- Profit taking was seen ahead of Chair Powell’s comments today, weighing on Treasuries and Wall Street as some of the aggressive Fed rate cuts bets were trimmed further.

- US economic data showed mixed results, with growth relying more on the service sector as manufacturing slows. A better than expected S&P Global services print, a bounce in new home sales, and cautious comments from several Fed officials from Jackson Hole were the catalysts for the selloff.

- The Yen rose after BOJ Governor Kazuo Ueda hinted at potential interest rate hikes, reaffirming the BOJ’s stance if economic data aligns with forecasts. This follows concerns after the BOJ’s July rate hike caused a global equity selloff. Japanese inflation data exceeded expectations, supporting the Yen as well.

- Focus on Powell’s Speech: Traders are awaiting Federal Reserve Chair Jerome Powell’s speech for clues on potential rate cuts. Some have been warning that the event risk is that Powell will be more cautious than markets are now expecting, which could weigh on the Euro and Sterling in particular.

Asia & European Sessions:

- Wall Street tumbled, with losses accelerating into the close. The NASDAQ finished with a -1.67% plunge, while the S&P500 was -0.89% lower, and the Dow was down -0.43%.

- Asian equities were mixed, with Chinese shares helping to erase earlier losses. Global stocks were volatile, with declines in Hong Kong, South Korea, Australia, and the US.

- Alibaba’s Hong Kong listing upgrade was approved, which is expected to attract significant investment. However, Chinese tech stocks like NetEase, Baidu, and Bilibili fell due to weak earnings.

Financial Markets Performance:

- The USDIndex has extended its declines, falling to 100.93. The buck has not closed with a 100 handle since April 2022.

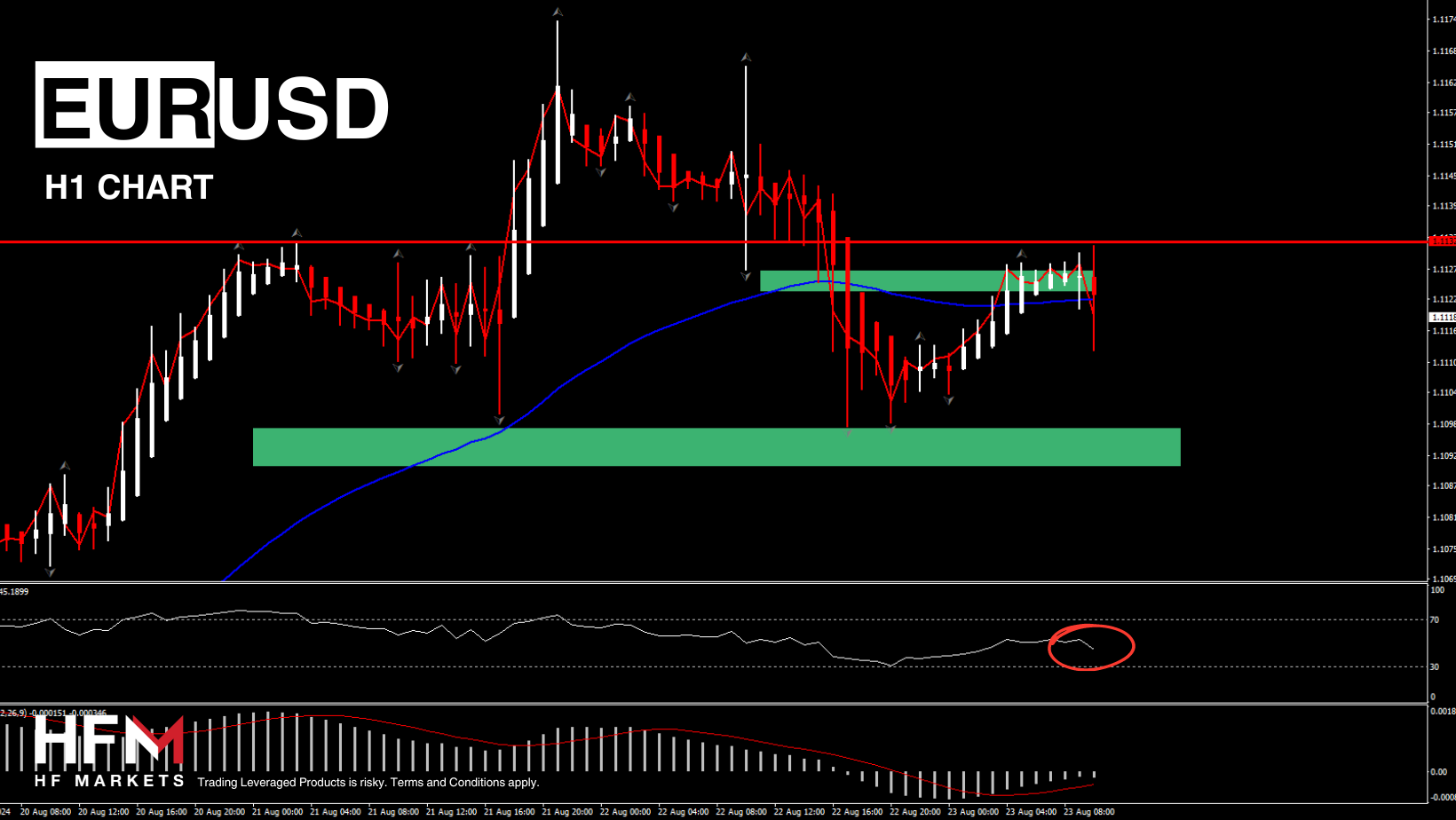

- EURUSD has inched down to 1.1130 after drifting to 1.1097, but is still near the highest level in a year. Sterling outperformed and Cable rallied to 1.3120 after strong PMI data. The USDJPY is trading at 145.27 (S1) after a broader correction in the Yen.

- USOil steadied between 72.58-72.94.

- Gold has inched down to $2470 per ounce and still holds below the $2500 level.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.