- The Swiss National Bank cuts interest rates for a second time in 2024. The Swiss Franc trades 0.70% lower against the US Dollar.

- The NASDAQ rises 0.60% in pre-trading hours. Global stock markets are rising, including the DAX, NIKKEI225, and FTSE100.

- The NASDAQ’s High Low Index rises back above 60.00 and the VIX falls 0.67% indicating a risk on appetite.

- Analysts expect the Bank of England to avoid any major announcement or adjustments due to the upcoming UK elections. The Pound Index trades slightly lower during today’s Asian Session.

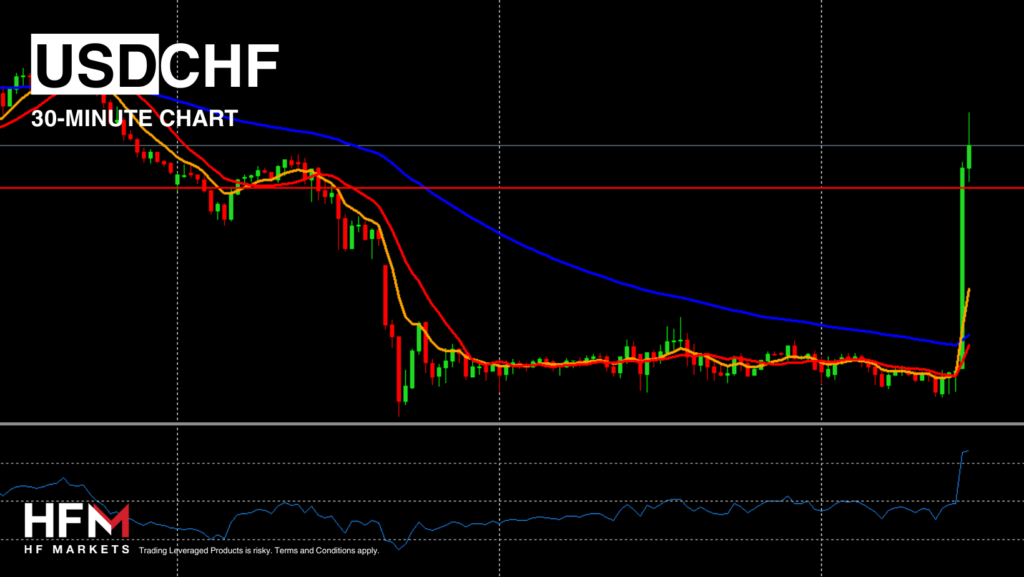

USDCHF – SNB Lowers Rates By 0.25%!

The Swiss National Bank’s decision to cut interest rates applies significant pressure on the Swiss Franc which is now declining against all currencies. Investors looking to trade against the Swiss Franc potentially can benefit from the USDCHF, NZDCHF and AUDCHF. These 3 have been among the better performing currencies of the past 24 hours.

The Swiss Franc cut its interest rate from 1.50% to 1.25%. This is the second time the Swiss National Bank has cut interest rates in 2024. Previously the SNB adjusted by 25 basis points in March. Experts speculated that the central bank may cut, but it was not necessarily a guaranteed cut which is why the currency quickly declined after 3 weeks of gains.

The price has risen to the previous sentiment line at 0.88895 which traders tend to aim for during a change of trend. Now the price has risen to this level, the exchange rate potentially is at a higher risk of trading sideways. The price is currently overbought on the RSI on all timeframes below the 1-Hour chart. However, if the US data this afternoon disappoints, the US Dollar potentially can come under pressure and trigger further buy signals. For example, investors will be waiting for the release of the Weekly Unemployment Claims, Building Permits and Philly Fed Manufacturing Index. Of main importance will be the Weekly Unemployment Claims which have signalled weakness in the employment sector over the past two weeks.

USA100 – Overbought or Unstoppable?

The NASDAQ quickly rose in value on Thursday due to Wednesday being a bank holiday for the US. The index is forming its ninth consecutive day of an increase for the first time in 2024. The announcements and decision by the SNB and Bank of England will not have a direct influence on the index but can change the global sentiment towards the stock market and global economy.

If both regulators cut or point towards an upcoming cut, investor sentiment can rise which supports stocks. Currently the index is trading with momentum indications pointing towards an upward trend and a bullish market. However, most oscillators point towards a potential retracement. For example, the RSI on a 2-hour timeframe (period of 18) is currently priced at 76.10 which is known as “overbought”.

Another factor which can potentially point towards some upcoming short-term weaknesses are bond yields which have risen by 0.33% and upcoming elections. However, the bullish side currently outweighs sell indications.

During pre-trading hours, the top 5 influential stocks for the NASDAQ are trading higher. The best performing of these 5 is Alphabet stocks which are currently trading 0.50% higher. Buy signals are likely to remain if the price trades above $20,129.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.