Key points to remember:

- The Democratic and Republican national conventions this summer mark the start of an active election season.

- It’s crucial to maintain perspective regarding elections’ potential impacts on capital markets and investments.

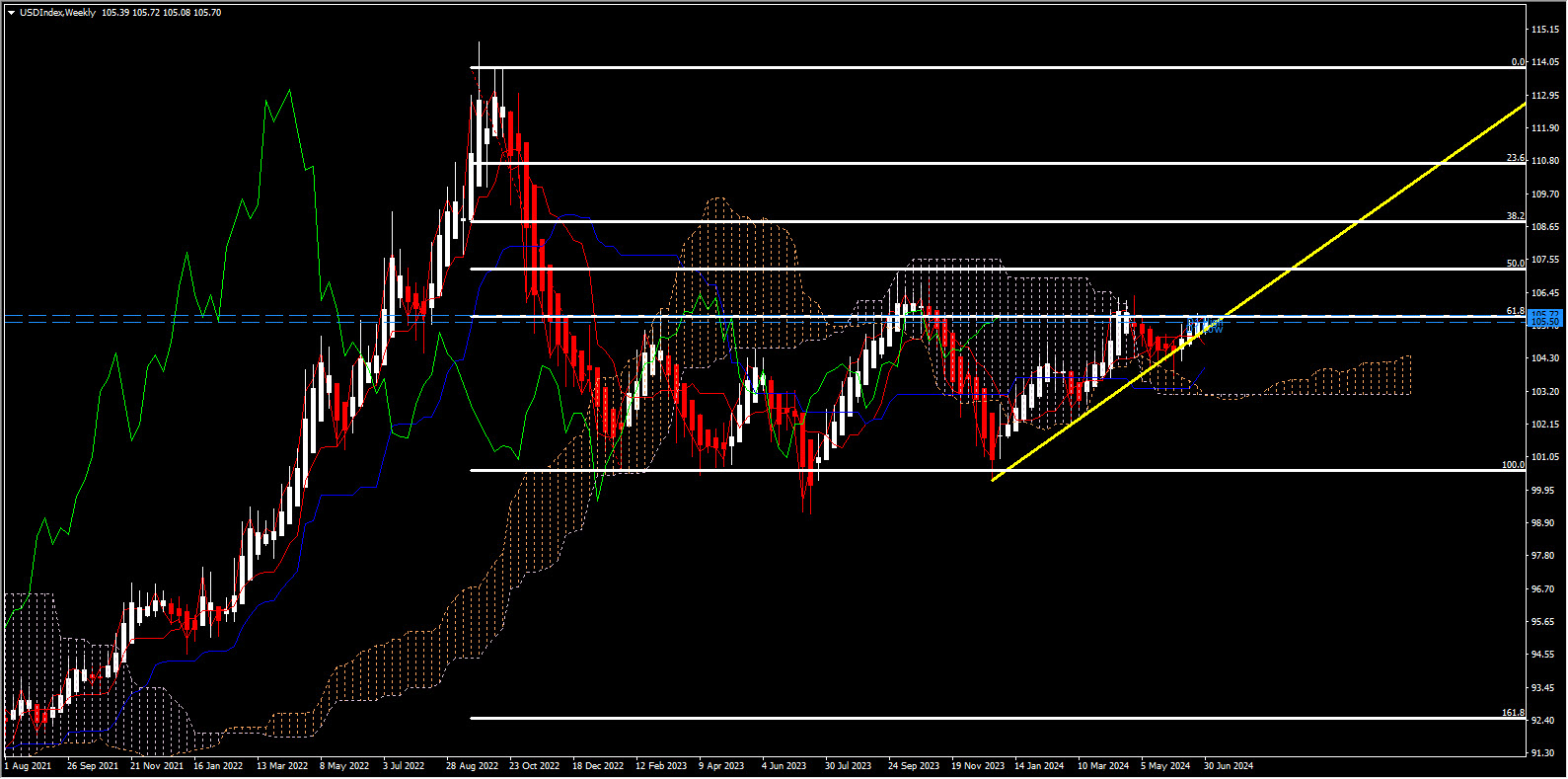

- The US Dollar’s future depends significantly on the outcome of the presidential election and subsequent policy decisions.

The Future of the US Dollar Hinges on the Presidential Election

The future of the US Dollar hinges significantly on the upcoming US presidential election in November. There is widespread agreement on this point, though opinions diverge on the likely outcome.

Potential Outcomes Under Democratic Leadership

If the Democrats win, the implications are largely seen as straightforward. The US Dollar has been robust in recent years under President Joe Biden, who has supported substantial fiscal stimulus while permitting the Federal Reserve to raise interest rates to combat inflation. This combination of expansive fiscal policies and restrictive monetary measures has bolstered the currency, aligning with traditional economic theories.

However, if Biden secures a second term, or if another Democratic candidate takes office, fiscal flexibility may be constrained due to existing wide budget deficits and alarming levels of public debt. Concurrently, as inflation potentially subsides, the Federal Reserve might lower interest rates, altering the policy mix in a manner less favorable to the US Dollar. While this does not forecast a US Dollar crisis, it suggests a scenario where the Greenback could weaken to some extent.

Additionally, the Biden administration has cooperated with allies in the imposition of financial sanctions on Russia, minimizing the international diversification of reserves that could otherwise undermine the Dollar’s strength.

Complex Predictions Under Republican Leadership

Predicting the currency consequences of a second term under Donald Trump is more complex. Historically, the US Dollar strengthened following his unexpected 2016 victory and weakened around his 2020 electoral defeat. Should Trump be re-elected, similar patterns might emerge, especially if he pursues further tax cuts for businesses and wealthy individuals, policies that historically favor a stronger dollar.

Moreover, Trump’s inclination towards tariffs on imports, despite their economic costs, could also lend support to the Dollar by increasing domestic product prices and prompting the Federal Reserve to raise rates in response to inflation. However, if Trump influences the Fed to maintain low interest rates, sustained inflation could diminish the Dollar’s value. There are even discussions about altering the Fed’s operational framework to enhance presidential influence, potentially impacting the US Dollar’s stability.

There are also indications that influential Trump advisors favor policies aimed at weakening the US Dollar to mitigate trade balance impacts caused by tariffs. These measures include additional sanctions on countries that fail to prevent their currencies from depreciating against the dollar or imposing taxes on foreign investments in US assets. Whether these strategies would achieve their intended economic objectives is debatable, as they may inadvertently strengthen the US Dollar or disrupt global trade dynamics.

In summary, while the US Dollar’s future depends significantly on the outcome of the presidential election and subsequent policy decisions, the exact trajectory remains uncertain due to the complex interplay of fiscal policies, monetary strategies, and international relations.

Investors’ Focus ahead of the Elections

Media attention on the election is intensifying, especially after the first debate between Democratic President Joe Biden and Republican Donald Trump, with the former’s faltering performance exacerbating concerns about his fitness for office.

Democrats had hoped the convention would showcase their unity behind a candidate. However, after the debate, many within the party are urging Biden to step down just months before the November election. If Joe Biden succumbs to the mounting pressure to withdraw from the 2024 race, the decision on who would face Donald Trump would likely be determined at what promises to be a highly contentious Democratic convention next month.

In the meantime, Donald Trump also faces questions about his age, mental acuity and temperament, while next month he will be sentenced for his criminal conviction in New York.

What Happens if a Candidate Drops Out After the Conventions?

If a candidate drops out after the conventions, party committees would vote to select a new nominee, likely triggering a significant succession battle.

Democratic Scenario:

-

-

- Front-Runner: Vice-President Kamala Harris.

- Other Contenders: California Governor Gavin Newsom, Michigan Governor Gretchen Whitmer, and Illinois Governor JB Pritzker.

- Challenges: Democrats face the challenge of limited national recognition and are seen as more viable candidates for 2028. Also a convention could divide Democratic party, particularly on geopolitics such as US support for Israel in its war in Gaza.

- Republican Scenario:

- Contenders: Florida Governor Ron DeSantis and entrepreneur Vivek Ramaswamy might aim to capture Trump’s MAGA supporters. However, Trump’s closest primary rival, former UN Ambassador Nikki Haley, represents the traditional conservative wing, leading to an ideological battle for the nomination.

- Challenges: If Trump were incapacitated, the fallout could be chaotic as Trump’s closest primary rival, Nikki Haley, represents the traditional conservative wing, leading to an ideological battle for the nomination.

-

Potential implications for businesses, the economy, and financial markets

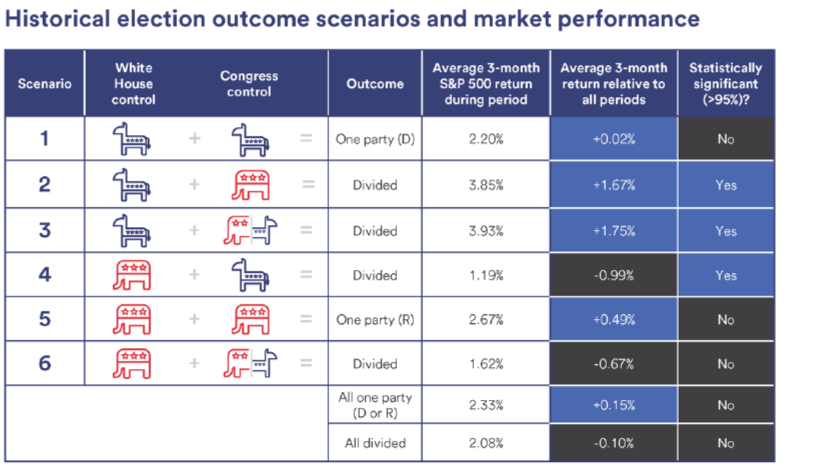

Nonetheless, other than the convention uncertainty, the election has yet to significantly influence market dynamics.

One contributing factor is the unpredictability of voter preferences, which current polls suggest.

“Investors are keenly interested in the policy direction of the winning candidate,” notes Rob Haworth, senior investment strategy director at US Bank Wealth Management. “Historically, significant policy changes occur when one party controls both the White House and Congress. Current polling suggests we are far from such a scenario at this point.“

In addition to the presidential contest, the fall ballot includes 1/3 of US Senate seats and all 435 seats in the US House of Representatives up for election. The outcomes in these races could shape legislative control starting in 2025, potentially resulting in unified or divided government scenarios similar to today.

As November approaches, investors are likely to pay closer attention to its potential implications for businesses, the economy, and financial markets, as uncertainty remains about how their policies could impact market dynamics.

Key policy issues, such as tax policy, are starting to take form. There is ongoing debate about extending provisions of the Tax Cut & Jobs Act (TCJA), which could significantly affect individual and corporate tax rates. The stance on tariffs, particularly concerning Chinese imports, also remains a point of contention.

Both candidates are expected to pursue fiscal stimulus, but with differing approaches involving tax incentives and increased spending.

The impact of tariffs on Chinese goods is another contentious issue. Implemented during Trump’s presidency and continued under Biden, tariffs represent a shift away from previous free trade policies. Both candidates are expected to pursue fiscal stimulus measures, though the exact mix of tax incentives and increased spending may vary.

However, the prioritization is different per party. The Republican administration may prioritize fossil fuel development, while a Democratic administration may favor renewable energy initiatives. Interestingly, market outcomes under recent administrations have not always mirrored these policy tendencies.

Elections have consequences.

Historically, elections impact the financial markets over the medium to long term, however this is typically limited. Economic and inflation trends tend to exert a more consistent influence on market performance than electoral outcomes.

Looking ahead, investors should keep in mind that market dynamics could change prior to election day on November 5, 2024. Key for market participants is to understand potential policy directions,which have greater impact on stock market rather than predicting election outcomes. They should remain grounded in broader economic indicators such as growth, interest rates, inflation, and corporate earnings, since they are proven to have stronger and more direct correlation with the financial markets.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.