FX News Today

- 10-year Treasury yields are unchanged at 2.497% and JGB yields up 0.6 bp at -0.059%, in catch up trade, after perky US PPI readings put pressure on bonds yesterday, even if they are not expected to alter the Fed’s patient policy setting for now.

- Chinese bonds continue to underperform amid warnings on the still large number of non-performing loans that could threaten some banks and force the government to step in.

- Stock markets traded mixed, again with China underperforming, as markets await key trade numbers. Topix and Nikkei are down -0.10% and up 0.67% respectively.

- The Hang Seng lost -0.27% so far and CSI 300 and Shanghai Comp are down -0.49% and -0.26% respectively.

- Reports of impending cost cuts at Australia’s largest bank meanwhile helped the ASX to close with a gain of 0.76%.

- US futures are posting slight gains ahead of key earnings reports from JPMorgan Chase and Wells Fargo. The front end WTI future is trading at USD 63.83 per barrel.

Charts of the Day

Technician’s Corner

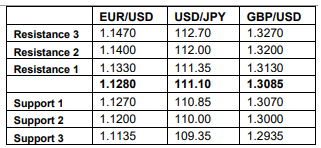

- EURUSD keeps trading above the 1.1276 level in the last few hours, after trading below that point through the night. A strong Resistance point remains at 1.13. Stochastics and the MACD show signals of a downwards move.

- GBPUSD keeps trading around the 1.30 mark, crossing its 20HMA early today, but with indicators showing mixed signals.

- USDJPY continues to increase and broke through the 111.68 level, and coming near the 111.80 Resistance. Stochastics and the MACD show an easing of the upwards movement.

- XAUUSD had a bad day yesterday, breaking through four Support levels and ending below 1294. Since then, it has been registering a slow upwards trend, something more evident in the Stochastics than the MACD indicator.

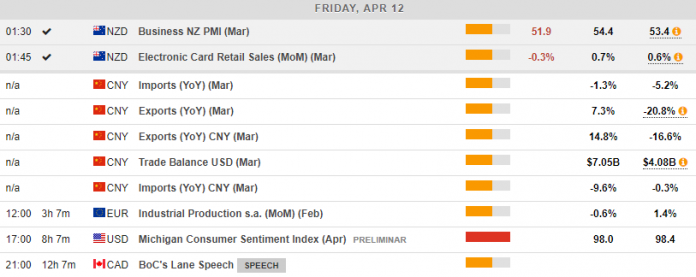

Main Macro Events Today

- China Imports and Exports (CNH, AUD, N/A) – Even though no exact time has been specified, China’s trade performance is expected to have a strong effect on its currency and the Aussie. Exports are expected to have increased, after a sharp decrease last month, while imports are still expected to have shown negative growth.

- Industrial Production (EUR, GMT 09:00) – Industrial Production is expected to have decreased by 0.6%, compared to growth of 1.4% in January.

- Michigan Consumer Sentiment Index (USD, 14:00) – US Sentiment is expected to decline to 98.0 in April, compared to 98.4 in March.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.