FX News Today

- Markets returning after a 4-day Easter break.

- Investors remain cautious ahead of key earnings reports including Amazon, Facebook, Twitter and Microsoft this week.

- Reluctance to push stock valuations out further kept bond markets underpinned during the Asian session.

- Chinese bond and stock markets continued to struggle, on the decreased expectations of future Chinese monetary stimulus since the weekend.

- Ongoing uncertainty about the outlook for world growth is underpinning caution on stock markets amid the deluge of earnings reports this week.

- Energy stocks remained supported as oil prices surged to a 6-month high.

- The front end WTI future is currently trading at USD 66.00 per barrel.

- European stock futures are posting slight gains, in tandem with US futures.

Charts of the Day

Technician’s Corner

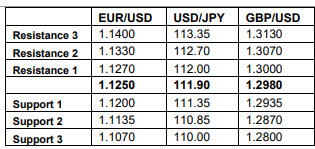

- EURUSD crossed below 20-day MA today, with the asset moving bearishly since Asia open. The underpinning of Euro could continue as the spread between the 10-year US and Germa government bond yields rising.

- USDJPY has been stuck inside of 111.50 and 112.20 for more than a week now, struggling over the 112.00 level reportedly due to ongoing Japanese exporter backed selling, while finding support from what have mostly been risk-on conditions of late. Further USDJPY gains this week ahead of the BoJ meeting.

- AUDUSD is in a 5-day decline. It crossed earlier into the lower Bollinger Bands area, indicating the increase of negative bias. Next Support levels at: 0.7107 and 0.7097.

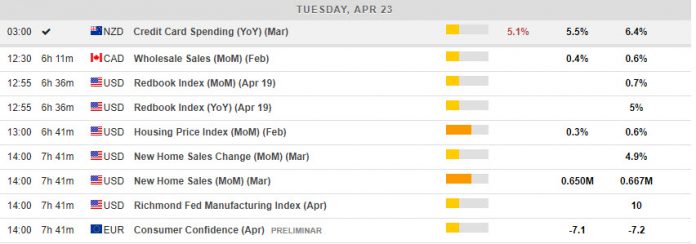

Main Macro Events Today

- New Home Sales –March new home sales are also expected to fall 7.0% to a 620k rate, following a 4.9% increase to 667k in February.

- Canadian Wholesale Sales – February wholesale trade is expected to show a 0.5% expansion in shipment values after the 0.6% gain in January.

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.