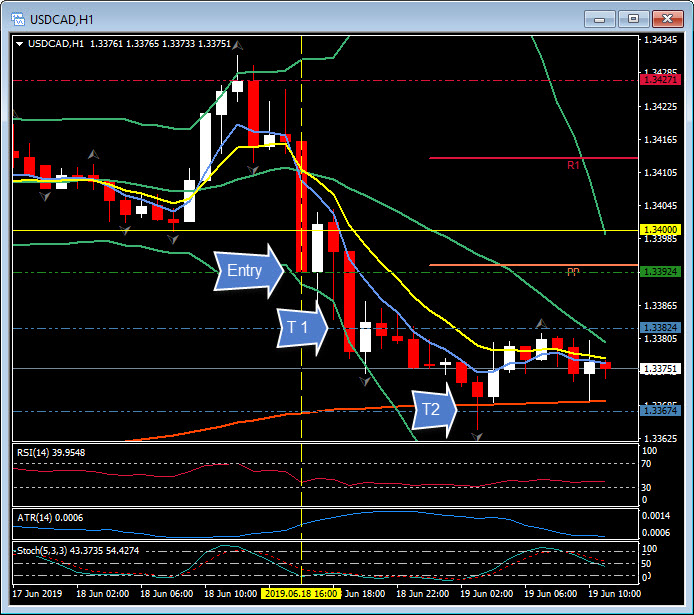

USDCAD, H1

The Canadian Dollar, buoyed by a 4.5%-plus (over $3.00/barrel) rally in oil prices over the last day, has seen some moderate outperformance, which has taken USDCAD to a three-session low at 1.3364. The triple whammy of tensions in the Middle East and particularly the Gulf supporting Oil prices, the fact that markets are expecting the Fed to follow Draghi into Dovish overtones later today and Presidents Trump & Xi confirming they will actually meet next week have all underpinned sentiment. This is a bullish mix of developments for currencies with higher beta characteristics, such as the commodity currencies of Canada, Australia and New Zealand.

USDCAD triggered lower on the crossing EMA Strategy (H1) at 1.3392 following the large engulfing candle that breached the key 1.3400 level. It eventually ran to T2 for a net gain of 25 pips as the pair ran down to the key 200 period moving average.

USDCAD remains bearish on the Daily time frame too, having failed to hold the weak break of the 20-day moving average on Monday. Yesterday’s (June 18) big move down was a return to trend continuation move first initiated back on June 3. USDCAD has support at 1.3250 and the 200-day moving average at 1.3285 with resistance sitting at 1.3400 and 1.3450. All subject to events in the Gulf and Washington of course.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.