Stock markets sold off amid fears that the renewed escalation in US-Sino trade tensions will derail the global economy and markets are not buying the Fed’s claim that last week’s rate cut was a “mid-cycle adjustment” rather than the start of a series of easing measures. The futures market priced back in 50 bps in Fed rate cuts over the rest of 2019.

After President Trump threatened another 10% tariff on USD 300 bln of imports from China, China vowed to fight back and the Yuan fell past 7 per dollar, which sparked concerns of a Currency War. Meanwhile, a Bloomberg report saying China asked state purchasers to halve imports of American agricultural products further indicated that the spat is escalating.

The focus on trade and tariffs overshadowed the July payroll and trade reports, which were also on the disappointing side, giving no backstop to Equities.

Nevertheless, it was the worst week of the year for Wall Street.

China’s Yuan fell to an 11-year low below the politically sensitive 7.0 to the Dollar level, which the PBoC blamed on “trade protectionism,” and which has the potential to mark the point at which the trade war goes from simmering to boiling.

The Yuan slip weighs negatively on Risk assets (i.e. Equities, Antipodeans and Oil) and positively on Safe haven assets.The safe-haven Yen outperformed.

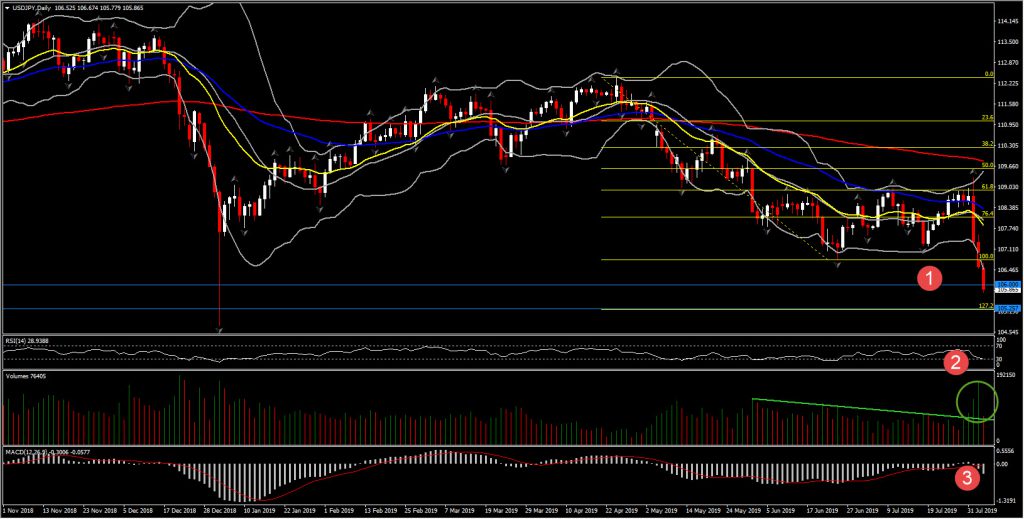

USDJPY was off its lows just ahead of the London interbank open, but still shows a 0.6% decline. The pair earlier hit a 7-month low at 105.78. AUDJPY dove by over 1% in making a fresh 7-month low at 71.40.

The three huge black crows since Thursday along with the break of June’s low and also the breach and break of the round 106.00 barrier, suggest the refreshment of bearish outlook for the USDJPY. Momentum indicators also present the renewal of bearish bias, as MACD extends southwards suggesting the increase of bearish momentum, while RSI drifted to 30.

The 2-month Support at 106.75 has now turned into a Resistance level, while attention is to the downside, towards 127.2 Fibonacci extension at 105.25, and 15-month low at 104.74.

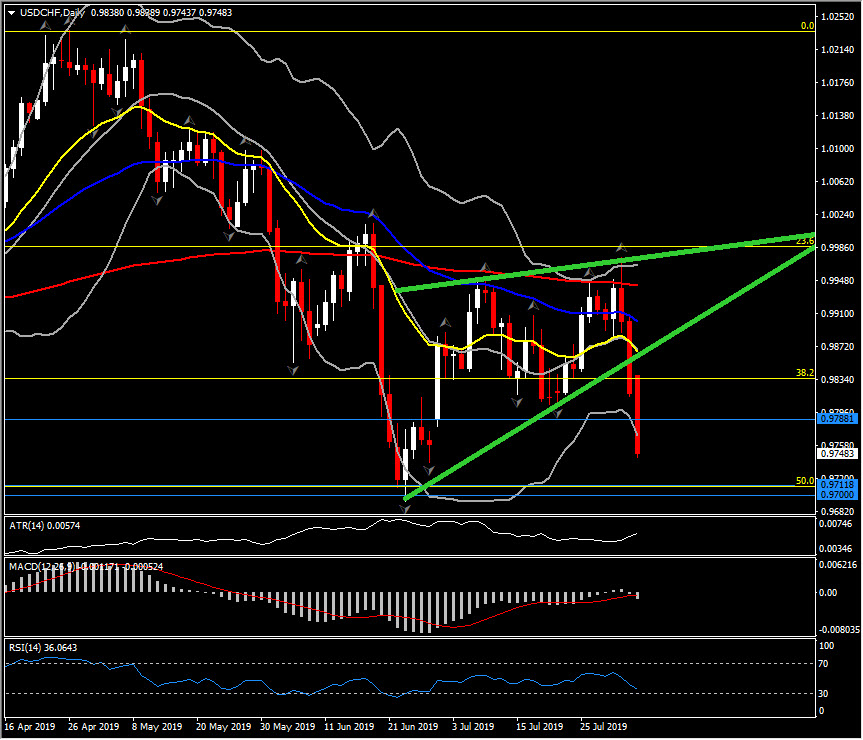

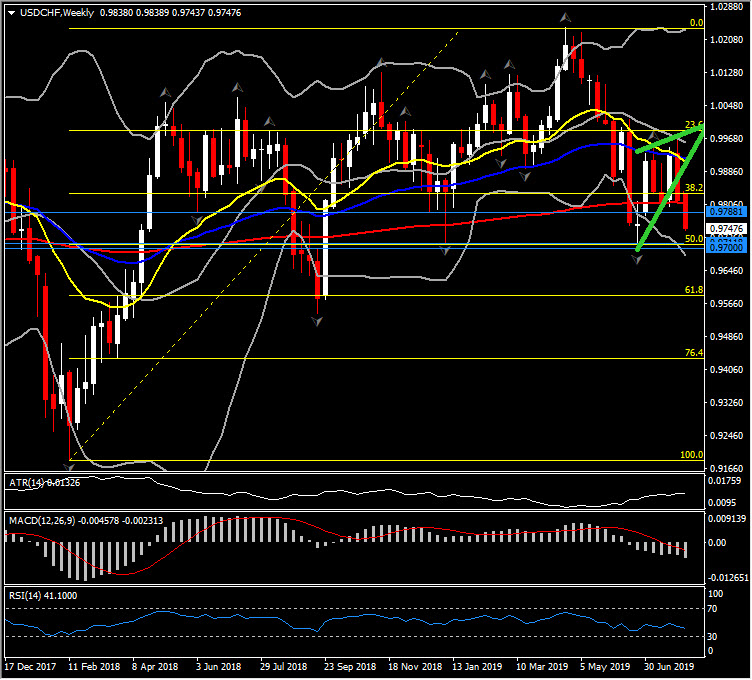

USDCHF: Swissy is in a similar rally as it benefited across the board as well. USDCHF fell to a 5-week low, while it has posted a decisive break below the 200-week EMA, which had supported the pair quite well since September 2018. The sharp decline, reinforced the possibility of a major retracement of 2018-2019 gains. The same stance can also be detected against Euro.

After the nearly full bearish body candle seen on Friday along with today’s aggressive decline below the 0.9800 area, and the negatively configured momentum indicators, bearish bias is expected to continue. The asset is currently trading outside the daily upper Bollinger Bands pattern, RSI is sloping towards 30 barrier, while MACD completed a bear cross in the negative territory.

Significant also is the fact that the asset is trading for a second consecutive day well below the ascending triangle formed the past 2 months. This adds further reliance on the negative outlook for USDCHF and the appreciation of the Swiss franc.

Next Support holds at the 0.9700-0.9711 area (50% Fib. retracement level since 2018 low and ATR indication for 57-pip movement). Resistance is at 0.9800.

A break of the 0.9700 level would open the doors towards the 61.8% Fibonacci retracement and the September 2018 lows, i.e. 0.9540-0.9600 area

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.