- Global stocks decline for a second consecutive day as investors fear employment data could prompt the Fed to pause in December.

- Apple beat earnings expectations but the stock fell 1.85% as the company’s sales remain weak in Asia. Amazon stocks on the other hand rose 6.00% after releasing their earnings report.

- The Great British Pound declined against all currencies on Thursday as investors continue to digest Labour’s latest budget.

- Traders turn their attention to the US NFP figures. Analysts expect the US economy to add 106,000 more employed individuals and the Unemployment Rate to reach 4.1%.

SNP500 – The SNP500 Falls Sharply As Economic Data Fail To Support Stocks!

The price of the SNP500 fell 1.84% on Thursday largely due to fear of a positive NFP and a hawkish Federal Reserve. Shareholders also did not get the support they were hoping for from yesterday’s economic data and Apple’s earnings report. Due to the decline over the past 48 hours, the SNP500 is largely witnessing sell signals on most charts. However, investors should note that this can change depending on today’s NFP data.

Analysts expect October NFP data to be the lowest in 4-years due to strikes in certain industries as well as the recent hurricane in Florida. Investors will be hoping the US employment data this afternoon will reassure the market that the Fed will continue to cut in December. Analysts expect the US Unemployment Rate to remain at 4.1%, but a higher figure could support the stock market.

Yesterday’s Core PCE Price Index read 0.3% as per the market’s expectations. The 0.3% release was the highest in 7-months which is a concern for investors. A high PCE Price Index is known to trigger a Federal Reserve which is reluctant to cut interest rates. Nonetheless, the Fed is almost certain to cut 0.25% at next week’s meeting.

The VIX index fell 1.71% lower this morning which is known to be positive for the stock market. However, further confirmation is required as bond yields continue to rise along with oil prices.

Apple beat earnings and revenue expectations but the stock fell 1.85% as the company’s sales remain weak in Asia. Amazon stocks on the other hand rose 6.00% after releasing their earnings report. Amazon earnings per share read 24% higher than expectations while revenue rose $11 billion compared to the previous quarter.

Technical analysis currently points towards a bearish bias due to the momentum over the past 2-days. However, traders should prepare for volatility in either direction as price action can change as the US releases their NFP data.

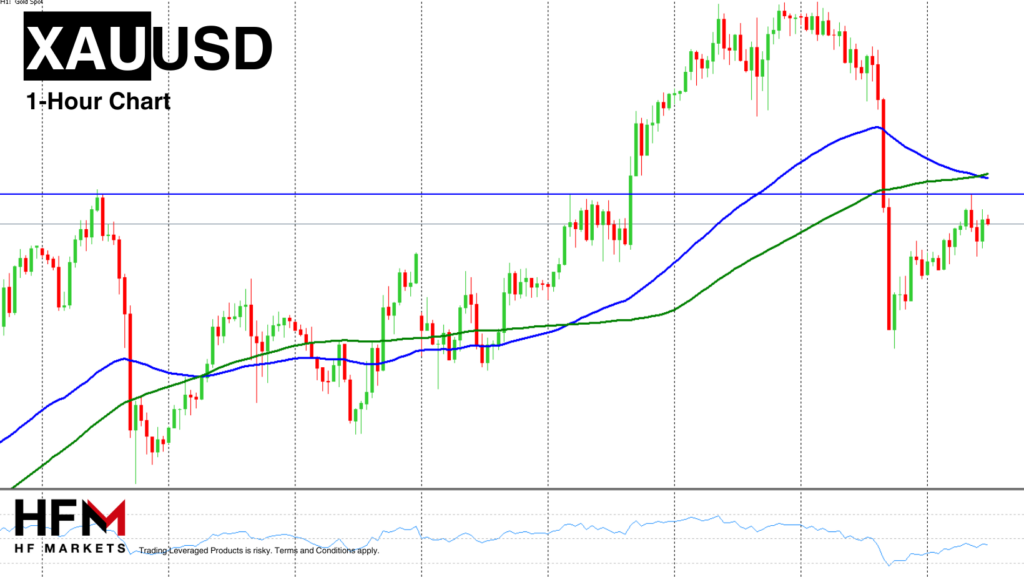

Gold – Price Action Tied To Interest Rates And NFP!

The price of Gold on Friday will depend on the US employment data this afternoon and whether the Fed will continue to cut interest rates. The weaker the data the better it would be for Gold as investors will look for an alternative to interest-based investments and the US Dollar.

Gold fell 1.57% on Thursday but is retracing upwards and is now trading 0.87% higher than yesterday’s low. If the price breaks above $2,757.50, the price action will form a breakout and potentially can signal further upward price action for the day. This signal will also become stronger if this afternoon’s employment data disappoints.

GBPJPY – GBP Trades On Shaky Ground!

The British Pound remains volatile due to the latest labor budget which saw taxes and debt levels rise. The main concern is Companies’ National Insurance Fund (NI) contributions will rise to 15%, and Capital Gains Tax (CGT) will increase from 10% to 18% for low-rate payers and from 20% to 24% for high-rate payers. These changes may put substantial pressure on businesses, potentially limiting profit growth and raising investor concerns, potentially leading some to move away from the GBP. However, this is something which global analysts and investors continue to analyze.

Currently the GBP is increasing in value attempting to correct upwards after yesterday’s decline. In addition to this, the Japanese Yen is the day’s worst performing currency so far which supports the GBP’s upward price movement. Though, investors should be cautious that the Pound’s future price action remains unstable due to the latest autumn budget.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.