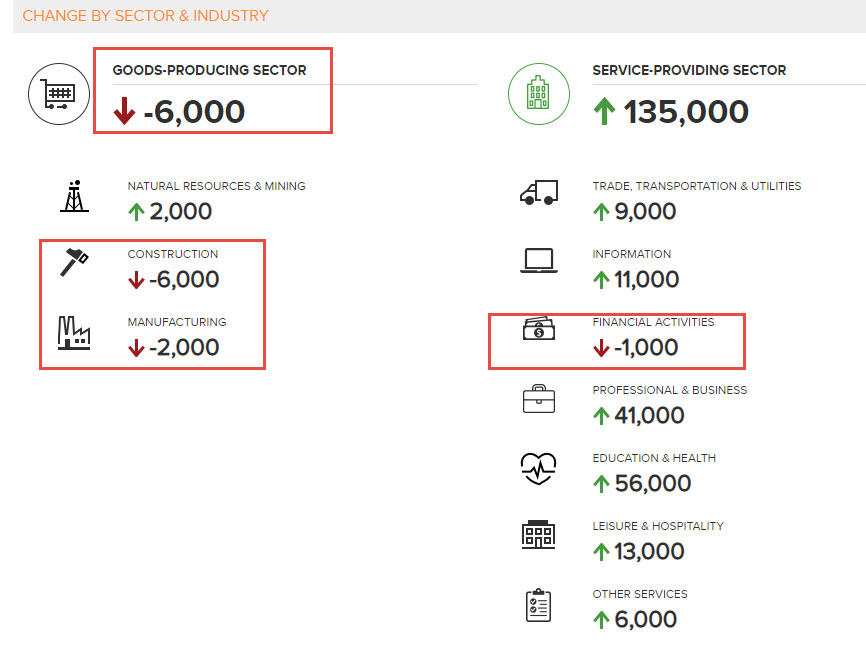

US ADP reported private payrolls increased 129k in March, missing expectations, after February’s upwardly revised 197k gain (was 183k). The services sector added 135k, while the goods sector declined 6k. For the former, education and health added 56k workers, with leisure adding 13k, while information services added 11k, with trade/transport adding 9k.

In the goods sector, there was a surprising 6k drop for Goods sector that defied March firmness in factory sentiment, with declines of 2k for factories and 6k for construction, but a 2k rise for mining.

While the headline disappointed and is consistent with other signs of a slowing economy, other labor data suggest the labor market remains solid, with a lack of skilled workers.

The March ADP rise substantially undershot the 216k total BLS payroll increase, though the forecast for the BLS figures usually incorporates a weather-gyration that mostly sidesteps the tabulation method for the ADP data.

Beyond the divergent weather impacts due to the different structure of the two measures, note that ADP rose 326k over the last two months, while the BLS measure will rise only 245k over the period if the 220k March forecast is correct, suggesting that ADP may still signal some upside risk for Friday despite the small March gain.

The “as reported” ADP figures have overshot private payrolls by 21k per month on average since the methodology change of October 2016. Yet, over the 12 months through February, there is a 207K average “as reported” ADP gain versus a 202k average BLS private payroll gain, leaving a 5k average overshoot for this more recent period.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.