FX News Today

- 10-year Treasury yields are up 0.7 bp at 2.598% and JGB yields climbed 1.8 bp to -0.015%, as stock market sentiment got a boost from Chinese data releases that beat expectations.

- Chinese GDP growth came in at 6.4% y/y, in the first quarter, unchanged from Q4, while production surged 8.5% y/y and retail sales 8.7% y/y.

- Data were taken as a sign that the government’s stimulus measures are starting to take effect. While it may be too early to call the all clear on the world economy, together with signs that US-Sino trade talks are making progress, the data will go some way to bolster confidence, especially after positive surprises on credit and housing data last week.

- The data underpinned Asian stock markets, as Topix and Nikkei posted gains of 0.29% and 0.27% respectively. The Hang Seng is up 0.01% and CSI 400 and Shanghai Comp gained 0.11% and 0.34%.

- Broader Asian indices are at the highest level since last July, even as the ASX underperformed and closed with a loss of -0.35%, dragged down by the materials sector.

- US futures are also posting broad gains and the front end WTI future has moved up to now USD 64.50 per barrel.

Charts of the Day

Technician’s Corner

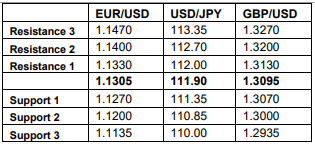

- EURUSD moved past 1.13 early today and has been moving towards the 1.1315 Resistance level. Key Resistance remains at 1.1320 while the Support at 1.1279 is still strong after being hit twice yesterday. Indicators support an upwards move.

- GBPUSD has been moving downwards but is so far unable to break through the psychological 1.30 level, fluctuating around the 1.3067-1.3026 levels. Indicators are giving mixed signals.

- USDJPY found support again under the 112.00 mark, and continued to trade there yesterday, with the Japanese data releases causing only some volatility. Indicators are showing mixed signals.

- XAUUSD is trading at lows, after breaking through the 1285 Support level. Gold appears unable to break through the 1275 level, with the MACD and Stochastics showing upwards signals.

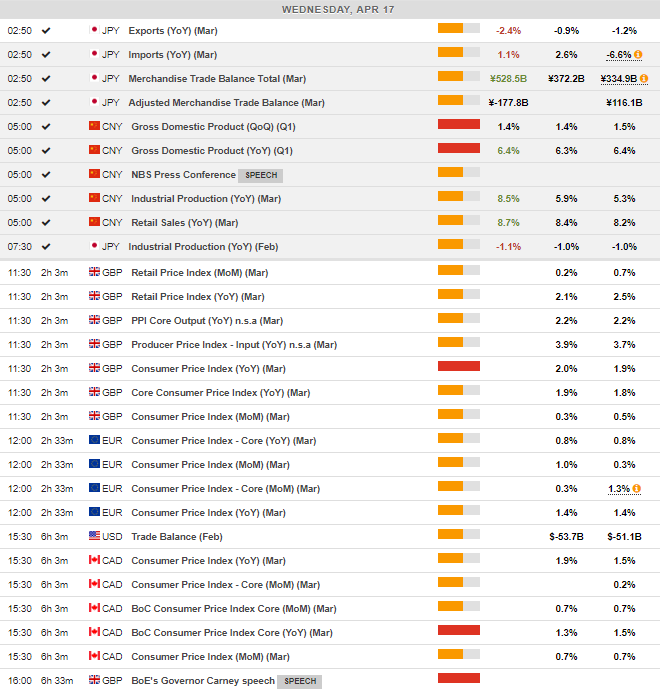

Main Macro Events Today

- UK RPI and CPI inflation (GBP, GMT 08:30) – Both the RPI and the CPI are expected to have declined in March, reaching 2.1% and 1.6% respectively, down from 2.5% and 1.9% respectively.

- EU CPI inflation (EUR, GMT 09:00) – Both the core and the overall CPI inflation rates are expected to have remained at the same levels, at 0.8% and 1.4% respectively.

- Canada CPI Inflation (CAD, GMT 12:30) – The BoC Core price index is expected to have remained at 1.3% y/y, while the overall CPI index is forecast to rise to 1.9% y/y in March compared to 1.5% in February.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.