Economic Indicators & Central Banks:

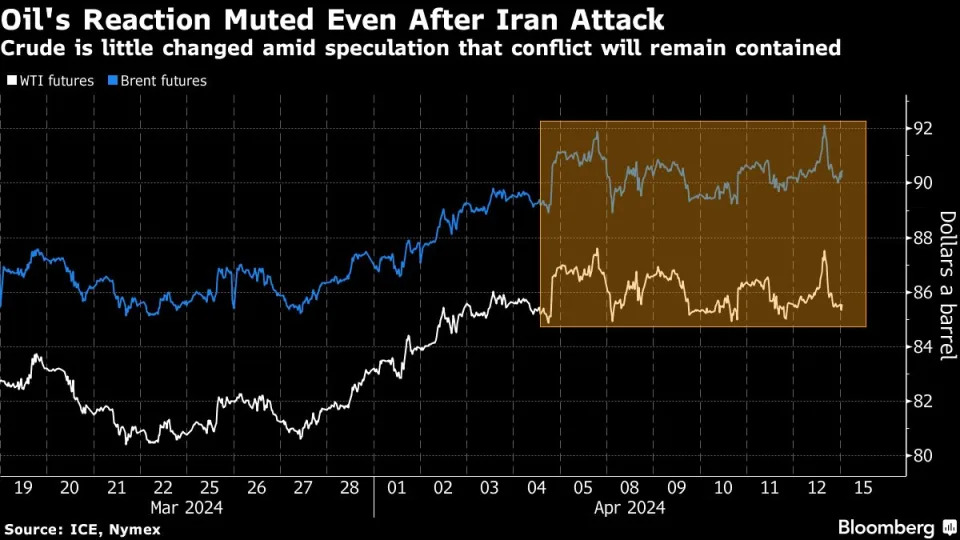

- Markets weigh risk of retaliation cycle in Middle East. Initially the retaliatory strike from Iran on Israel fostered a haven bid, into bonds, gold and other haven assets, as it threatens a wider regional conflict.

- However, this morning, Oil and Asian equity markets were muted as traders shrugged off fears of a war escalation in the Middle East. Iran said “the matter can be deemed concluded”, and President Joe Biden has called on Israel to exercise restraint following Iran’s drone and missile strike, as part of Washington’s efforts to ease tensions in the Middle East and minimize the likelihood of a widespread regional conflict.

- New US and UK sanctions banned deliveries of Russian supplies, i.e. key industrial metals, produced after midnight on Friday. Aluminum jumped 9.4%, nickel rose 8.8%, suggesting brokers are bracing for major supply chain disruption.

Financial Markets Performance:

- The USDIndex fell back from highs over 106 to currently 105.70.

- The Yen dip against USD to 153.85.

- USOIL settled lower at 84.50 per barrel and Gold is trading below session highs at currently $2357.92 per ounce.

- Copper, more liquid and driven by the global economy over recent weeks, was more subdued this morning. Currently at $4.3180.

Market Trends:

- Asian stock markets traded mixed, but European and US futures are slightly higher after a tough session on Friday and yields have picked up.

- Mainland China bourses outperformed overnight, after Beijing offered renewed regulatory support. The PBOC meanwhile left the 1-year MLF rate unchanged, while once again draining funds from the system.

- Nikkei slipped 1% to 39,114.19.

- On Friday, NASDAQ slumped -1.62% to 16,175, unwinding most of Thursday’s 1.68% jump to a new all-time high at 16,442. The S&P500 fell -1.46% and the Dow dropped 1.24%. Declines were broadbased with all 11 sectors of the S&P finishing in the red.

- JPMorgan Chase sank 6.5% despite reporting stronger profit in Q1. The nation’s largest bank gave a forecast for a key source of income this year that fell below Wall Street’s estimate, calling for only modest growth.

- Apple shipments drop by 10% in Q1.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.