The Euro took a turn lower, in the wake of ECB President Draghi exclaiming during his post policy-meeting press conference today that the risks to the Eurozone economy remain tilted to the downside, and that inflation is likely to decline in the coming months while talking of the need for continued “ample” stimulus.

While acknowledging that some domestic headwinds on growth were fading, geopolitical uncertainties and trade protectionism, along with some emerging market problems, are having an impact on sentiment.

ECB sees relatively low probability of recession in the Eurozone, while the president also stated that today’s meeting was less of an operational meeting but one that clarified the ECB’s overall stance, which effectively continues an easing bias. As we expected, the June meeting, when the next round of forecast updates will be available, is the next meeting to look out for in terms of monetary policy and the details of the TLTRO program as well as possible measures to mitigate the side effects of the negative deposit rate. Draghi admitted that incoming data remains weak, especially in manufacturing, and stressed again that the ECB is ready to adjust all instruments if needed.

This leaves the ECB on standby should things get worse. So far though the ECB still expects the impact of negative factors to continue to unwind, with the economy supported by favourable financing conditions, although overall the risks to the outlook remain tilted to the downside, due to external uncertainties. Inflation is expected to firm over the medium term, even if the headline rate is seen declining slightly in coming months.

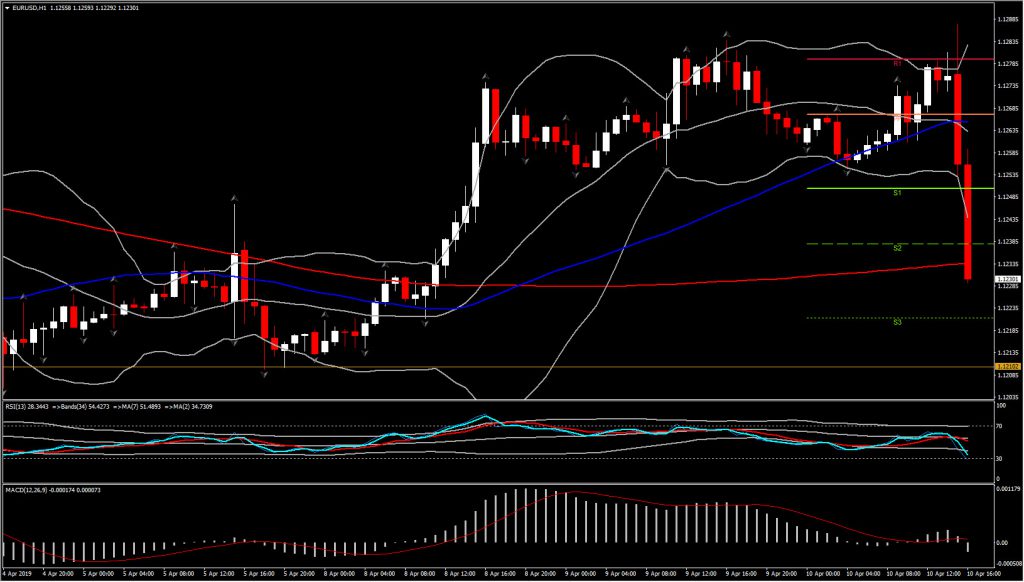

EURUSD tumbled to a 1.1230 low in the immediate wake of this communication, down from levels above 1.1280. The pair had been tracking modestly higher from the 1.1210 low seen in the wake of the US jobs report last Friday, which revealed a blend of strong payrolls but tepid earnings growth, which supported Wall Street but pressured Treasury yields, and which in turn put a lid on the Dollar.

President Draghi has now rebalanced the scales somewhat. Market participants will now be looking to today’s FOMC minutes, which are expected to remain on hold, especially after the US March CPI report revealed an as-expected 0.4% gain in the headline, rounded from 0.409%. The FOMC minutes are on tap as well at 19:00 GMT, which will be sifted for any juicy details on the dovish pivot at the March 19-20 meeting.

The EURUSD has Resistance at 1.1282-87, which has been tested unsuccessfully yesterday and today. Next Support is set at 1.1210-1.1220. In the bigger picture, EURUSD is in a bear trend, which has been unfolding since February last year, although downside momentum has abated noticeably in recent months.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.