Economic Indicators & Central Banks:

- Powell wants to keep inflation expectations anchored at 2%. – Recent data have not “materially” changed the overall picture.

- Nothing new is added to the outlook, keeping the door open for several rate cuts this year, though Bostic continues to favor just one easing.

- The ISM services index slowed and prices paid softened, but the ADP solidly beat.

- JGB and Treasury yields have moved up overnight, with the US 10-year 1.8 bp higher on the day.

- Bunds are finding buyers though, with Eurozone spreads narrowing as peripherals outperform.

- Fed funds futures: implied rates are now about 50-50 for a June cut, with July showing about a 95% probability for the first cut. A 25 bp easing is not fully priced until September.

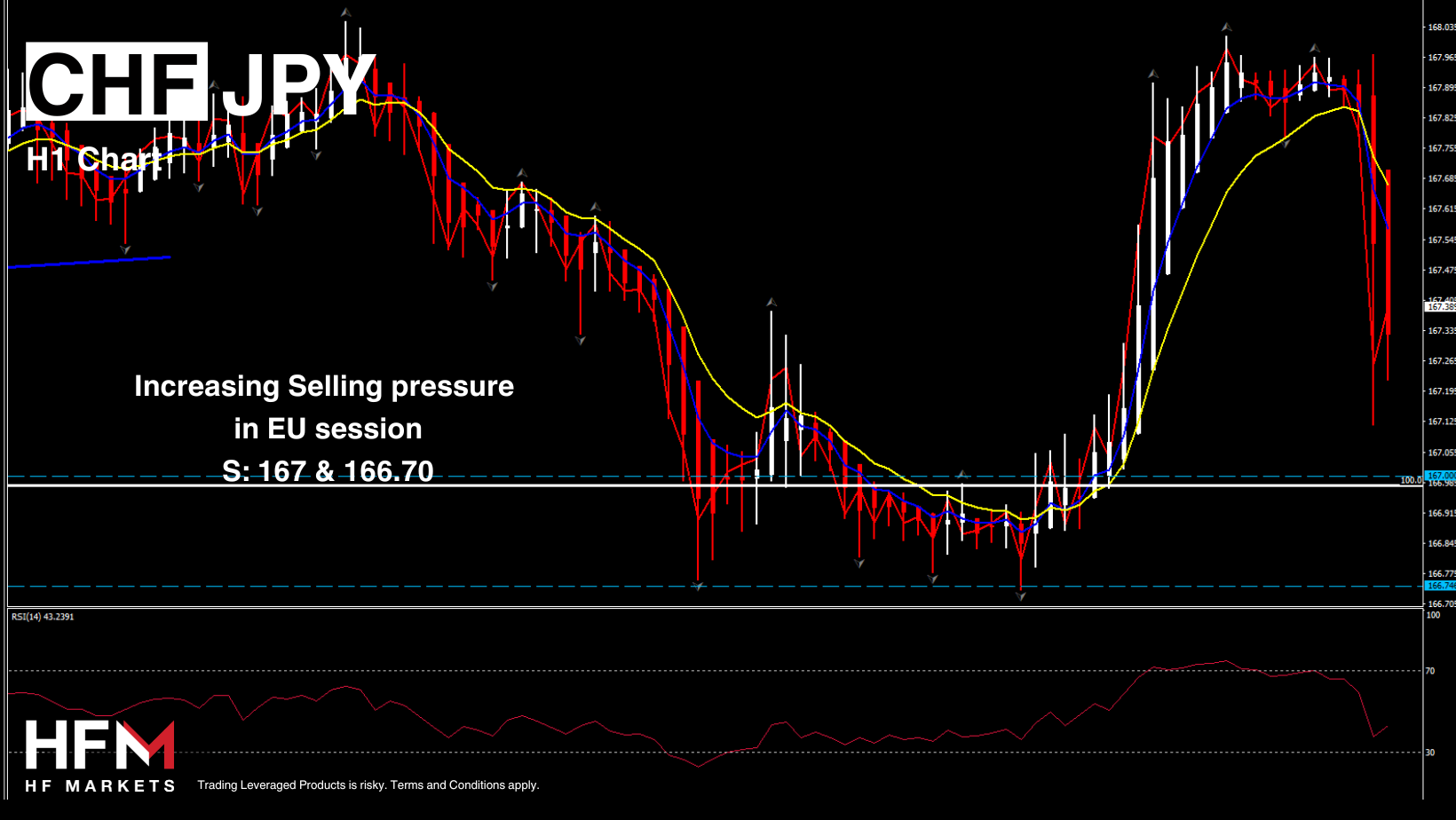

- Swiss inflation drops to just 1.0% y/y. Expectations had been for a slight uptick in the headline and the lower than expected number will justify the SNB’s decision to cut rates at the previous meeting, especially as the growth outlook remains subdued.

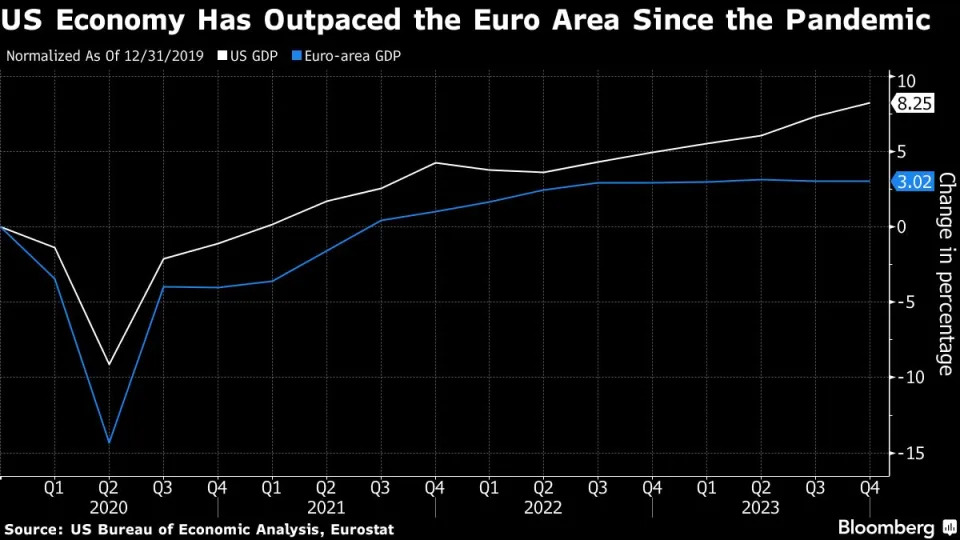

- The ECB asserts it won’t rely on the Federal Reserve’s actions to determine when to start reducing interest rates. However, economic trends in the US often swiftly affect other regions, impacting financing conditions, exchange rates, and various metrics such as inflation and trade.

Market Trends:

- Wall Street closed with a 0.23% advance in the NASDAQ, a 0.11% gain on the S&P500, and a -0.11% dip on the Dow.

- Stock markets traded mixed across Asia. Nikkei and ASX benefited while China bourses corrected though and the Hang Seng underperformed once again.

- European bourses are slightly in the red, US futures are higher, as markets continue to evaluate rate outlooks and growth prospects against the background of geopolitical risks.

Financial Markets Performance:

- The USDIndex is below 104, in the wake of Powell’s comments along with the stronger than projected ADP which weighed on the markets, and Bostic’s comments.

- The Yen continues to consolidate as investors awaited cues from the BOJ. BOJ board member Sakurai said that the central bank is likely to wait until around October before mulling another interest rate hike.

- Gold remained stable after reaching a new all-time high, surpassing $2,300 per ounce. This surge was supported mainly by Powell.

- USOIL appeared ready for its 5th consecutive day of increases.

- Copper rose to its highest level since January 2023, driven by increasing supply risks and indications of heightened demand

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.