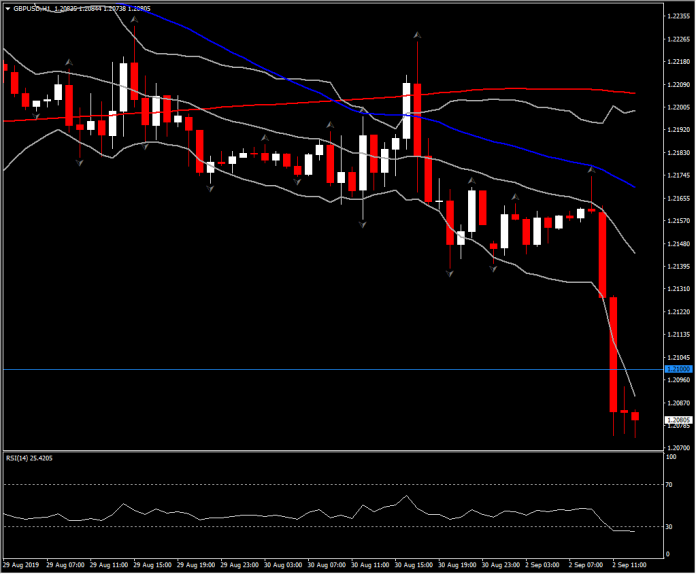

GBPUSD, H1

The UK’s August manufacturing PMI underwhelmed at 47.4 in the headline reading, which is an 85-month (7 year) low. The median forecast had been for a turn higher, to 48.4, after the 48.0 headline seen in July. The survey showed new orders falling at the quickest pace in almost seven years, and business confidence falling to a record low for the data series. Weakness was seen across all of the main product categories. The level of new export business contracted at the fastest rate in over seven years amid Brexit uncertainty and slowing global growth. The report found that some EU-based clients were routing supply chains away from the UK due to Brexit, while inflows from the US and Asian economies also slowed. Employment in the sector fell at one of the quickest rates in six-and-a-half years. There was some evidence of stock-piling activity into the October 31 Brexit deadline, similar to what had been seen into the original Brexit date of March 29, though evidently not sufficient to counter an overall dismal report.

Although manufacturing only accounts for approximately 10% of UK GDP, it is a key indicator of sentiment and overall economic activity. Sterling moved down on the numbers as Cable slipped below 1.2100 to 1.2080, GBPJPY moved down another leg, breaking S2 to trade at 128.40 and EURGBP moved up from lows following in-line manufacturing PMIs from the Eurozone countries, to 0.9075.

It’s going to be a huge, potentially future-defining week for Sterling with the UK Parliament returning from summer recess tomorrow (13:30 GMT) with opposition parties scheming on taking the no-deal Brexit option off the table, or at the least force Prime Minister Johnson to allow Parliament to vote on any new Brexit deal or on a no-deal itself. As weekend remarks from various opposition members of parliament affirmed, their favoured option is to pass legislation that would ban no-deal by law. If they were to succeed, the Pound would likely rotate sharply higher for a burst, though follow-through would likely be curtailed as the prime minister would be certain in this circumstance to call a general election. Recent polling suggests that Johnson’s Conservative Party could win in the UK’s first past the post electoral system, too, especially if he formed a coalition with the Brexit Party, although with the electorate likely to view any election as a straight choice between voting for or against Brexit, the anti-Brexit alliance of opposition parties would present a potentially considerable force if they managed a highly disciplined strategy (entailing some parties withdrawing candidates in a range of seats so as not to split the anti-Brexit vote). The other option would be for the opposition to call a vote of no confidence in the government. This is less favoured by them than the legislative route as it could give Johnson, in the event his government is taken down (and assuming that an interim government failed to form in a 14-day period following a successful no-confidence vote) the power to rig it so that the election would happen after Brexit had been triggered on October 31.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.