NZDUSD, AUDJPY & AUDUSD, Daily

US and China look set on a prolonged impasse on trade. The US on Sunday demanded promises of concrete changes to Chinese law, and President Trump stated that “we are right where we want to be with China.” In response Beijing said it would not take “bitter fruit” that harmed its interests. China’s foreign ministry spokesman also said today that retaliatory measures to the US tariff hikes, which took effect last Friday, will be announced in due course. An editorial in China’s state-backed Global Times stated the perception that China cannot bear a trade war “is a fantasy and misjudgment,” and that “nothing is unbearable for China in order to safeguard its sovereignty and dignity as well as the long-term development rights of the Chinese people.”

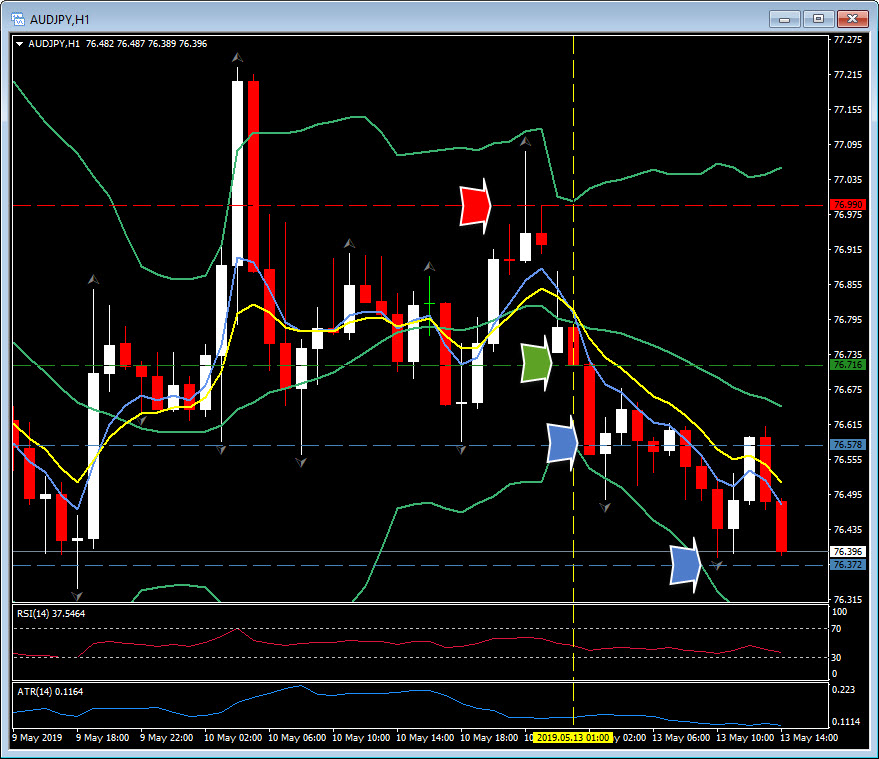

Only a week ago there was a general air of optimism that the two sides were set to reach an accord. Then China proposed extensive revisions to a draft agreement, wanting to omit previous commitments that Chinese laws would be changed to enact new policies on issues such as technology transfers and intellectual property protection. China’s Vice Premier Liu tried to persuade his US counterparts that decrees issued by China’s State Council would instead be sufficient. The US rejected this. There is conjecture that Beijing had been observing Trump’s recent pressuring of the Fed for looser policy and took this as a cue to take a tougher stance in trade negotiations, thinking that Trump was worried about the economic outlook. There is also conjecture that the two sides will still eventually find a win-win solution, especially if higher tariffs have an increasingly evident impact on the two economies, though the deadlock looks entrenched and set to persist for some time. The key proxy for the state of the trade war is the AUDJPY and much is written of this pair with it again being a significant mover today, down some 0.3%.

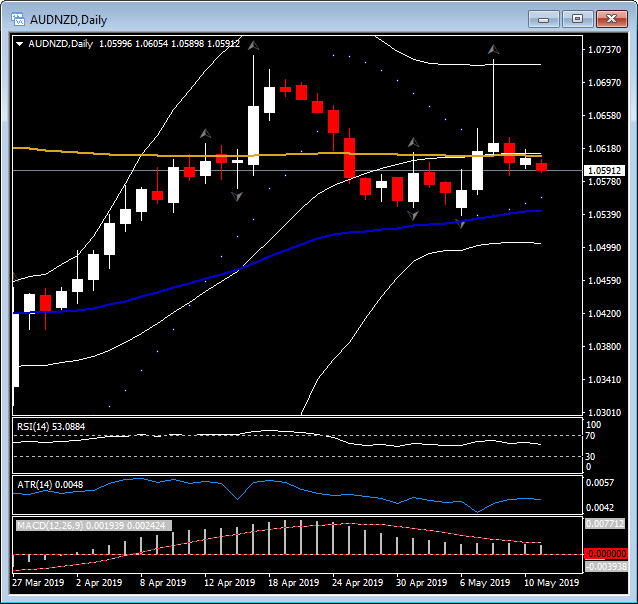

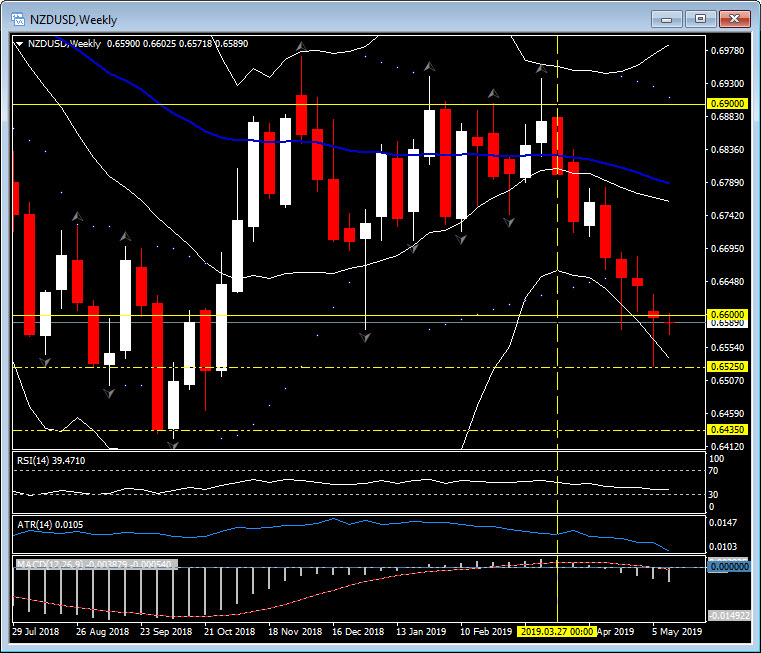

However, the wider AUD and NZD crosses are all vulnerable to the ebbs and flows of US-China trade discussions. The move last week by the RBNZ to cut the main interest rate to 1.5% from 1.75%, simply added to the pressure on the NZD in particular. The Kiwi has been trading under the 20-day moving average versus all its key competitors, with only the AUDNZD close to this important technical level.

The NZDUSD last week plunged to test a six-month low below 0.6525 following the RBNZ’s surprise rate cut. The Daily chart has been exhibiting weakness following the major move down March 27 when the 20, 50 and 200-day moving averages were all broken. The MACD turned negative a few days later. Last Friday’s close registered a fourth consecutive lower close for the week in an overall seven-week downtrend. A breach of 0.6525 and the next support is the September low at 0.6435. Resistance to the upside is initially at 0.6600 and then the descending 20-day moving average at 0.6640.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.