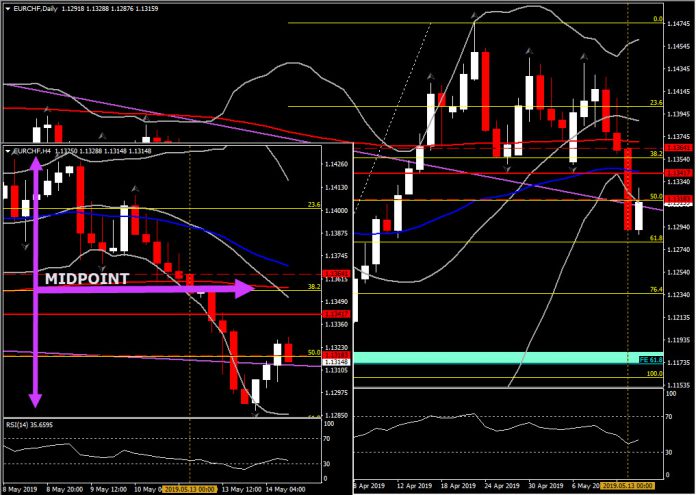

EURCHF, H4

The Euro is trading generally firmer, recouping ground lost against the Yen and Swiss franc yesterday as markets unwind safe haven premiums following conciliatory-sounding remarks from President Trump. EURJPY is showing a gain of 0.5%, making it the biggest mover out of the main Dollar pairings and associated cross rates. EURGBP earlier printed an 8-week high, and despite since correcting some remains net higher on the day.

EURCHF has lifted modestly but has remained comfortably close to 1-month lows, which coincides with the 61.8% Fib level from the upleg seen in April. The dive yesterday came amid renewed risk-off position in global markets, rekindling the Franc’s hitherto latent safe haven appeal, despite the SNB’s -0.75% deposit rate.

Meanwhile, Eurozone data today have included an as-expected 0.3% m/m contraction in March industrial production, while German ZEW investor confidence unexpectedly declined to -2.1 in the May reading from 3.1 in the previous month. ECB’s Villeroy said that recent data underscore a “significant, but temporary slowdown” while caveating that this is “notwithstanding persistent and substantial geopolitical uncertainties.”

In the medium picture, we still view EURCHF as remaining in a bear trend, as it has failed to recover its 3-day losses so far. Even if the pair has been in a rebound phase today away from 1.1280 (61.8% Fib. level), only a boost above 1.1355 (38.2% Fib. level but also halfway of 5-day drift) could imply a potential upswing to 1.1400 area. Hence as the overall outlook remains pessimistic, on the break of 1.1280, the next Support for the asset is set at 1.1235–1.1250 area.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.