- The Federal Reserve’s Meeting Minutes confirms not all committee members agreed with the 0.50% cut.

- JP Morgan, Wells Fargo and Blackrock are set to kickstart this quarter’s earnings season.

- Traders brace for volatility as the US releases its latest inflation report. Analysts expect inflation to fall to 2.3%.

- Investors evaluate whether higher bond yields could prove to be a headwind for US stocks. US Bond Yields rise to a 3-month high.

SNP500 (USA500) – Earnings and Inflation To Drive The SNP500’s Future Price Movement!

The price of the SNP500 again rose to an all-time high after increasing 0.65% on Wednesday. The future price movement of the asset will now largely depend on this week’s inflation data and the upcoming quarterly earnings reports. Ideally buyers will want to see higher than expected earnings as well as a lower inflation rate. Some economists also advise an inflation rate of 2.3% as per expectations, and can still improve sentiment for as long as earnings are positive.

Tomorrow investors will fix their attention on the earnings of JP Morgan, Wells Fargo and Blackrock. The 3 companies make up 1.90% of the SNP500 with JP Morgan being the most influential individual stock of the 3. JP Morgan is the 12th most influential stock for the SNP500. The below data confirms that economists expect lower earnings compared to the previous quarterly report, but higher stock prices indicate market participants expect the report to beat expectations.

Expectations for Start of Earnings Season (Friday 11th)

JP Morgan – Earnings Per Share to fall from $6.12 to $3.99. Revenue to fall from $50 billion to $41.38 billion.

Wells Fargo – Earnings Per Share to fall from $1.34 to $1.28. Revenue to remain unchanged.

Blackrock – Earnings Per Share to fall from $10.36 to $10.30. Revenue to increase from $4.80 billion to $4.92 billion.

Stock performance over the past 30 days:

- JP Morgan +3.82%

- Wells Fargo +6.65%

- Blackrock +8.16%

The Meeting Minutes from the Federal Reserve’s last meeting show that not all officials agree with the 50 basis point cut in borrowing costs. Some members believe it is a step too far given the limited drop in inflation pressure. Only Michelle Bowman openly opposed the decision. A further cut of 25 basis points seems more likely. However, if today’s consumer price index (due at 14:30 GMT+2) shows a sharp slowdown, officials may rethink a 0.50% cut. Though this remains unlikely unless economic or employment data deteriorates further.

Also investors will continue to monitor the price of oil. If oil prices continue to rise the Federal Reserve may fear another surge in inflation and potentially opt for a smaller cut or a pause. Buyers of the SNP500 will ideally want oil to remain below $75 per barrel in order to avoid sticky inflation or lower consumer demand. Currently, the VIX trades 1.00% higher and bond yields have risen 0.13%. Both these factors are known to be negative for the stock market, but this may drastically change due to volatility after the US releases its CPI (Consumer Price Index).

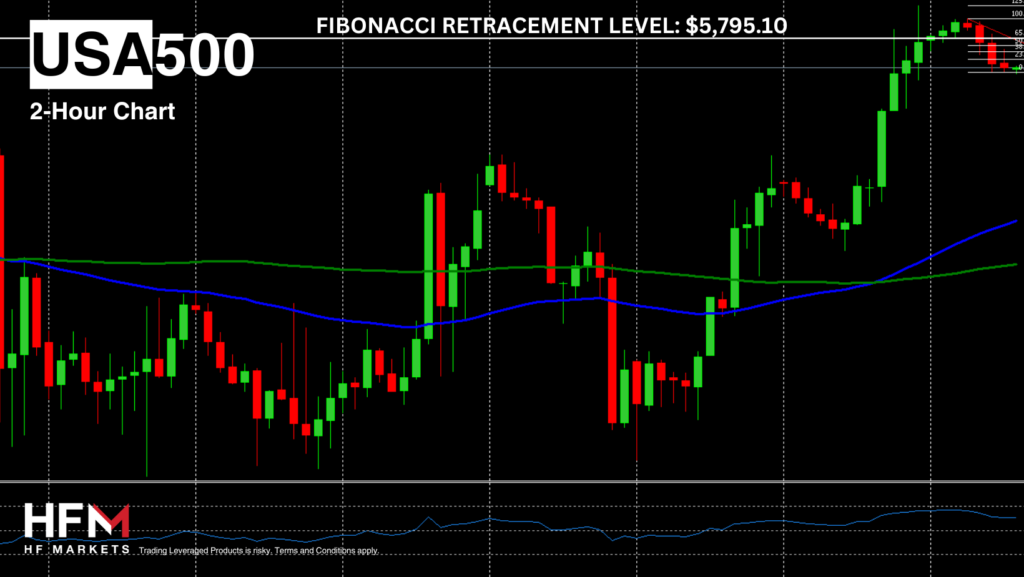

On a 2-hour timeframe the price of the SNP500 is retracing downward potentially due to being oversold in the short-term. However, the retracement remains significantly weaker than yesterday’s impulse wave. Currently, the price is trading below the VWAP but above the trend line and the neutral level on most oscillators. Therefore, if the inflation data is positive, traders may find opportunities using the price crossing above the VWAP as a potential signal to buy. Alternatively, the Fibonacci retracement levels indicate a potential “long” indication at $5,795.10.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.