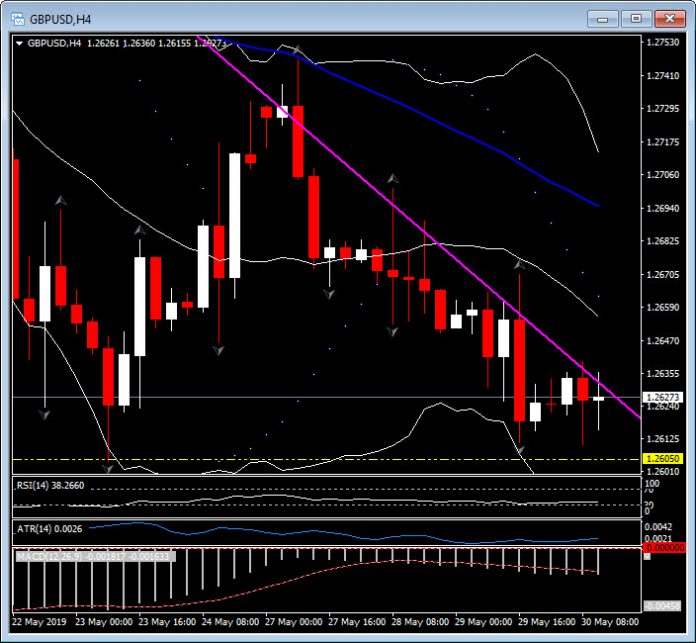

GBPUSD, H4

Sterling is trading on a relatively steady footing, though a bout of Dollar demand saw Cable stab over 20 pips lower to a 1.2611 nadir before reverting to the 1.2625-30 area. The pair’s five-month low seen last week at 1.2605 has remained unchallenged.

It’s gone quite on the Brexit front, at least in terms of substantive developments, with the Conservative Party presently seeing a lot of jostling for position of candidates to replace Prime Minister May, who will step down at the end of next week (after President Trump’s state visit). The leadership contest will formerly commence on the week of June 10th.

The new prime minister will almost certainly be either a person in favour of a hard, no-deal-if-necessary Brexit, or someone in favour only of a Brexit with a deal, such as Michael Gove, who asserts that leaving the EU without a deal on divorcing terms and outline for a future trading relationship would be irresponsible. Most likely it will be someone of the former type, Boris Johnson being the favourite, which should keep the Pound’s upside potential in check.

Leaving the EU without a new deal would see the UK adopt WTO trading terms, which most economists attest would leave the UK on much less beneficial trading terms compared to current arrangements (member of the EU’s single market and customs union, plus participation in the trade deals that the EU has with 50 countries around the world).

Cable posted an April low at 1.2865, then rallied to a May high in the aftermath of the NFP data at 1.3172 on May 3rd before collapsing over 560 pips to register that five-month low. Trend following remains the mode with regard to Cable and indeed all the Sterling crosses. The January 2 “Flash Crash” low for Cable at 1.2430 cannot be ruled out. The market is looking for political clarification and a reduction in uncertainty and is largely ignoring the economic data.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.