FX News Today

- Stock markets headed south during the Asian session.

- Trade headlines continue to drive market sentiment and fresh doubts that there will be a breakthrough on the trade front at the highly anticipated meeting between US President Trump and China’s leader Xi Jinping saw investors heading for cover again.

- Trump repeated threats of more tariffs and with global equities still more than 5% higher on the month, the risk of disappointment is capping markets for now.

- If there are at least further negotiations and central banks remain on course to add more stimulus, it should be a constructive start to the second half of the year.

- Topix and JP225 lost -0.25% and -0.50% respectively so far.

- US futures are trading narrowly mixed, with American lenders gaining overnight after announcing share buybacks in the wake of annual Fed stress tests.

- The WTI future is at $59.19 per barrel after seeing a high of $59.54 overnight.

- In Europe, peripheral markets are outperforming and Eurozone spreads are narrowing as a sharp drop in German import price inflation at the start of the session added to pressure on the ECB to implement further easing.

- Eurozone stock futures are narrowly mixed.

Charts of the Day

Technician’s Corner

- BTCUSD retreated further overnight, with the contract bottoming at $10,228.24, down from Wednesday highs of $13,821. This sell off has been measured as a 25% plunged. The sell-off started on the failure of Coinbase website. Technically, the decline came after the asset reached the 61.8% retracement level from year’s high, while it is currently retesting the 50% Fib. level. Hence, as the asset was overbought such a correction is technically acceptable. If the pair manages to sustain a move above the 38.2% Fib level along with a move above the midpoint from this week’s decline (i.e. 12000.00), it could spread hopes for another attempt higher again.

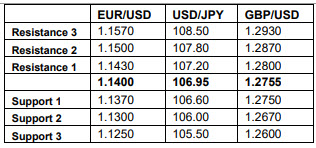

- USDJPY fell briefly under 107.70. Word that China would require preconditions for the talks weighed the pairing down, though moved off its lows as NEC chief Kudlow said there were no pre-conditions to the talks. Wall Street gains limited the pairing’s losses, though soft Treasury yields put a cap on USDJPY. Resistance is now at the 20-day moving average of 108.08, with Support at the overnight low of 107.55.

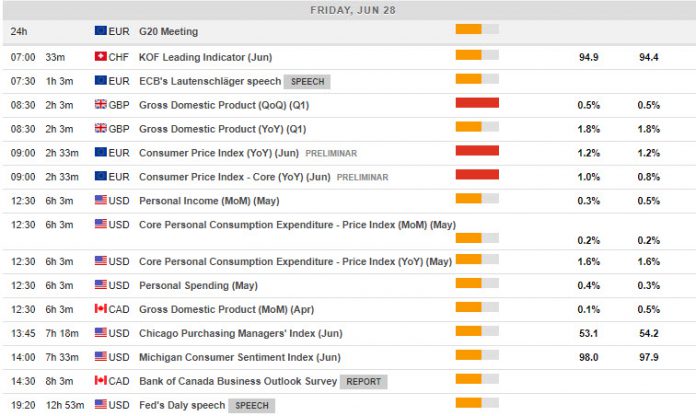

Main Macro Events Today

- Gross Domestic Product (GBP, GMT 08:30) – The Q1 GDP could be seen falling to 0.2%q/q from the preliminary reading seen in May at 0.5%q/q. The ONS stats office noted there was a “dramatic fall” in the UK car production in April, which was pinned squarely on Brexit uncertainty.

- Consumer Price Index (EUR, GMT 09:00) – The preliminary Euro Area CPI for June is anticipated to rise to 1.3% y/y from 1.2%y/y last month. The core inflation is seen at 1.0% y/y from 0.8% y/y.

- US Personal Spending (USD, GMT 12:30) – A 0.3% gain is seen in personal income in May after a 0.5% increase in April, alongside a 0.3% rise in May consumption.

- Chicago PMI and Michigan Index (USD, GMT 13:45-14:00) – The Chicago PMI should be 55.0 from 54.2 last month. Michigan Index is the main US consumer confidence index and it is expected to remain flat following the drop to 97.9 from an 8-month high of 100.0 in May.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.