Risk aversion continues to support Bond markets and stopped the rise in global stock markets after a bullish start to the month. Equities traded mixed across Asia with Japanese indices outperforming with Nikkei posting gains of 0.14%, while Hang Seng and CSI 300 lost -1% and -0.9% respectively and in the US futures are heading south with the US100 future underperforming. Still, the USA500 held near record highs yesterday as the FOMC meeting comes into view and the impact on global stock markets has not been as negative as it could have been.

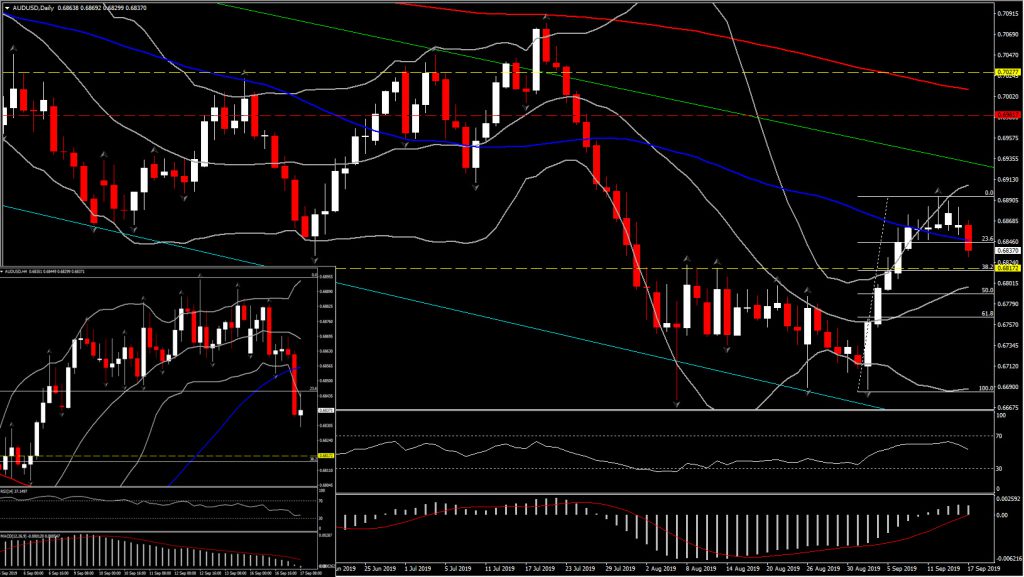

In the currency market at the same time, Aussie attracts the attention this week as well, however on the flipside this time.

The Australian Dollar ebbed to an 11-day low versus the US Dollar, at 0.6829.

Several factors weighed on the antipodean currency. First, the RBA minutes from the September policy meeting showed that the central bank remains disposed to further easing, and second, Australian consumer sentiment fell to a two-year low. At the same time, China’s PBoC also took its foot off the stimulus pedal a little, refraining from rolling over nearly CNY 300 bln in money market instruments today. The asset retested the 50-day EMA, which supported the asset for the past 7 days. So far in the European session though, it rebounded from today’s lows, reverting nearly 38% of day’s losses.

Momentum indicators flip lower, with daily RSI retesting a break below 50 zone, while intraday is already below neutral, warning for a possible reversal of Septembers 200 pips rally. MACD has flattened on the zero line confirming the intraday weakness.

Yet, as far as the daily indicator holds above its 50 neutral mark while the price action holds above the 20-, 50-day SMA and above the 38.2% Fibonacci retracement since September 3 rebound, signals are not enough to convince that negative momentum could persist.

A decisive decline below the 0.6800 could increase the bearish momentum for the asset. Further down, the sell-off could pause somewhere between 0.6760 (61.8% FIb. level) and 0.6735.

Should the bulls retake control above the 0.6870 (day’s peak), resistance could shift up to month’s high at 0.6895 and the round 0.6900. This could trigger a fresh rally if significantly breached, with focus turning to the December 2018-April 2019 Support at 0.6980 and the 0.7010 (200-day SMA).

Elsewhere, the Dollar has been in a narrow-ranged consolidation after rallying yesterday on safe haven demand as markets reacted to weekend news of the attacks on Saudi Oil facilities.

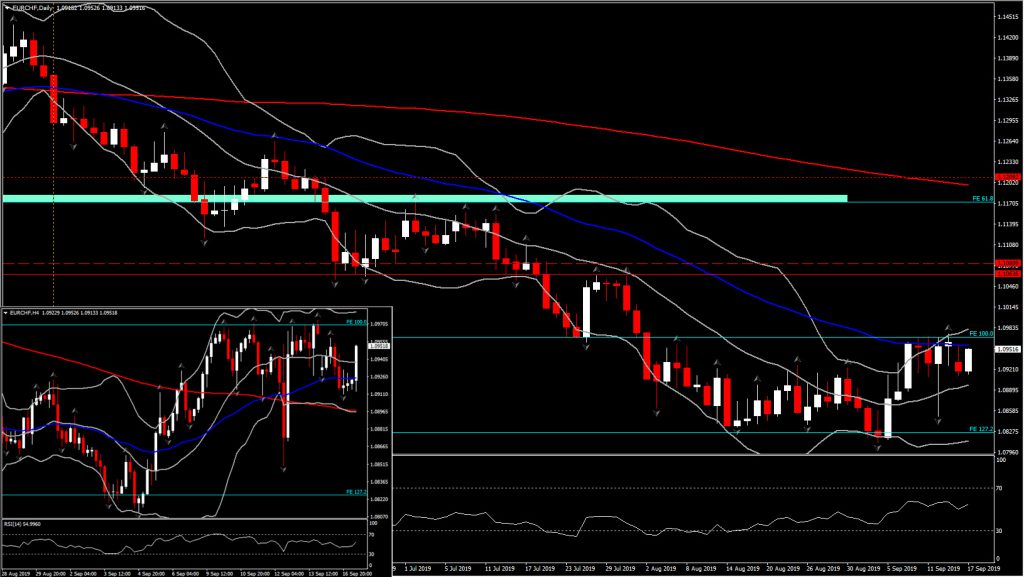

EURCHF has remained buoyant after printing a 6-week high last Friday at 1.0974, which extended the rebound from the 26-month low at 1.0811.

The pickup in risk appetite in global markets, and reduced risk for a no-deal Brexit, has fostered an unwinding in the Franc’s safe haven premium (such as it is given the punishing -0.75% deposit rate in Switzerland). The SNB’s quarterly policy review is up this week, on Thursday. The SNB is widely expected to hold steady for now while stressing that it remains ready to intervene in forex markets if necessary. The central bank’s next official policy meeting is in December.

EURCHF is currently resting for a 7 day in a row, a strong Resistance at 50-day SMA at 1.0957. A close today above it and more precisely above 1.0970 which is the upper barrier of the 33-day range, could provide an upside direction to the asset with next Resistance at 1.1063.

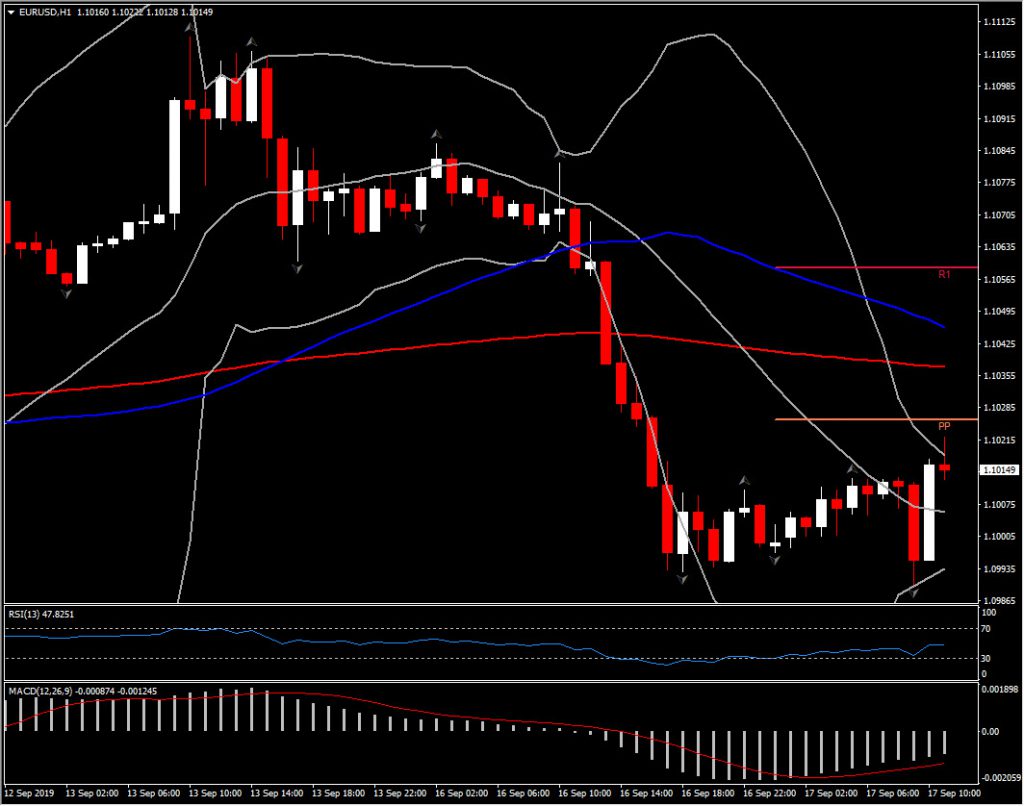

EURUSD has settled near the 1.1000 level after yesterday dropping from levels above 1.1050.

The decline was driven by safe haven demand for the Dollar. The downward shift reinvigorates what has been a moderate downtrend, the latest leg of which has been in play since the late June highs above 1.1400.

The favourable yield carry of the Dollar — 1.8% for the 10-year U.S. T-note vs nearly -0.5% for the benchmark Bund and -0.15% for the 10-year JGB — along with the fact that the Treasury market stands as the biggest, most liquid risk-free asset market in the world, means that the US currency is likely to remain underpinned, much to President Trump’s chagrin, no doubt.

This view assumes that the Fed doesn’t abandon prudent fiat-currency management and resists pressure from the executive for gung-ho on monetary easing. This view also assumes that the Fed hikes by no more than 25 bp following its FOMC meeting this week, and continues to frame easing as a mid-cycle adjustment rather than the beginnings of a committed cycle of easing. The Fed’s move will be juxtaposed to last week’s ECB promise of open-ended asset purchases.

Intraday, EURUSD has Resistance at 1.1035-1.1038, and Support at 1.0975.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.