FX News Today

- The FOMC announcement that delivered the 25 bp cut that was widely expected, but didn’t signal further moves down the line. It repeated that will act as appropriate to sustain expansion.

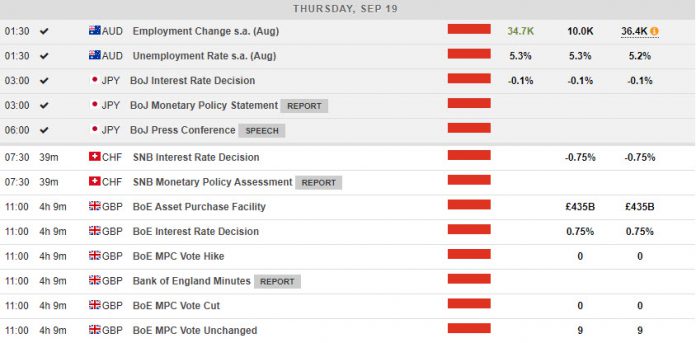

- BoJ held monetary policy on hold for now, but flagged review in October.

- Australian Dollar slumped on the back of a rise in unemployment at 5.3% from 5.2%.

- Asian stock markets traded mixed, JPN225 gained 0.58%. The Japanese stock markets up from yesterday’s lows, but below the highs seen early in the session.

- EGBs rallied yesterday and are likely to remain supported going into today’s central bank announcements from BoE, Norges Bank and SNB .

- Brexit: UK given ultimatum to submit Irish border proposals by Sep 30.

- The focus now turns to central bank decisions in Europe, where BoE and SNB are expected to hold policy unchanged, while Norges Bank could dodge the trend and deliver a hike.

Charts of the Day

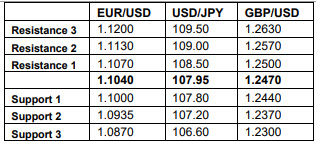

Technician’s Corner

- YEN: The Yen posted fresh trend lows against the Dollar, though remained just off the lows it saw against the Euro, Australian Dollar and other currencies yesterday. USDJPY printed a 6-week high at 108.26 in what is now the fourth consecutive day of higher-high making. The Japanese currency has been deflating amid a persisting phase of risk-on conditions in global markets.

Main Macro Events Today

- Interest Rate Decision, Monetary Policy Statement (CHF, GMT 07:30) – The SNB kept policy on hold at the June council meeting. The Libor target was replaced with a key policy rate, but the central bank was adamant that the degree of monetary accommodation remains unchanged. After the ECB cut rates, while the Fed is now widely expected to ease rates, the SNB has little room to manoeuvre, especially against the backdrop of ongoing Brexit uncertainty and geopolitical trade risks. The SNB’s central message remains that the situation remains fragile and the currency “highly valued”.

- Interest Rate Decision, MPC Voting (GBP, GMT 11:00) – Shadowed by the ongoing political developments in Brexit, the BoE is not expected to proceed with any interest rate actions.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.