WTI ended the week on fresh 5-month highs, peaking at $63.27 so far, and up nearly 2%. The contract has been in rally-mode since the US jobs report this morning, which buoyed demand sentiment. General risk-on conditions seen this week helped crude higher as well. It is up by 0.5% at $63.41, earlier printing a $63.53 high, making this the fifth consecutive week of gains.

The familiar bullish themes of OPEC supply quotes, US sanctions on Venezuelan and Iranian crude exports and still-strong global demand remain in play. However, the heating of tensions in OPEC member Libya have been a cause for concern, with newswires talking up the potential for civil war as the two major political factions there come closer to armed conflict. Libya’s exports have been spotty at best for some time, though a war could ultimately see output come to a halt.

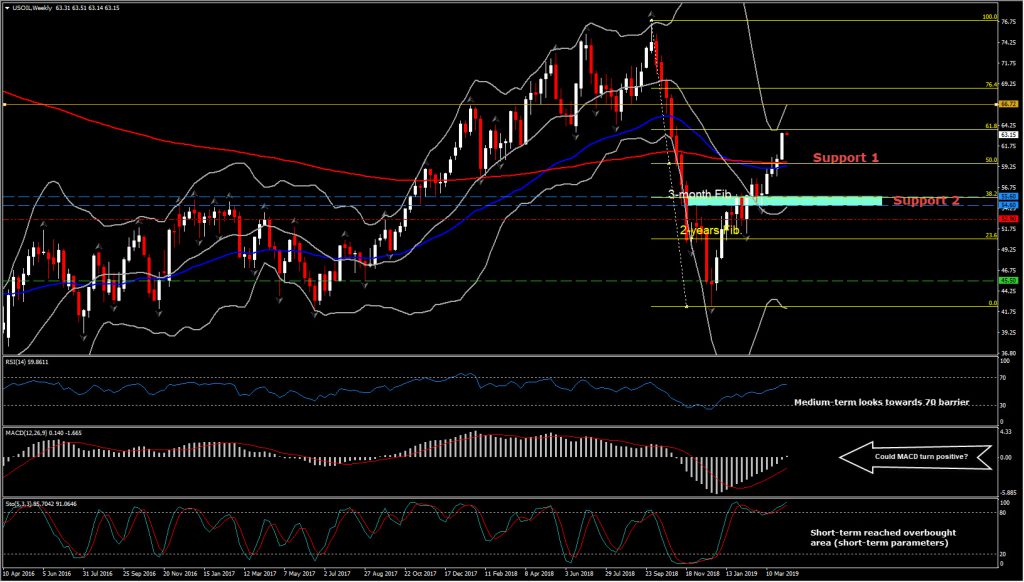

At prevailing levels, WTI benchmark oil prices are up 39.6% on the year-to-date, and are back to near flat versus year-ago level. A lot of people could say that it has reached overstretched levels, however technically momentum remains strong overall, with signs of moderate firmness being taken as corrections before the next bull wave. A sign of consolidation is given by the flattening of the 200-week but also 200-day EMA.

The asset is currently retesting its 61.8% Fibonacci retracement Resistance level at $63.70, on the decline seen since Q4 2018 from $76 highs. On the break of this level and as the price remains inside upper Bollinger Bands, the next level to be watched should be the $66.60 (December 2017 peak) and $68.70 (76.4%). Support is set at $61.70 (last week’s midpoint) and further down at $59.90 (200-day EMA and 50% Fib. level).

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.