FX News Today

- Treasuries recovered during the Asian session after better than expected data and a weak auction put pressure on bonds yesterday.

- Bonds across Asia were under pressure though and JGB yields moved up 2.6 bp to -0.121%, while Australia’s 10-year yield jumped 12.0 bp to 1.450%.The RBA already cut rates to record lows and comments from the central bank governor yesterday didn’t sound as though the bank was readying further easing at the moment.

- Stock markets were cautious ahead of trade and lending data out of China today, which are expected to set the tone for GDP numbers out on Monday.

- With Powell’s testimony out of the way the focus is shifting back to the impact of trade tensions, and after Singapore reported the weakest GDP growth number in a decade investors are holding back before taking fresh positions, especially after a tweet by US President Trump saying China was not living up to promises made on buying agricultural products from the US.

- Indices swung between gains and losses overnight and Topix and Nikkei are currently down -0.19% and up 0.15% respectively.

- European stock futures are moving higher in tandem with US futures.

- The WTI future is trading at $60.67 per barrel, amid escalating tensions in the Middle East.

Charts of the Day

Technician’s Corner

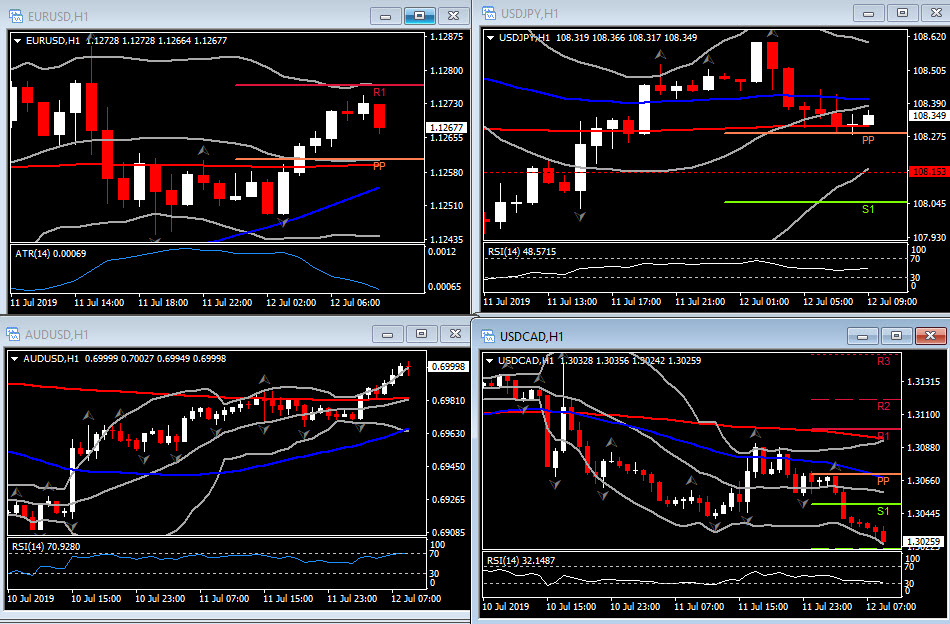

- EURUSD spiked to 1.1274 in the Asia session after knocking lower following the warmer US CPI outcome. Looking ahead, the Dollar is likely to remain in sell-the-rally mode ahead of the July FOMC meeting, where a 25 basis point rate cut is widely expected. EURUSD support is now at the 50-day Moving Average at 1.1240, with resistance at 1.1287-95, the July 5 and July 4 highs.

- USDCAD drifted lower to 1.3023 area as the WTI future is trading at USD 60.58 per barrel, amid escalating tensions in the Middle East. Next Support stands at 1.2970-1.2990.

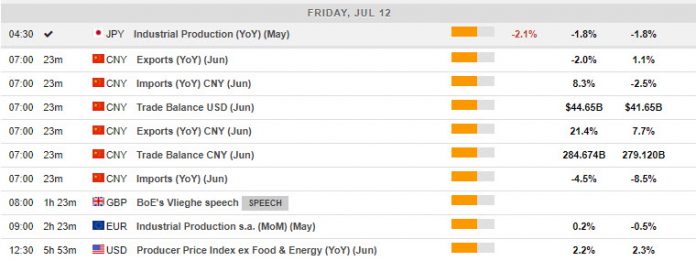

Main Macro Events Today

- Producer Price Index (USD, GMT 12:30) – The Headline PPI is expected to hold at 0.1% in June, and at 0.2% in the core index. These readings would keep in a y/y gain of 1.4% for headline PPI. We see y/y headline readings in a 1.3%-1.9% range over coming months, while core prices should be in a 2.1%-2.5% range.

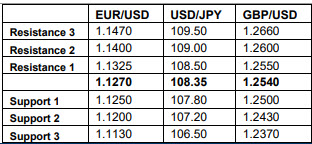

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.