Last week, Alibaba announced withdrawal of HK IPO for its logistics unit Cainiao. This was after the conglomerate scrapped plans to spin-off its cloud business as well as postponing the IPO plans for grocery chain Freshippo (also known as Hema).

According to the management, the IPO is deemed as not being able to highlight Cainiao’s intrinsic value as a global leader in e-commerce logistics. As an integral core part of Alibaba’s businesses, the above decision shall allow Cainiao to focus on its business and execute expansion plans further, whilst Alibaba shall support the expansion of its global logistics network and increase its strategic investment in the logistics field.

Founded in 2013, Cainiao has achieved a tremendous success as a leading e-commerce logistics service provider, collaborating with the top 50 consumer goods brands in the world, with more than 80 million packages being processed per day. It has established an effective solution in which the common logistics time between China and major countries around the world has shortened from 30-60 days to 10 days or lesser.

In the latest quarter, Cainiao reported its international orders achieved triple-digit month-on-month growth. Its fabulous cross-border logistics capabilities enabled air and sea freight delivery to be completed the fastest by 5 days and 15 days, respectively. In FY 2023, Cainiao reported 77.8 billion yuan in sales revenue, with CAGR of 21% in the past three years. Its profitability continued to increase, with adjusted EBITDA over 2.8 billion yuan. In the previous quarter, the business unit last reported its revenue up 24% (y/y), reflecting a solid business growth.

Meanwhile, Alibaba plans to issue an offer to buyback issued shares from its minority shareholders (including employees), at a price of $0.62 per share, total up at $3.75B (or 27.069 billion yuan). The plan will be implemented in August 2024. Then, Alibaba shall adjust some of Cainiao’s businesses to better achieve strategic synergy with Taotian Group and Alibaba International Digital Business Group, as well as support the division’s long-term strategic expansion of its global network.

In fact, Alibaba announced in February this year that it would increase its shares repurchase to $65B (a net increase of $25B), with validity period extended to the end of March 2027. Furthermore, the company’s founders – Jack Ma and Tsai Chongxin – have been significantly increasing their holdings of Alibaba shares, in hopes of boosting confidence of the internal team as well as elevating investors’ sentiment.

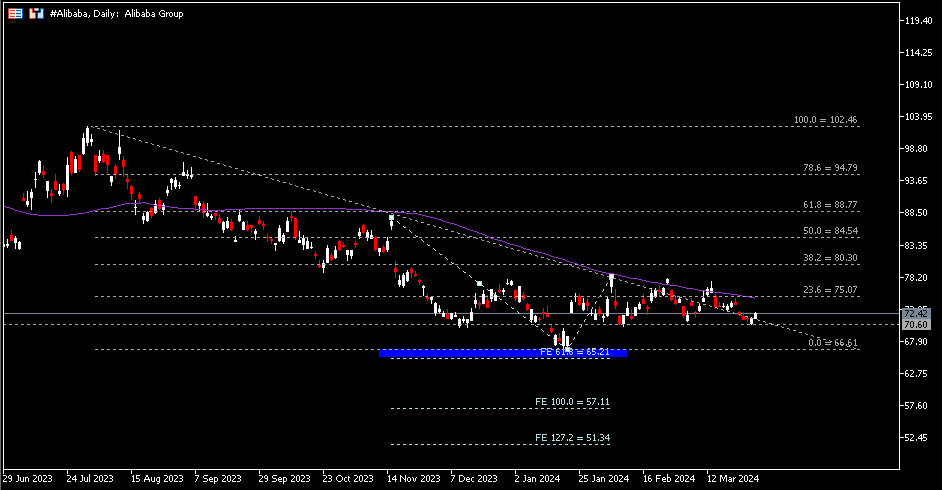

Technical Analysis:

#Alibaba, Weekly: The company share price remains supported above $70.60. The nearest resistance is seen at $75, a 23.6% FR level which intersects with 100-day SMA. The asset has been traded below this moving average since mid September last year. Thus, a successful breakout above the said level may indicate a change in trend direction, with bulls continuing to focus on $80.30 (FR 38.2%) and $84.50 (FR 50.0%). On the contrary, a break below $70.60 may indicate bearish continuation, towards the next support zone $65.20 – $66.60.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.