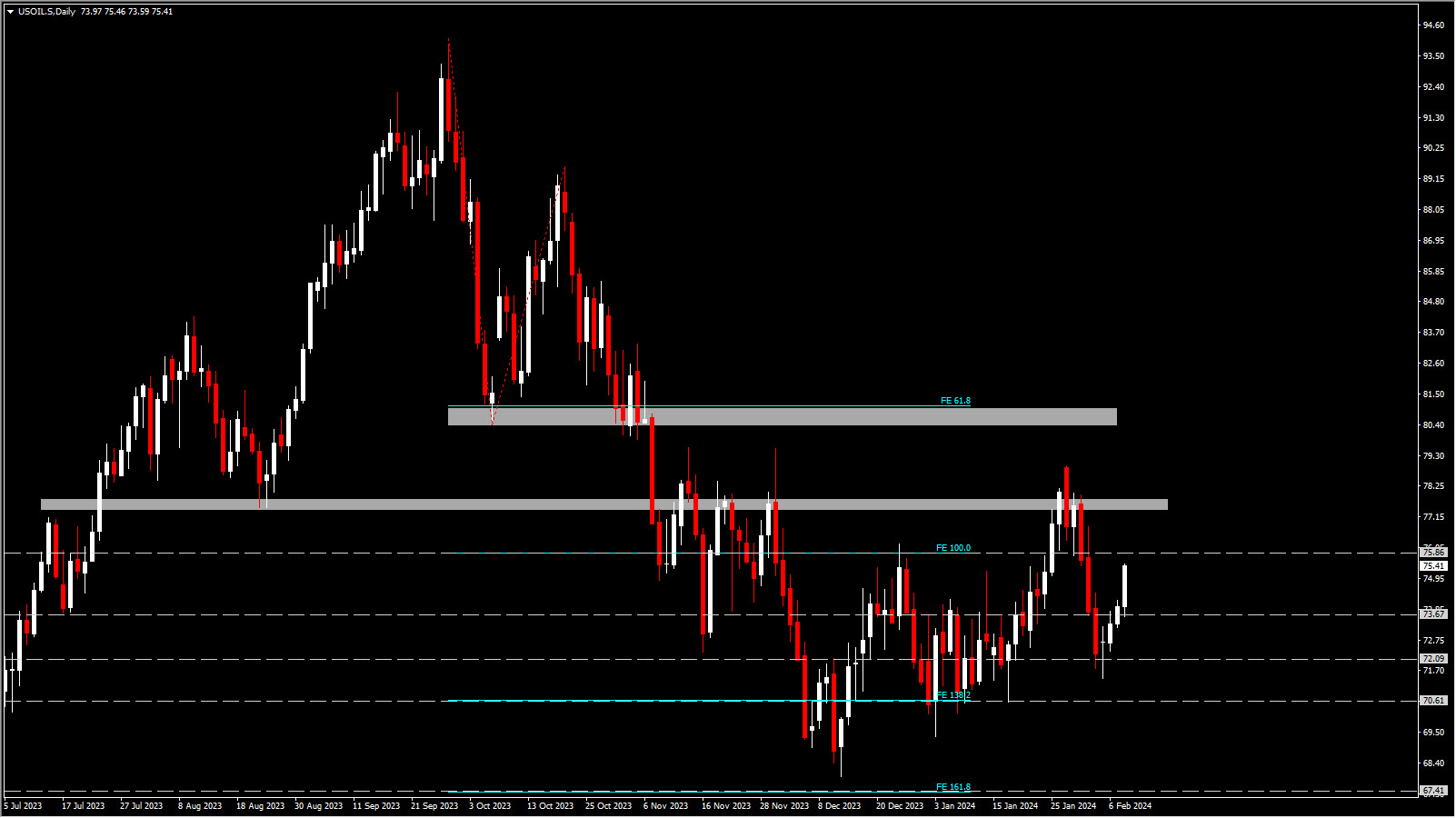

Last week, commodity indexes experienced notable declines primarily due to a sharp drop in oil prices. Additionally, hawkish statements from the Federal Reserve ruling out a March rate cut contributed to the downward pressure, strengthening the US Dollar in the process.

Despite gold initially reaching near-record highs, it later retreated following a robust US jobs report. Oil prices, both Brent and WTI, witnessed significant slumps as US officials emphasized efforts to prevent further escalation of regional conflicts. This correction also reflects reduced concerns regarding broader supply disruptions.

However this week, the recent indications of sluggish growth in China and the Fed’s hawkish stance have tempered demand expectations. Oil prices have continued to climb, with USOIL rising more than 1% to $75.30, while UKOIL is trading at $80.60 per barrel. Although prices have seen a 4-session uptick, they remain below levels seen before the Fed signaled the unlikelihood of a March rate cut last week.

Market attention remains on potential supply disruptions and global growth prospects as central bank policies and Middle Eastern developments are assessed. Israel’s Prime Minister Benjamin Netanyahu rejected a ceasefire offer from Hamas, although US Secretary of State Antony Blinken indicated room for further negotiations. Moreover, official data revealed a larger-than-expected 3.15 million barrel decline in US gasoline inventories last week.

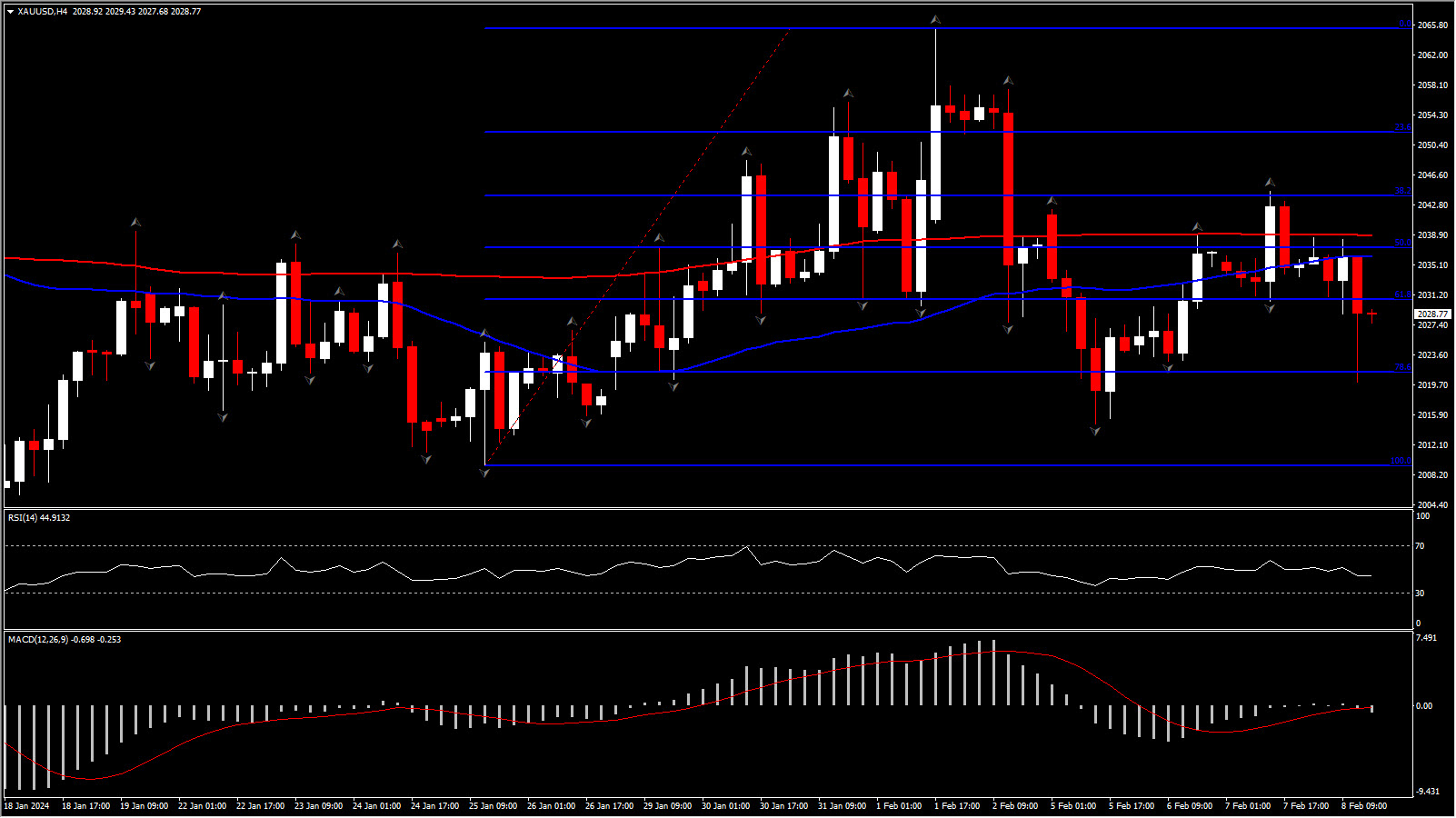

In metal markets, Gold prices peaked at $2,065.48 per ounce before plummeting following the better-than-expected US jobs report and Powell’s subsequent comments. The overall demand for gold remained resilient amidst geopolitical and economic uncertainties, as highlighted by the World Gold Council’s recent report.

The Gold price has retreated from last week’s highs but remains elevated at $2030 per ounce awaiting US CPI next week and any further indications regarding the timing of the Fed’s potential interest rate cut this year. Currently, the Fed officials are hesitant to lower interest rates until they are more confident that inflation will reach the 2% target. They provided various reasons for not feeling rushed to initiate policy easing or to act swiftly once they do. Hence, high interest rates amplify the opportunity cost of holding gold.

Meanwhile, Palladium prices declined to a fresh 5-year low amid persistent concerns about demand. Palladium has declined by 2% to $858 per ounce, reaching its lowest level since August 2018.

Copper futures suffered due to apprehensions about Chinese demand, aggravated by reports indicating a continued decline in manufacturing activity. Meanwhile, the dampening prospects of early rate cuts in the US and Europe have weighed on demand. Additionally, reports of a substantial copper deposit discovery in Zambia contribute to long-term supply expectations.

Lithium prices remain depressed, attributed to the downturn in electric vehicle sales across China. Despite short-term fluctuations, factors such as geopolitical tensions, trade uncertainties, and ongoing elections worldwide are anticipated to sustain investor interest in gold as a safe-haven asset throughout 2024, according to Louise Street, Senior Markets Analyst at the World Gold Council.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.