FX News Today

- Stock market sentiment stabilised during the Asian session and bargain hunting helped at least the Chinese markets to recover slightly.

- Australian Dollar continues to outperform as markets position for a rate cut from the RBA.

- US President Trump seemed to keep hopes of a trade deal alive, but it is pretty clear that any agreement is still a way off and that will likely keep market volatile for now.

- In Europe, investors will be bracing for more political turmoil in the U.K., which also raises the threat of a no-deal Brexit scenario once again, and the fallout from the ongoing European Parliament elections.

- The marked widening of spreads clearly has attracted the attention of ECB officials, which are once again eagerly campaigning for more risk sharing, Eurobonds and a Eurozone wide deposit insurance.

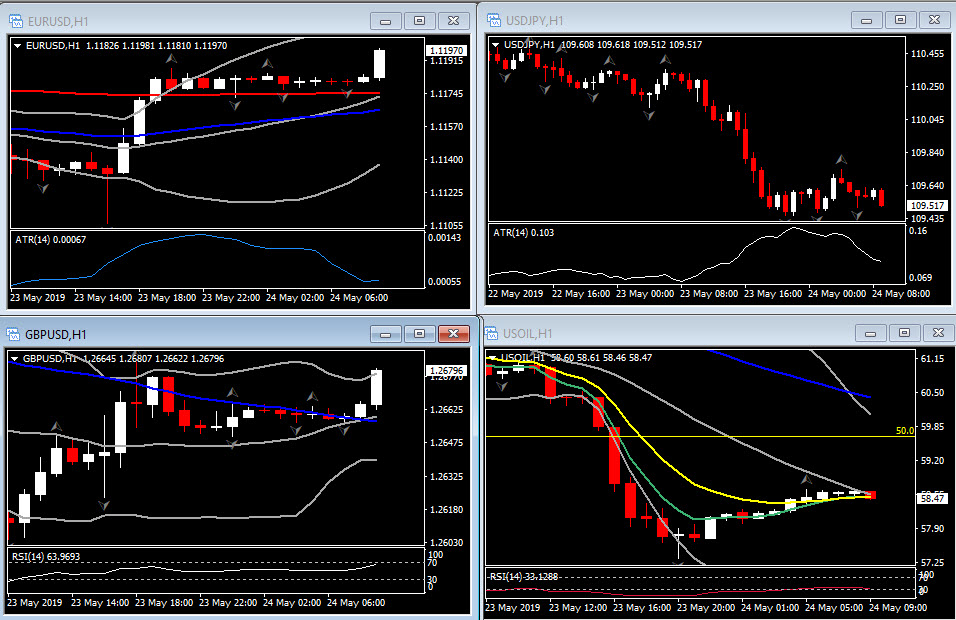

- The Oil prices have come slightly back from lows, although at currently $58.65 per barrel, the front end WTI future is heading for a sizeable weekly loss.

Charts of the Day

Technician’s Corner

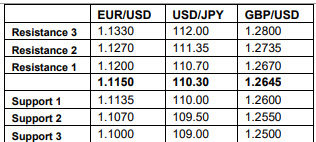

- EURUSD spiked up from 2-year lows of 1.1200 into European open. The Euro’s new trend low, along with data misses prompted a quick and sharp short covering driven rally yesterday, which has since seen EURUSD touch highs of 1.1187. With a good number of shorts squeezed out of the market, the pair could enter a consolidative phase into the weekend.

- XAUUSD traded to 1-week highs over $1,287 yesterday, while today despite the small selling pressure it manage to hold above the $1,282 area. Safe-haven buying remains the mover, as global equities remained awash in a sea of red, largely driven by escalating trade war fears. From there, a sharp reversal lower for the Dollar added support to Gold prices. Solid resistance comes at the psychological $1,300 level.

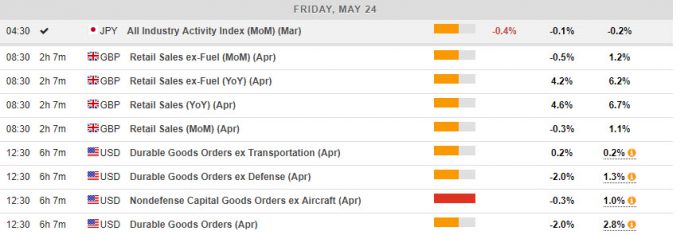

Main Macro Events Today

- Retail Sales and Core (GBP, GMT 08:30) – Following a correction in March, Retail Sales are expected to slip this month by -0.4% m/m from 1.1% m/m.

- Durable Goods (USD, GMT 12:30) – Durable goods orders are pegged at -1.8% in April, after a 2.7% figure in March. Transportation orders should be -7.2%. Boeing orders should fall to the lean 28 area from an already-low 44 in March, with a likely hit via problems with the Boeing 737 Max that may have prompted buyers to delay new purchase commitments, while vehicle assemblies are seen steady from a 10.8 mln pace in March.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.