Economic Indicators & Central Banks:

The advent of Wednesday’s FOMC decision and the further slippage in Fed rate cut expectations extended selling pressures on Treasuries.

- Corporate issuance and the risk-on trades into equities weighed too.

- BoJ delivers dovish hike: The BoJ ended its yield curve control, ETF buying and the 8 years of negative interest rates and ushered in the nation’s first policy tightening since 2007. Also the bank pledged to continue to buy long-term government bonds. There was little indication of additional hikes, which signalled that this is not the first step of a rapid tightening cycle.

- RBA drops tightening bias, as it keeps the policy rate at a 12-year-high. The RBA held the cash rate at 4.35% for another meeting, but removed any reference to possible further hikes from the statement. When asked if the RBA had indeed moved to a neutral stance, Bullock said the risks to the outlook are indeed “finely balanced now”.

- Today: The FOMC meets for 2 days, and will issue its post-meeting statement at 18:00 GMT on Wednesday. Expectations are for no policy change at this meeting, but verbiage will be closely monitored for hints regarding the rate path in the remainder of 2024.

Market Trends:

- Wall Street bounced but pared its early rally. It continued to shrug off the evolving Fed outlook and instead re-focused on tech enthusiasm.

- A Bloomberg report that Apple is in talks to build Google’s Gemini AI engine into the iPhone boosted risk appetite.

- The NASDAQ (US100) advanced 0.82%, after halving early gains. The S&P500 (US500) was up 0.63% and the Dow was 0.20% higher.

- Nikkei (JPN225) was choppy after the decision but closed 0.66% higher, while Japanese government bond yields fell.

Financial Markets Performance:

- The USDIndex firmed and held over the 103 mark. It rose to 103.45.

- The USDJPY lifted to 150.47, with the Yen paring recent gains, despite the hike, as Ueda made clear that the inflation target has not been reached yet. As interest rate differentials between Japan and the United States remain stark, Yen is likely to remain under pressure.

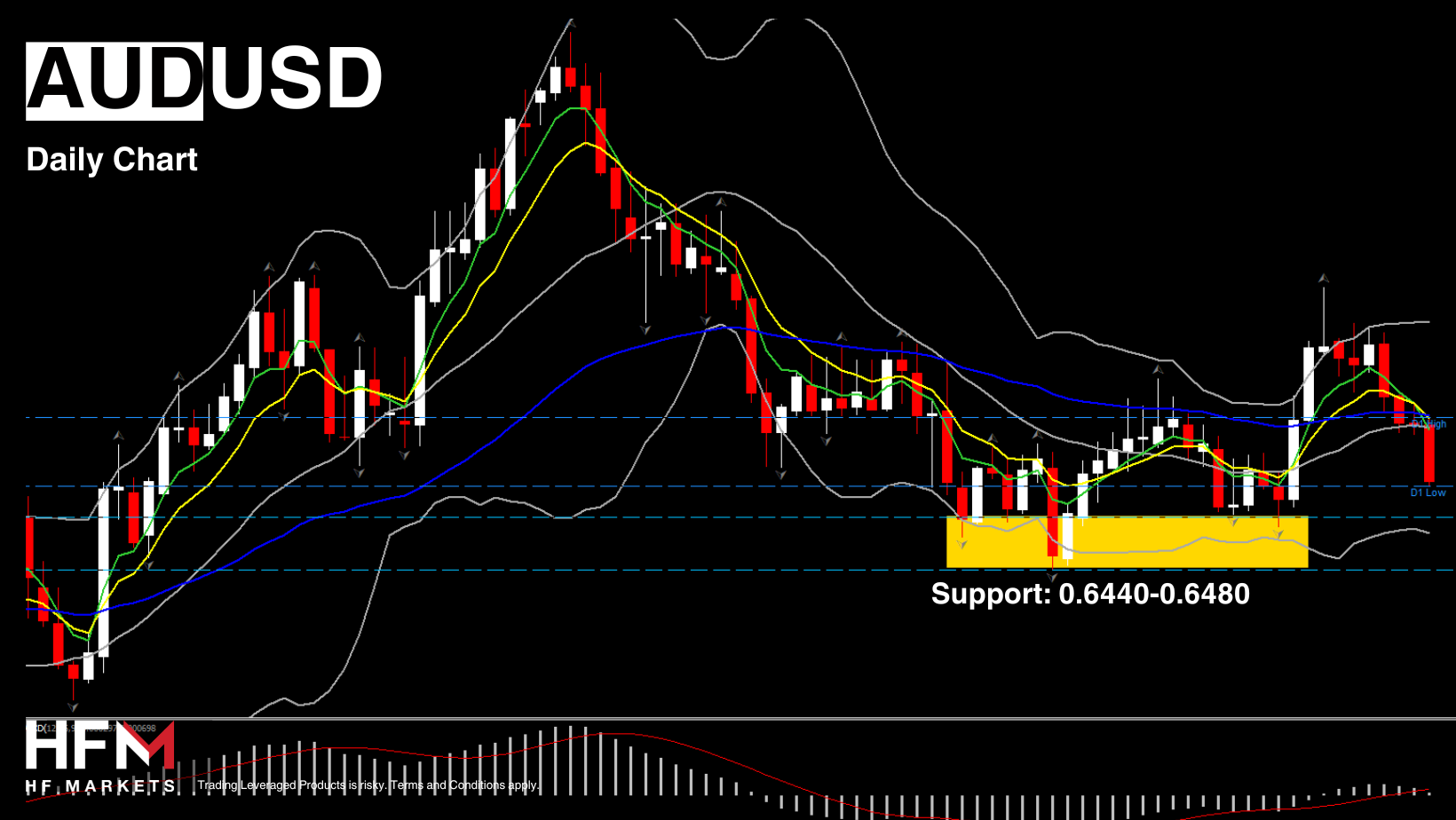

- Antipodeans: AUD and NZD slid to 2-week lows, i.e. 0.6515 and 0.6050 respectively.

- Gold eased to $2,153.95 and USOIL steadied at $82.

- Bitcoin drifted for a 4th day in a row, currently at $64,500, slightly above 20-DMA.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.