- EU Purchasing Managers Index falls lower than previous expectations sending European Stocks lower.

- The US Dollar increases in value as the market’s risk appetite falls due to the latest PMI data.

- UK Retail Sales rise 2.9%, the highest in 4 months and beating analysts’ expectations.

- The NASDAQ declines ending an 8-day streak. 60% of the most influential stocks retrace downwards.

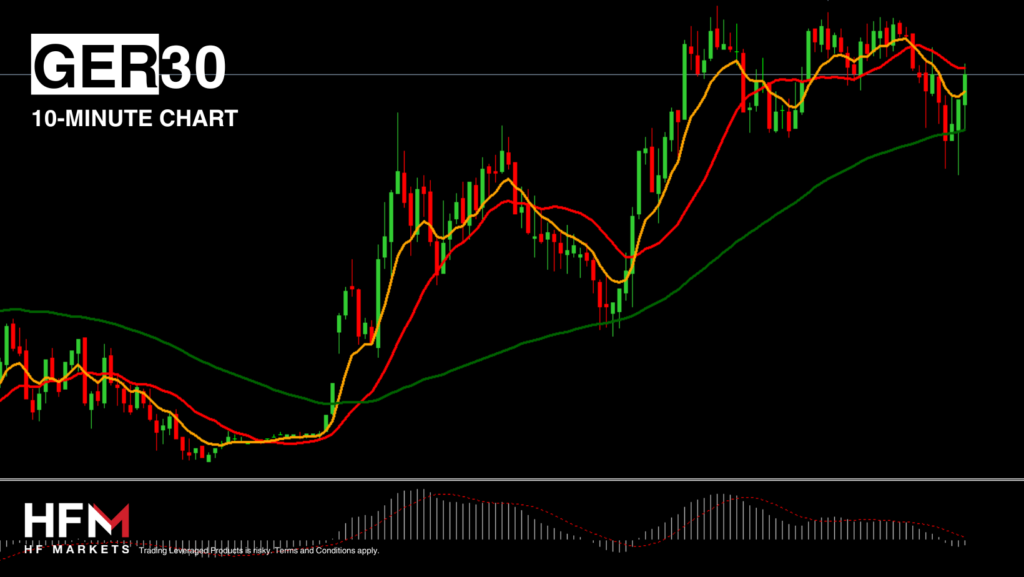

GER40 – German & French PMI A Concern for Investors!

The German DAX declines 0.34% as investors again exit trades due to the latest Purchasing Managers’ Indexes. The German Services PMI fell from 53.9 to 53.5 and reads lower than previous expectations. The Manufacturing PMI fell to 43.4 and 3.0 points lower than analysts’ expectations. Investors are particularly anxious about the Manufacturing data which is lower than 50.00 which indicates a risk of economic contraction.

In addition to this, the French data also read lower than expectations and lower than the previous month. The data has triggered a lower risk appetite which is negative for the stock market. However, on the other hand the data could prompt a second-rate adjustment in 2024. If the US and UK PMI data also decline, the market may take a broader lower risk sentiment. This could trigger continued bearish momentum. This would be considered more dovish than other central banks.

The regulator’s governing board confirmed that the decision to cut interest rates at a meeting earlier this month was made to test the monetary system. Simultaneously, the parameters of the PEPP bond purchase program will remain unchanged until the end of 2024. The ECB will continue to reduce its portfolio by an average of 7.5 billion euros per month.

In terms of technical analysis, the price is trading below the 75-EMA and the 100-Bar SMA. This indicates sellers are controlling the market regardless of recent impulse waves. The Moving Averages have formed a bearish crossover and the MACD is trading below the signal line. If the price falls below 18,210.30, sell signals potentially could intensify.

USA100 – Will The NASDAQ Fall For A Second Consecutive Day?

The NASDAQ is close to again forming another sell trade as risk appetite takes a hit while the price is at such a high price. The price of the NASDAQ is coming under pressure for multiple reasons including pricing, economic data and a decline in risk appetite. However, some positive data does remain for the index.

For example, economists still believe the Federal Reserve will cut interest rates in September 2024 and the High Low Index will remain above 50.00. According to most analysts, the price is likely to remain within an upward trend under the current market conditions, but in the medium to longer-term. In the short term, the price is likely to hold either a “neutral” signal or a “sell” for as long as the price remains below 19,767.16.

Intel is a company within the NASDAQ which is experiencing difficulties with expanding its production infrastructure. Thus, yesterday, it became known that the construction of the Fab 38 chip manufacturing plant in Israel, worth 25.0B dollars, due by 2028, was suspended. In December, the country’s government allocated a grant of 3.2B dollars for the project. Among the positive news, there is a recent report by analysts at Bank of America Corp., according to which the Q2 volume of personal notebook shipments will increase by 12.0%, higher than the estimates of 5.0% a month earlier. Experts revised their forecasts after the indicator added 15.0% in May amid increased demand in the commercial and consumer segments.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.