US stock indices on Friday gave up earlier gains and ended slightly lower, with the USA100 and USA500 retracing previous all-time highs. The decline was due to 10-year T-note yields hitting a 2-week high, following better-than-expected US economic data on the University of Michigan June consumer index and MNI Chicago June PMI.

USA500 lost 0.41% after touching a fresh high of 5,526, USA100 fell 0.71% after reaching 20,047. Meanwhile, the USA30 fell 0.12%. New data showed the Fed’s favoured inflation measure was virtually unchanged in May, paving the way for the Fed to cut interest rates this year.

The USA500 Index closed down -0.41% on Friday [28 June], the USA30 Index closed down -0.12%, and the USA100 Index closed down -0.71%.

Meanwhile, Michigan consumer sentiment was revised significantly higher and inflation expectations were lower than previously reported. Communication services led the declines as Alphabet (-1.7%), Meta (-2.9%), Netflix (-1.4%) and Walt Disney (-2.8%) fell. In contrast, energy and real estate stocks posted small gains. Most megacaps closed in the red, including Nvidia (-0.3%) and Amazon (-2.3%). On the month, the S&P gained 2.9%, the Dow gained 0.7% and the Nasdaq gained 4.9%. For the first half of 2024, the S&P added 15.1%, the Nasdaq 20%, and the Dow rose 3.7%.

Richmond Fed President Barkin’s remarks put pressure on stocks, as he stated, “Given the extraordinary strength we are seeing in the economy,” he was a bit more pessimistic on stocks and open to the possibility, that the long-term interest rate that keeps supply and demand in balance “has shifted somewhat” and that the perceived restraints on policy may not be that great. Generally positive Q1 earnings results were in favour of stocks.

Umumnya hasil pendapatan Q1 yang positif mendukung saham. Pendapatan Q1 diperkirakan naik +7,1% y/y, jauh di atas perkiraan pra-musim pendapatan sebesar +3,8%. Menurut data yang dikumpulkan oleh Bloomberg Intelligence, sekitar 81% perusahaan yang melaporkan S&P 500 telah melampaui perkiraan pendapatan Q1.

Technical Review

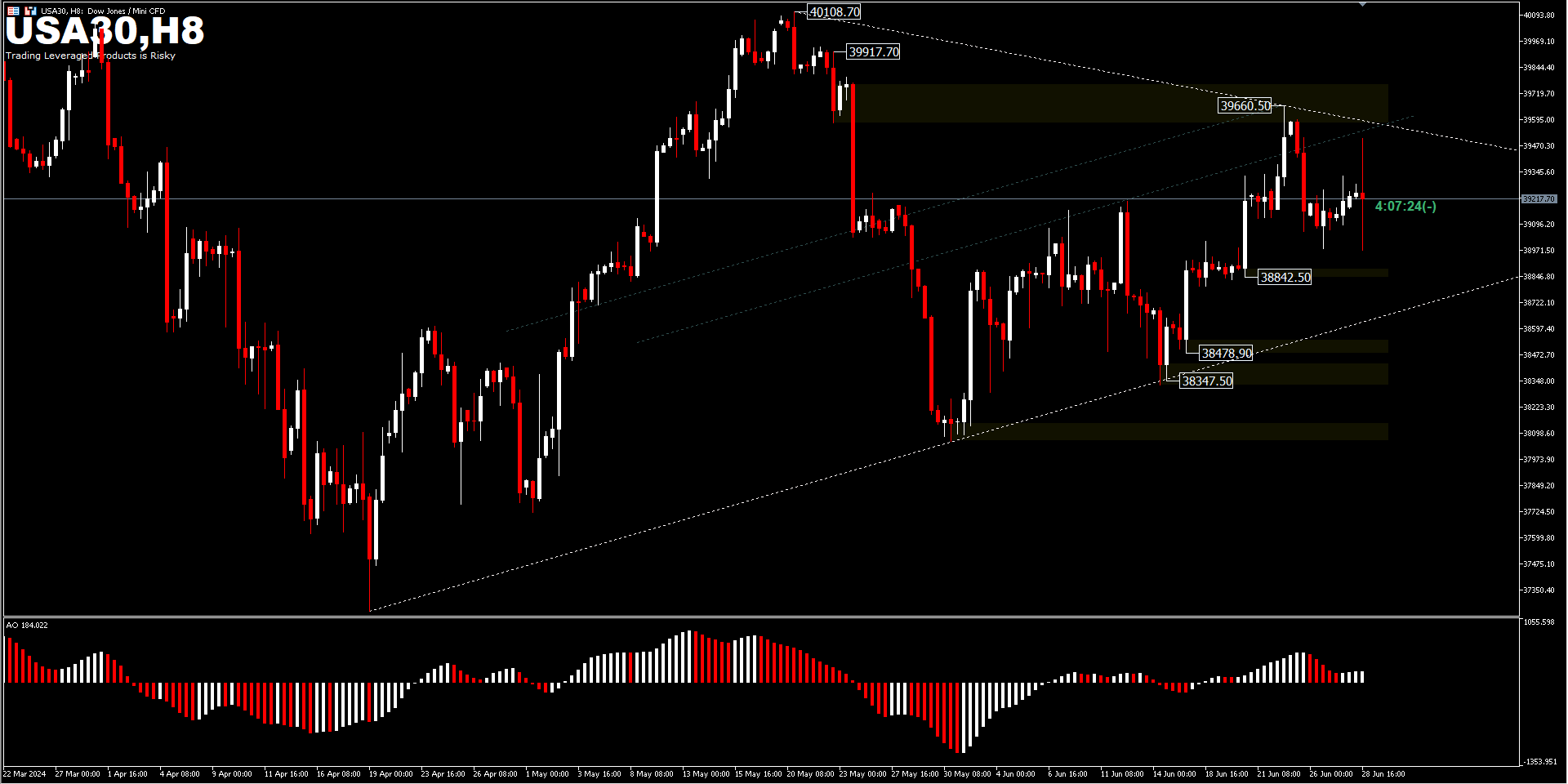

The price momentum of the USA30 Index indicates that the bears are currently in control in the high-wave candle format on H8. The decline is likely to continue, if the $39,660 resistance holds.This could lead to the first support forming at $38,842; however, expansion of control by sellers could break the figure and potentially send the index lower to test $38,478 or $38,347. On the other hand, if buyers push the price above $39,660 they are likely to take control, although the upside may face resistance at 39,917 and 40,108.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.