FX News Today

- Comments from Fed’s Bullard that a rate cut could become an “attractive option” if inflation continues to disappoint added support to bond markets ahead of the release of the Fed minutes from the May meeting.

- Ahead of today’s Fed minutes, this helped to lift sentiment and underpin stock market sentiment, which struggled for direction amid conflicting trade headlines.

- Reports that the US administration is considering blacklisting up to 5 Chinese surveillance firms, including Hikvision added fresh concerns about a deepening of trade frictions and put pressure on tech stocks.

- The GER30 futures are heading south in tandem with US futures after a mixed session in Asia, where mainland China bourses underperformed.

- The FTSE 100 future is getting some support from a weaker pound, which is shedding the gains seen in the wake of May’s latest Brexit deal yesterday

- At the same time, China’s ambassador to the US said Beijing is ready to resume talks and ASX and Nifty 50 slightly higher.

- The WTI future meanwhile fell back to USD 62.58 per barrel.

Charts of the Day

Technician’s Corner

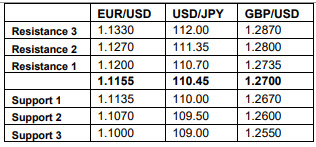

- EURUSD spiked up briefly to 1.1188, just above its 20-day MA, though has now eased back under 1.1150. The Euro remains in sell the rally mode, given the Dollar’s yields advantage, and relatively better performing economy. EURUSD has posted 6-straight sessions of lower daily lows, a bearish signal, and has sights set on the May 3 bottom of 1.1135, then 2019 lows of 1.1110 seen in late April.

- XAUUSD: Renewed dollar strength, along with the return of risk-taking conditions has dented gold’s safe-haven appeal. The US easing of restrictions on Huawei has helped equity sentiment, to the detriment of gold prices. Next support comes at $1,270 in the near term, then $1,267.30, , the May 2 low, then $1,258.38, the 200-day MA.

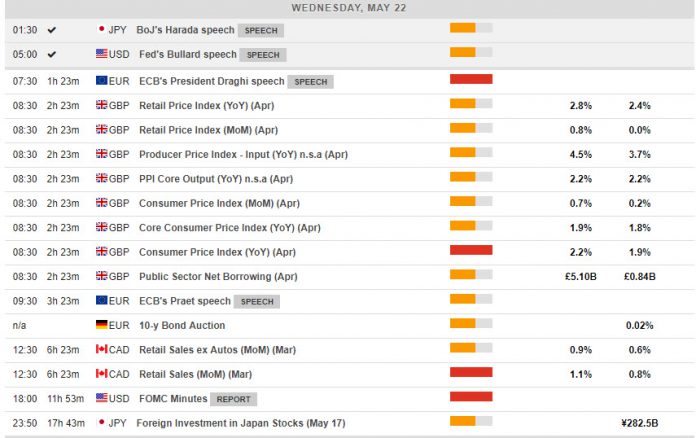

Main Macro Events Today

- Consumer Price Index (GBP, GMT 08:30) – Prices are expected to rise in April, with overall inflation expected to stand at 2.1%y/y, compared to 1.9% y/y last month.

- Retail Sales and Core (CAD, GMT 12:30) –Canadian sales are expected to have eased by 0.4% m/m in March, compared to 0.8% m/m in February.

- FOMC Meeting Minutes (USD, GMT 18:00) FOMC minutes, detailing the view of each of the Fed Governors and FOMC Members, shed light on their perspectives regarding the future of the US economy. FOMC left policy on hold earlier this month, and it cited solid growth, low headline and core inflation, though Powell said in his presser that the weakness was likely “transitory”.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.