FX News Today

- Trading remained nervous ahead of the Friday deadline on tariff hikes.

- While comments from US President Trump that an agreement is still possible initially saw stock markets rallying in Asia, caution has since made a comeback as investors react to headlines.

- Japanese markets erased earlier gains and fell back into negative territory before stabilizing, and Topix and Nikkei are down -0.18% and 0.47% respectively as of 05:39GMT.

- The front end WTI future meanwhile is trading at USD 61.92 per barrel.

- German exports rebound in March – German trade data at the start of the session is showing another solid surplus in March and Q1, amid lingering fears that the focus of the US administration will once again turn to stagnant US-EU trade talks.

- European stock futures are moving higher, while US futures recovered most of their overnight losses and are little changed on the day, as it seems markets are set to buy into hopes that a deal will be reached eventually.

Charts of the Day

Technician’s Corner

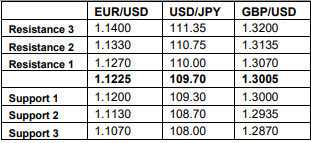

- USDJPY has been pushed down to 109.51. Another severe session of risk-off has weighed, with both Wall Street and Treasury yields getting hammered, keeping the pressure on the pairing. The pair managed to find some ground ahead of the EU session, and hence it is currently moving above PP level. However, as the overall outlook remains bearish, the February 4 low of 109.43 remains the next downside Support level, with a break there set to test the 109.00 level.

- USDCAD rallied to 2-week highs of 1.3505, finding support from modest Oil price losses, and a generally firmer USD. Light buy-stops were noted on the break of 1.3500, though follow through was limited. USDCAD is rangebound between 1.3505 and 1.3430. April highs of 1.3516-1.3521 will need to be eclipsed to shift sentiment to a more bullish stance, otherwise overall consolidation holds.

- USOIL has remained rangebound, sticking inside of Monday’s trading band, between $60.00 and $62.92. Concerns over the US/China trade war have kept a lid on prices this week, due to the prospects for demand destruction. On the supply side, Libya exports (near 1.0 mln bpd) are at risk due to civil war in the country threatening further supply disruption on top of the shutdown in production from Iran and Venezuela due to sanctions, and the ongoing OPEC+ production cuts. As a result, risk would appear to be to the upside for oil prices in the coming sessions, regardless of trade worries.

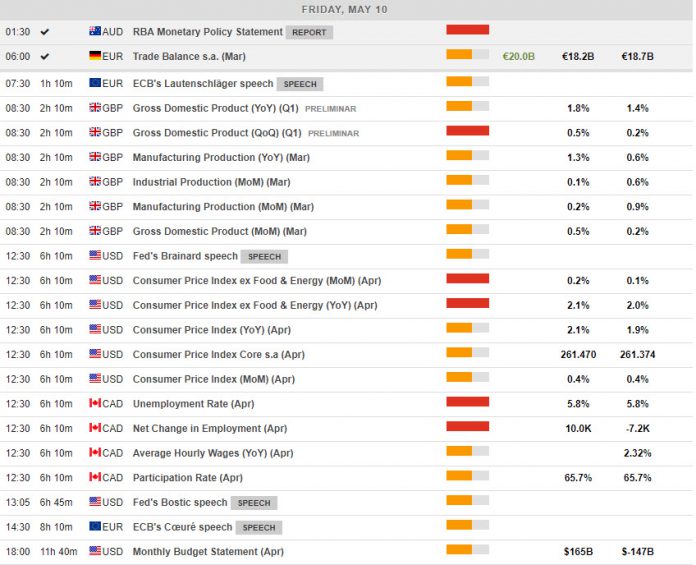

Main Macro Events Today

- Gross Domestic Product (GBP, GMT 08:30) – The economy’s most important figure, preliminary Q1 GDP is expected to be unchanged at 0.2% q/q.

- Consumer Price Index and Core (USD, GMT 12:30) – The headline CPI is estimated to rise 0.4% in April, after a similar reading in March. The overall CPI is expected to be up 2.1% y/y, from 1.9% in March. US Core CPI is estimated to rise 0.2% in April, following a 0.1% increase in March.

- Labour Market Data (CAD, GMT 12:30) – The unemployment rate is expected to hold at 5.8% in April, however the employment change is forecast to increase to 1K, after the 7.2k loss in March.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.