European stock markets moved broadly higher in quiet trade, after a mixed close in Asia. The latest round of US-Sino tariffs came into effect yesterday but a better than expected China Caixin manufacturing PMI and reassurance from Chinese officials helped CSI 300 and Shanghai Comp.

In Europe, data releases confirmed that manufacturing sectors on both sides of the channel are in contraction, however GER30 and UK100 still managed to move higher.

In the US meanwhile, USA500 futures pared losses and are showing a fractional 0.1% decline at prevailing levels, having been showing a loss of nearly 0.5% during Asian hours. There is a lack of directional commitment given the North American holiday, although European and Chinese stock markets have managed gains.

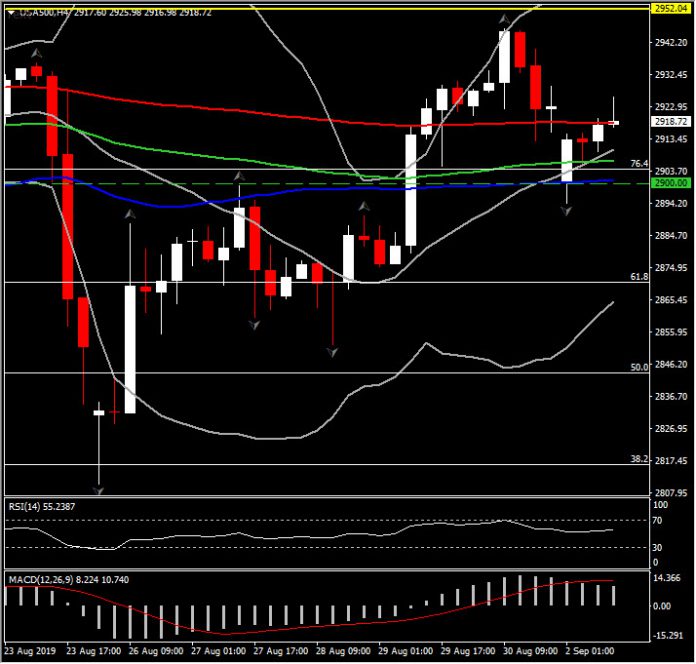

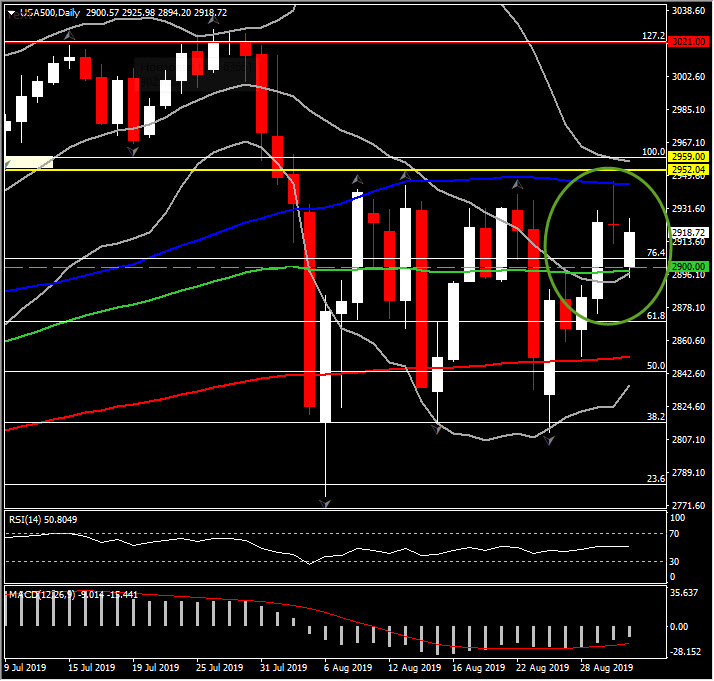

The USA500 is currently well above today’s open however its direction is unknown as we cannot see consistency in today’s trading, as candles are up , then down , then up etc. This along with the doji Friday candle, the 3-week consolidation and the nearly flat momentum indicators, are strengthening the uncertainty for the USA500 outlook.

Having the USA500 price close to the upper line of the range, along with the doji candle on Friday, we can see the possibility of a pullback rising. However, a closer look at the charts suggests that negative momentum is higher than positive, despite the indecision seen in the markets so far today. The asset failed to move above the PP level at 2,927.30, and RSI and MACD remain below neutral zone in the daily chart, suggesting that bearish momentum will hold.

The hourly chart shows support initially at 2,908.10 (100-period EMA). Resistance mounts up around PP level at 2,927.30 and 2,944.30 (3 up daily fractals and 50-day SMA). This remains a very difficult market to study as we need to see a clear break outside the range in order to identify the direction of the USA500.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.