Last week, Nvidia CEO Jensen Huang expressed optimism towards the global data center market at an investor event. He pointed out that annual global spending on data center equipment shall reach $250B, and Nvidia will capture a bigger market share than other chip manufacturers. The company provides customers with AI models and other related software, with costs being charged based on the computing power they require and the number of chips running the calculations.

At the same time, Huang unveiled the “world’s most powerful chip” – Blackwell B200, which claims to be able to reduce AI inference operating costs and energy consumption by up to 25 times compared to the previous H100 (208 billion transistors versus 80 billion transistors). The new Blackwell GPU architecture is said to be able to achieve AI training and real-time LLM (large language model) inference on ten trillion-level parameter models.

In addition, the Blackwell architecture shall also be integrated within Nvidia’s centralized vehicle computing platform DRIVE Thor. A successor to DRIVE Orin, the system is said to be delivering feature-rich cockpit capabilities, plus safe and secure highly automated and autonomous driving, all on a centralized platform. It has single computing power up to 2000 TOPS, 8 times that of the Orin chip, and 14 times that of the Tesla FSD chip.

There are a number of Chinese electric vehicle manufacturers which have equipped their next-generation fleets with DRIVE Thor, including BYD, Xpeng, Li Auto, etc. In fact, according to Chinese media data, Nvidia ranked first in terms of high computational power autonomous driving SoC shipments in 2022, with market share over 80%. With continuous invention and innovation, Huang expressed his confidence in its automotive segment to become Nvidia’s pillar business, in addition to data centers and games.

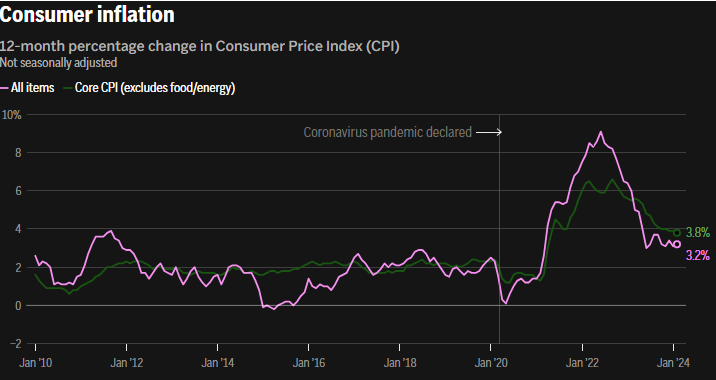

US CPI: 12-month percentage change. Source: APnews

Last week, the Federal Reserve held the interest rate unchanged at 5.25%-5.50%, but clearly signaled that there will be an average of three quarter-point rate cuts this year, despite the background of a pickup in inflation earlier at the start of the year in which these results “haven’t really changed the overall story” as claimed by Fed Chair Powell. An outlook for rate cuts indefinitely cheered the stocks market, with overall market sentiment being improved.

Technical Analysis:

#Nvidia, Weekly: The asset price has been riding on a strong upward trend, with bullish candlesticks being closed for the past 11 weeks. No signs of technical correction yet. It last closed above $892.50, a level projected by Fibonacci Expansion. The ATH formed two weeks ago at $973.68 serves as the nearest resistance, followed by psychological level $1000 and then $1028 (FE 161.8%). On the other hand, a close below $892.50 may indicate short-term technical correction, with next support to focus at $786 (FE 100.0%).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.