Sterling has hit fresh trend lows against the Dollar, Euro and Yen, among other currencies. EURGBP buying has been the latest focus of Pound selling, with the cross popping upward by 20-30 pips in making a 4-month high at 0.8866. Cable carved out a fresh 5-month low at 1.2581 late yesterday, and looks set to extend this.

Given the risk of a disorderly no-deal Brexit scenario and the deleterious impact the prolonged political uncertainty is having on the UK’s economy, Sterling has found itself as a natural currency to short, especially in context of a broader risk-off theme in global markets.

In the UK, there is presently a lot of jostling for position of candidates to replace Prime Minister May, who will step down at the end of next week (after President Trump’s state visit). The leadership contest will formally commence on the week of June 10th. The new prime minister will almost certainly be either a person in favour of a hard, no-deal-if-necessary Brexit, or someone in favour only of a Brexit with a deal, such as Michael Gove, who asserts that leaving the EU without a deal on divorcing terms and outline for a future trading relationship would be irresponsible. Most likely it will be someone of the former type, Boris Johnson being the favourite, which should keep the Pound’s upside potential in check.

Meanwhile, safe haven currencies remain strongly on bid, after President Trump unexpectedly announced tariffs on Mexican goods but also as China announced the existence of an “unreliable entities” list earlier today.

China looks to be digging in deeper for a protracted trade war, with state-backed radio reportedly announcing that Beijing is setting up an “unreliable entities” list comprising of foreign businesses that cut supplies to China. Beijing had promised to respond to the US listing of Huawei and 70 affiliates to its “Entity List,” which keeps these companies from acquiring components and technology from US firms without government approval. China hasn’t yet released any details of who is on its blacklist.

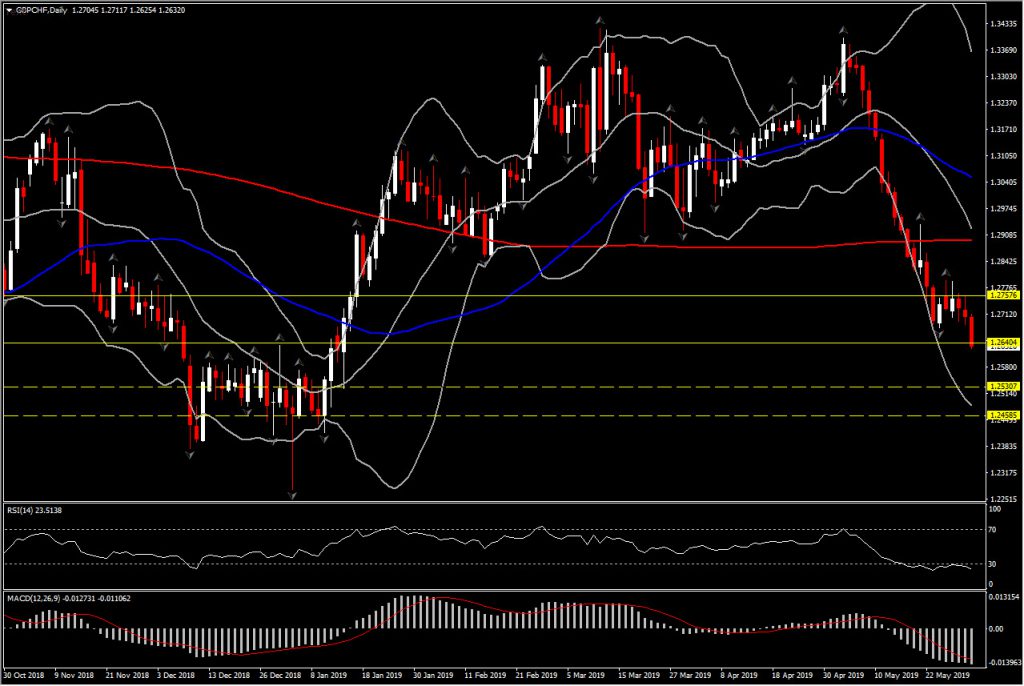

Hence as trade war headlines are endless, we have seen GBPCHF extending May’s drift with another downleg, which bottomed at 1.2625 from 1.2680 .

The strong daily decline so far today, along with the extension of the lower Bollinger Bands pattern and the negatively configured momentum indicators, imply the continuation of the longterm negative bias for the asset. The daily RSI is at 24 looking further to the downside, however the fact that it has crossed the oversold area suggest the possibility of consolidation in the near future. Also MACD lines have confirmed a bearish cross in the negative area.

Signs of consolidation in the near future could be seen in the weekly chart, as the weekly candle is currently outside the Bollinger Bands, something that implies to an overextended price action.

Therefore, we might see a bit of consolidation in the near future, however the overall outlook remains bearish, with the next Support for the pair being set at 1.2530 (January 15 low) in case the asset closes today below the 1.2640 area (previously December’s Resistance area). Resistance levels come at : 1.2757, 1.2800 and 1.2850.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.