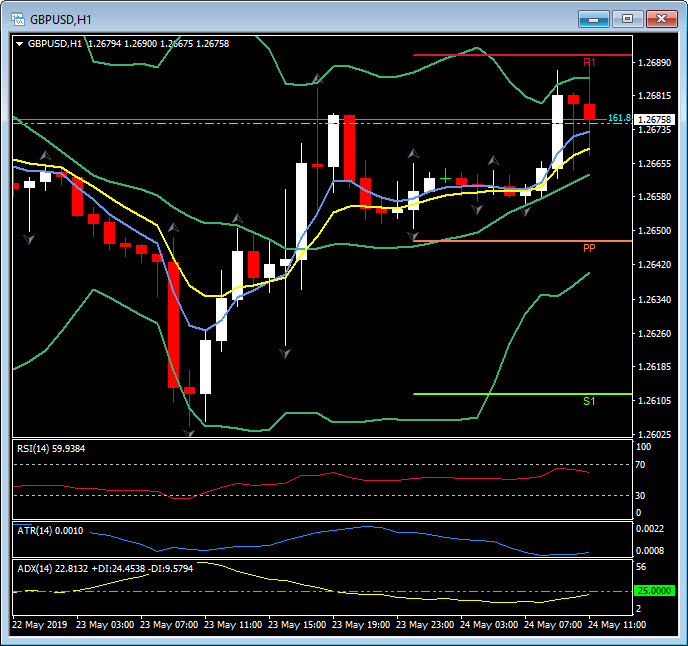

GBPUSD, H1

The cooling of the bid underpinning the USD, which started yesterday following the weak PMI data, has continued overnight and into the European session. The US Flash Markit Manufacturing Index fell to 50.6 in May versus 52.6 in April. It was at 56.4 a year ago. This is the worst since September 2009. New orders dropped into contraction at 49.7 versus 53.5. The services index slid to 50.9 from 53.0, and was at 56.8 last May. This is the weakest since February 2016. Prices charged have declined versus April. And the composite also declined to 50.9 from the prior 53.0, and was 56.6 last year. This is the lowest since May 2016. The data reflects the worrisome sentiment amid global risks.

Today, even beaten up Sterling continues to recover with 1.2700 in sight. The departure of Mrs May and her replacement by a harder-line Brexiteer is all but priced in to a lowly Pound today. The UK Retail Sales for April showed remarkable strength, being better than expected, and signals that the UK shopper will not be deterred and consumption remains robust. As the UK High Street reels from closures, the growth in the online sector in the three months to April helped to boost the reading and is largely driven by clothing purchases.

A surprising bright spot for UK data, however the UK economy is still struggling due to the Brexit uncertainty and one data point certainly “does not a trend change make”. EURGBP yesterday completed 14 consecutive days of gains, its largest rally since the Euro became legal tender in 1999.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.